EUR/USD" title="EUR/USD" height="438" width="871">

EUR/USD" title="EUR/USD" height="438" width="871">

Summary:

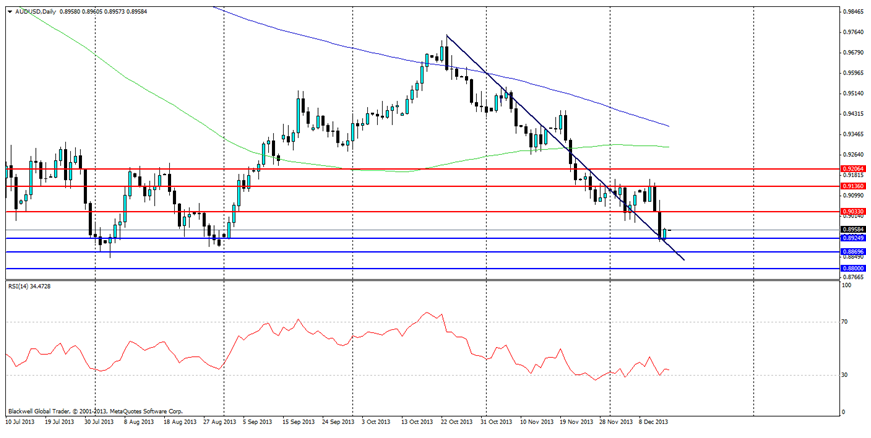

The Aussie dollar continued its dramatic decline last week, as the RBA governor Glenn Stevens took further action against the AUD, after commenting that he believed the current fair value of the AUD should be 0.85 cents to the USD. This, in turn, sent the dollar dropping rapidly despite upbeat unemployment figures which showed a boost in the month of November.

The week ahead looks likely to impact the dollar heavily, as the RBA meeting minutes are due out. Traders will be looking closely at this report as the threat of a rate cut by the RBA is on the cards and could lead to more dramatic drops for the Australian dollar. Overall though, more significant drops could certainly be in play for the AUD before the year is out, giving room for the RBA and the Australian economy as it looks to have an export-led recovery.

Current resistance levels can be found at 0.9033, 0.9136 and 0.9206; with major resistance found at 0.9033 as the AUD looks likely to sink further. Support levels can be found at 0.8925, 0.8869 and 0.8800 with 0.8800 likely to be the hard floor to crack in order for any further movements south on the charts.The RSI still has room to move lower and certainly, traders will look to push on support levels.  EUR/USD" title="EUR/USD" height="438" width="871">

EUR/USD" title="EUR/USD" height="438" width="871">

Summary:

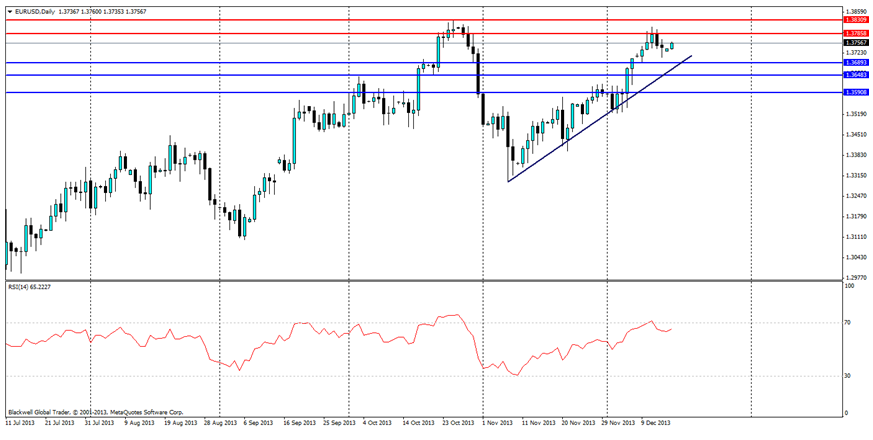

The Euro managed to push its way higher last week before pulling back from recent monthly highs as traders were worried that it had overextended in the current market. Despite comments from the ECB which painted a fairly neutral picture over the rise of the currency, this was in conjunction to the recent speech two weeks earlier which the ECB warned against higher currency prices as a risk to the Euro-zone.

Markets are poised for this week's inflation data, as the CPI data will help markets determine the state of deflation in the Euro-zone which is currently a real risk, as policy makers look to act to prevent another Japan. Overall though, German data is due out throughout the week and this will likely have a big effect in the run up to Christmas.

Current technical movements show that resistance can be found at 1.3785 and 1.3830; with major resistance at 1.3830 with markets looking to break through if given the signal by the ECB. Support levels can be found at 1.3689, 1.3648 and 1.3590. These look unlikely to be tested unless the current bullish trend line is broken and a breakout occurs – RSI movements suggest that buying pressure is still there and that it's unlikely.  GBP/USD" title="GBP/USD" height="438" width="871">

GBP/USD" title="GBP/USD" height="438" width="871">

Summary:

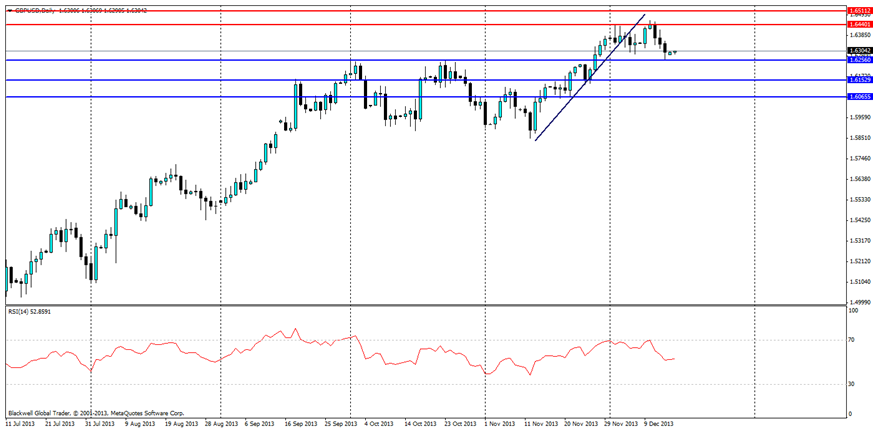

The Pound started to range after last week’s light economic data output. However, sentiment remained overall positive for the Pound versus its major partners. The week as a whole though saw a breakthrough of the current bullish trend line and the pound looked to range again as it searches for direction.

The markets are now awaiting the crucial end of year data on CPI which showcases the so far stellar performance of the Pound. Overall though, it’s likely that markets will react positively to a decrease in inflation, and the prospect of rates being increased in the near term.

Current market technicals show resistance at 1.6440 and 1.6511; with major resistance at 1.6440 as the Pound looked to push through before falling back last week. Support levels can be found at 1.6256, 1.6152 and 1.6055; with major support found at 1.6256. Overall though, the RSI shows strong buying pressure for the Pound, and it’s likely there will be no dramatic falls in the short-medium term. NZD/USD" title="NZD/USD" height="438" width="871">

NZD/USD" title="NZD/USD" height="438" width="871">

Summary:

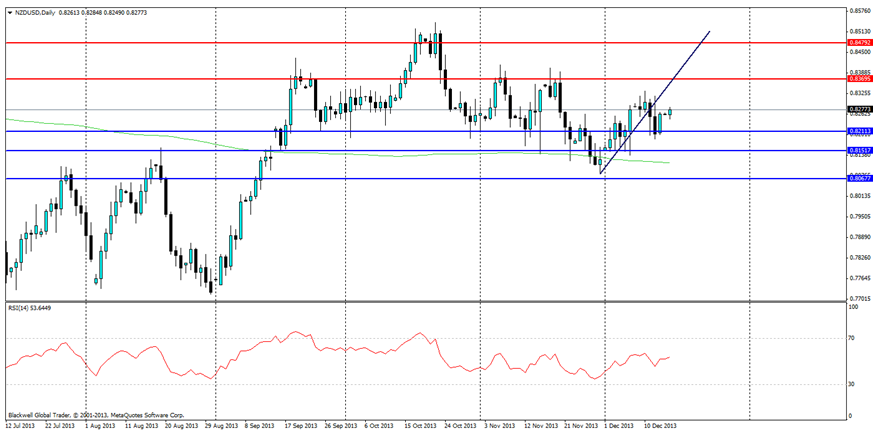

The New Zealand Dollar showed massive economic confidence last week, as data released showed that markets remain positive with business confidence up, and the RBNZ talking up the current state of the economy and its primary sectors. However, this was all overshadowed by the heavy drops of the Australian dollar which weighed on the Kiwi leading to the high flying Kiwi starting to range.

Traders in the coming week will be focused on GDP forecasts for New Zealand in the coming weeks – these are expected to massive growth in the economy, Trade Balance data is also expected to be positive. However, Aussie data will likely weigh on the currency.

Market technicals are relatively unchanged compared to last week and that resistance can be found at 0.8369 and 0.8479; with major resistance at 0.8369 where the market has tested the level twice in the last month. Current support levels can be found at 0.8211, 0.8151 and 0.8067. Overall though, current market sentiment is bullish, however, with a weak AUD weighing on the Kiwi, it is likely we could see more consolidation and ranging in the short term.  USD/JPY" title="USD/JPY" height="438" width="871">

USD/JPY" title="USD/JPY" height="438" width="871">

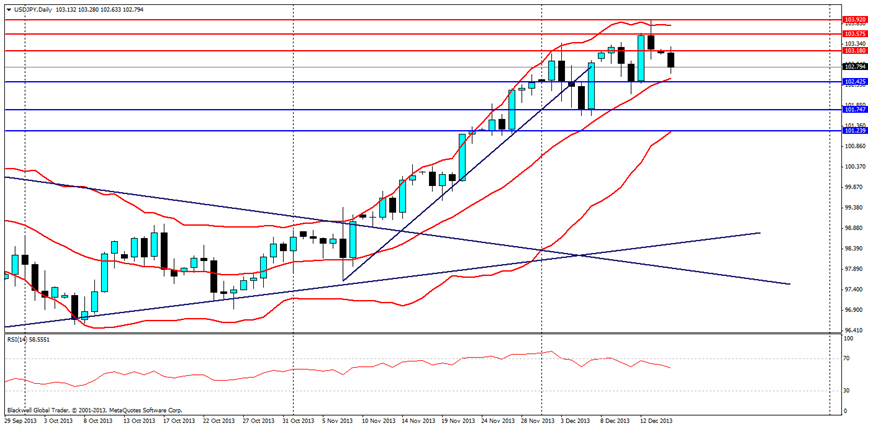

Summary:

The Yen fell further over the last week as markets looked to push it lower, amid fears of a weaker Japan as business investment is down and as the US dollar looks to get even stronger on a string of positive economic data that was released last week.

The week ahead looks likely to centre around the end as the BoJ is set to have its monthly Interest Rate Statement followed by its Monetary Policy Statement, which traders will pay close attention to as a window of what might happen in 2014 as the BoJ is expected to get more aggressive if need be.

Looking at market technicals, we can see that current resistance is at 103.180, 103.575, and 103.920; with 103.575 the current major level of resistance which is likely to be tested again in the near future. Current support levels can be found at 102.425,101.747 and 101.239. The RSI shows heavy buying pressure for the USD however, the Yen is likely to show low volatility unless we see strong US economic data putting pressure on the pair and forcing it lower.

DISCLAIMER

The report provided by Blackwell Global Investments Limited ("Blackwell Global") is meant for informative reading and should not be relied upon as a substitute for extensive independent research . The information and opinions presented do not take into account any particular individual's investment objectives, financial situation, or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions and should tailor the trade size and leverage of their trading to their personal risk appetite.

Blackwell Global and all of its subsidiaries and affiliates endeavour to ensure that the information provided in this communication is complete and correct but make no representation as to the accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed in the report are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global. It should not be construed as financial advice for a purchase or sale of any foreign currency, contracts-for-differences, precious metals or any other products offered by Blackwell Global mentioned herein. Any projections or views of the market provided by Blackwell Global may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global will not accept liability for any losses incurred directly or indirectly made by readers and clients as a result of any person or group of persons acting on the information contained herein.

The Blackwell Global's Research team does not render investment, legal, accounting, tax, or other professional advice. If investment, legal, tax, or other expert assistance is required, the services of a competent professional should be sought. This report is prepared for the use of Blackwell Global's clients and may not be reproduced, distributed or published by any person for any purpose without the prior consent of Blackwell Global.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Outlook: Aussie Continues Its Decline, Euro Pushes Higher

Published 12/16/2013, 05:11 AM

Updated 05/14/2017, 06:45 AM

Weekly Outlook: Aussie Continues Its Decline, Euro Pushes Higher

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.