According to the White House, this will be the week we will get to know who the next Fed Chief will be, with US President Biden weighing whether to keep Jerome Powell or pass the torch to Fed Governor Lael Brainard.

The preliminary PMIs will also be closely watched, especially in the Eurozone, as new lockdown measures have increased concerns over the bloc's economic performance. In New Zealand, the RBNZ is widely expected to hike interest rates again, but the question is by how much.

Monday appears to be a relatively light day in terms of economic data and releases, but that doesn't mean that investors will not lock gaze on their monitors for any potential market-moving headlines.

Besides news that covid infections in Europe have soared recently, prompting fresh lockdowns, something that raises concerns over the future performance of an already fragile economy, there were also headlines last week that, in the US, President Joe Biden may choose the next Federal Reserve Chair before Thanksgiving, which is on Thursday.

Biden has weighed whether to keep Powell, whose term ends in February, or pass the torch to Fed Governor Lael Brainard. Brainard is the candidate of choice for progressive Democrats, while Powell has the backing of moderate Democrats and Republicans.

In any case, Brainard is considered to be more dovish than Powell on monetary policy. Thus, if she is appointed, market participants may push back their rate hike expectations and thereby sell some US dollar.

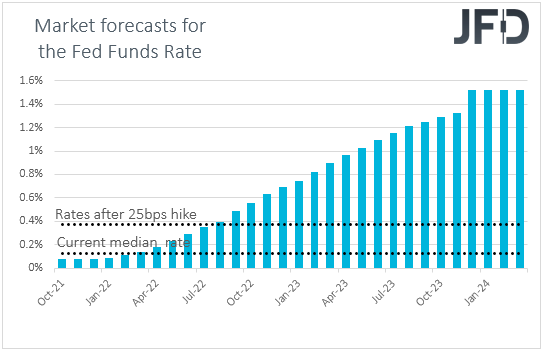

At their latest meeting, Fed officials began tapering their QE purchases. Although Chair Powell said that they would stay "patient" on interest rates, he did not close the door to the likelihood of a rate hike just after the tapering is over.

Since that meeting, data showed that the labor market continued to improve, and consumer prices kept accelerating in October, while last week, retail sales for the month rose well more than anticipated.

On top of that, last week, Fed Vice Chair Richard Clarida said that increasing the tapering pace might be worth discussing at the upcoming gathering, while Chicago Fed President Charles Evans, who is known as a policy dove, said that he is now "more open-minded" to supporting hiking rates next year.

Atlanta Fed President Raphael Bostic has also signaled his support for a rate hike during the summer months of next year. According to the Fed funds futures, market participants anticipate a 25 bps hike to be delivered in July, while they are fully pricing in another quarter-point increase by the end of the year.

Thus, there is room for slowing down that expectations path if Brainard is chosen as the next Fed Chief. Now, if Powell stays in charge, nothing will change in interest-rate expectations, and thus, we don't expect a significant dollar rally at the time of a potential announcement.

The currency may slowly continue drifting north, conditional upon more data and headlines supporting the case for a rate hike around the middle of next year.

On Tuesday, the main items on the agenda may be the preliminary PMIs for November from the Eurozone, the UK, and the US.

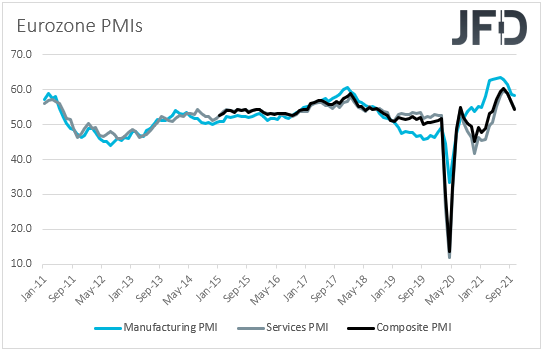

Getting the ball rolling with the Eurozone, both the manufacturing and services indices are expected to have continued sliding, resulting in the 4th consecutive slide to the composite index.

Specifically, the composite index is anticipated to slide to 53.1 from 54.2. This will add to concerns that the latest supply shortages and bottlenecks have left their marks on the Euro-area economy and, combined with the latest lockdown measures around the bloc, could add more credence to the recent remarks by European Central Bank (ECB) President Lagarde that tightening monetary policy now to rein in inflation could choke off the euro zone's recovery.

Thus, with all that in mind, we believe that sliding PMIs could prompt EUR traders to push further back their bets over a potential rate hike by the ECB next year and thereby keep the euro under selling pressure.

Now, moving to the UK, both the manufacturing and services indices are forecast to have held steady, which is unlikely to alter market pricing with regards to the Bank of England's (BoE) future course of action.

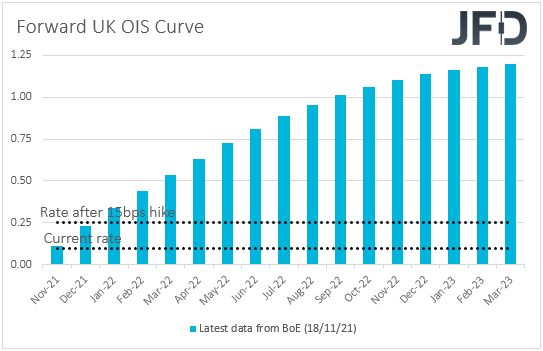

At its latest meeting, the BoE decided not to hike, despite market participants assigning an 80% chance for such a move ahead of the meeting, and instead said that this could happen in "coming months."

However, soon after that, Governor Andrew Bailey said that they are still on a path towards raising interest rates, remarks which combined with further acceleration in inflation last week, encouraged investors to place bets over a December hike.

According to the UK Overnight Index Swaps (OIS) forward yield curve, such a move is nearly fully priced in, and for that to change, the PMIs may need to miss their forecasts by a decent margin.

In the US, in contrast to the Eurozone, both the manufacturing and services PMIs are forecast to increase, underscoring the resilience of the US economy and perhaps adding more validity to the view over a potential rate hike by the Fed in the middle of next year.

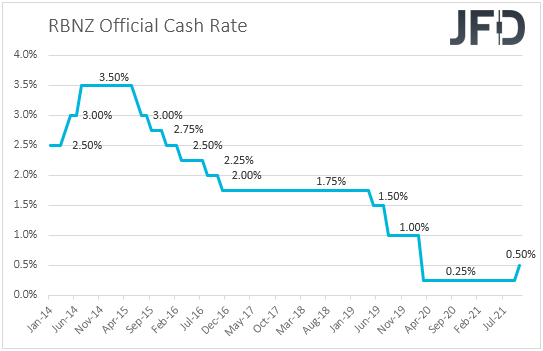

On Wednesday, during the early Asian morning, we have a central bank deciding on interest rates and this is the Reserve Bank of New Zealand (RBNZ). Back in October, this bank raised interest rates by 25 bps as was widely expected, noting that further removal of monetary policy stimulus is expected over time.

With the New Zealand CPI surging to 4.9% in Q3, and the unemployment rate hitting a record low during the same quarter, market participants are almost sure that officials will hit the hike button again this week. The main question, though, is whether they will add 25 or 50 bps. According to market chatter, there is around a 40% chance for a "double hike."

In our view, despite the domestic economy performing very well, there are other significant economies still facing problems, one of which is China, New Zealand's biggest trading partner. Thus, we believe that there is no reason for RBNZ policymakers to rush into delivering more than a 25 bps increase.

This could disappoint those expecting more and may result in a pullback in the Kiwi at the time of the announcement. However, conditional upon the bank's willingness to continue normalizing its policy, the retreat may stay limited and short-lived. After all, the RBNZ will be the only major central bank raising interest rates post pandemic, not once but twice.

Later in the day, the FOMC releases the minutes of its latest meeting. However, after the meeting, we got data and remarks from several Fed officials supporting the case for a hike in mid-2022. We would treat the minutes as outdated.

We prefer to focus more on upcoming data, like the PMIs on Tuesday, and the core PCE index, the Fed's favorite inflation metric, which comes out a few hours ahead of the minutes.

Thursday is Thanksgiving Day in the US, and thus, Wall Street will stay closed. Elsewhere, the only releases worth mentioning are Germany's final GDP for Q3, which is expected to be revised down to +1.5% QoQ from +1.8%, and the minutes from the latest ECB gathering.

We expect these minutes to pass unnoticed as well. Euro-traders are likely to pay more attention to the PMIs, and any headlines surrounding the new restrictive measures due to the surging COVID cases around the bloc. After all, ECB President Lagarde was adamant that now is not the time to start thinking about raising interest rates, and we don't expect the minutes to paint a more hawkish picture.

Finally, on Friday, the holiday shopping season officially starts, with "Black Friday" sales around the globe. Although we will not get any instant numbers over consumer spending, we will closely watch the upcoming retail sales data.

During October, a surge in US retail sales indicated that Americans started shopping early, and further strength in retail sales during November could add more credence to the view that the US economy is performing exceptionally well. At this point, it is worth mentioning that Wall Street will close early on Friday.

Elsewhere, during the Asian morning, we have Japan's Tokyo CPIs for November and Switzerland's GDP for Q3. No forecast is available for the headline Tokyo CPI, while the core one is anticipated to have accelerated to +0.4% YoY from +0.1%. As for Switzerland's data, expectations are for GDP to have accelerated to +2.0% QoQ from +1.8%.