AUD/USD" title="AUD/USD" height="489" width="869">

AUD/USD" title="AUD/USD" height="489" width="869">

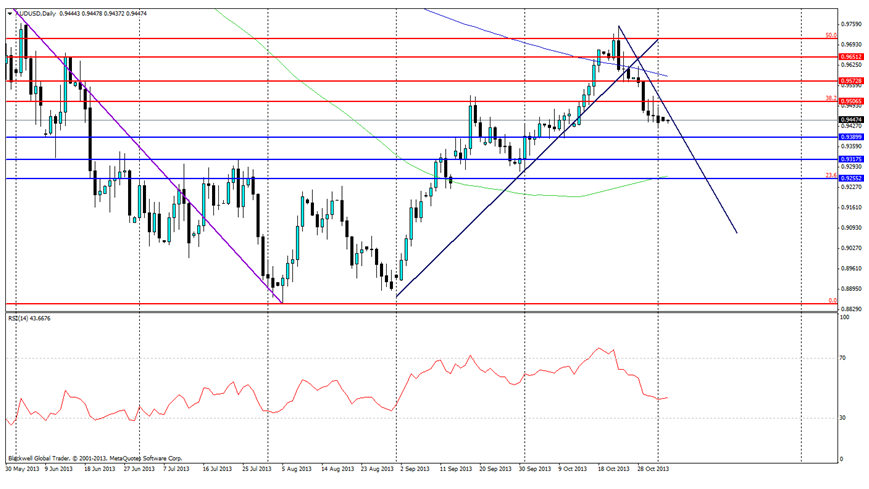

Summary:

The Aussie dollar has fallen off recent highs after a strong sell off in commodity currencies,leaving the Aussie dollar looking incredibly weak. This was further compounded by comments from the head of the RBA Glenn Stevens, as he said that “current fundamentals don’t support the valuation of the AUD”. Markets have since responded and forced the currency down heavily as the market looks to find a bottom in its bearish trend.

Tuesday will be a heavy hitter for the Australian economy, as interest rates are reviewed by the RBA, current outlook though is that they will remain unchanged, as the RBA has tried to remain passive while it pays close attention to recent happenings in China. Additionally, the unemployment rate will be due on Thursday and is expected to rise slightly.

Current market technical movements show that support can be found at 0.9389, 0.9317 and at the 23.6 Fib mark at 0.9255; with heavy support found at 0.9317. Market pressure will have to be heavy to push the market down further as it may range slightly before falling further as the RSI shows equal buying and selling currently. Current Resistance levels can be found at the 38.2 Fib level at 0.9506, 0.9572 and 0.9651. EUR/USD" title="EUR/USD" height="489" width="869">

EUR/USD" title="EUR/USD" height="489" width="869">

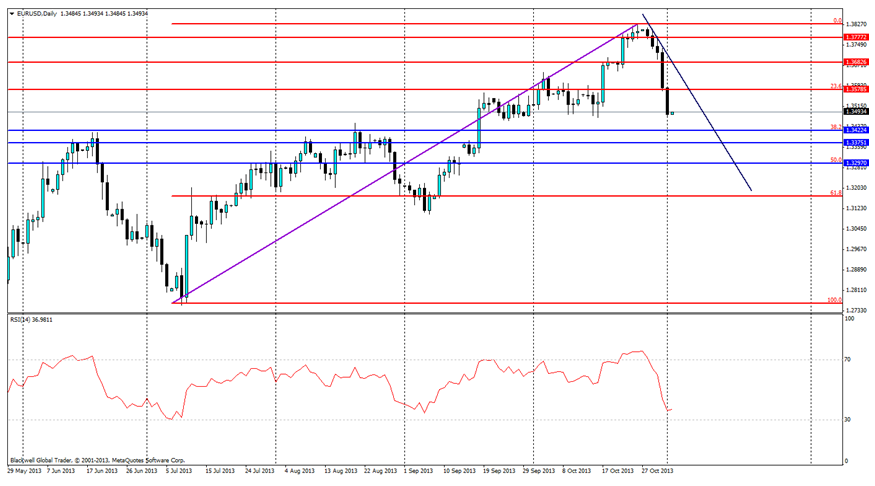

Summary:

The Euro fell heavily last week as markets looked to exit the Euro in favour of the strong USD, as optimism from the FOMC meeting helped push down the Euro. Additionally, fears that Mario Draghi could act as well to stop the strength of the Euro helped ease it further,as the ECB has spoken out about a strong Euro and how it could affect the current economic recovery, seeing that Spain has only just broken out of its 2 year recession.

Markets will be wired though come this Thursday as the ECB conference will be taking place, delivering their monthly interest rate review. Currently, markets are looking at a possible interest rate cut, as inflation has slowed in the Euro-zone and a rate cut will help boost inflation to EU mandated levels. Either way, it is likely that Mario Draghi will come out firing against the recent strength in the Euro and the risks it has had on the recovery.

Current technical movements show that the EUR/USD pair has started to trend downwards in a bearish motion and this looks likely to continue given the heavy selling pressure on the RSI which is abnormal. Current Support levels are at the 38.2 Fib mark at 1.3422 and 1.33751, and also the 50.0 Fib mark at 1.3297. It looks likely that these will certainly be tested with the major resistance coming through at the 38.2 Fib mark. The current resistance levels are spaced out at the 23.6 Fib mark at 1.3578, 1.3682 and 1.3777. It seems unlikely that the upper two levels will be tested as it would indicate a breakout, requiring a pierce through the current trend line in order to reach them. GBP/USD" title="GBP/USD" height="489" width="869">

GBP/USD" title="GBP/USD" height="489" width="869">

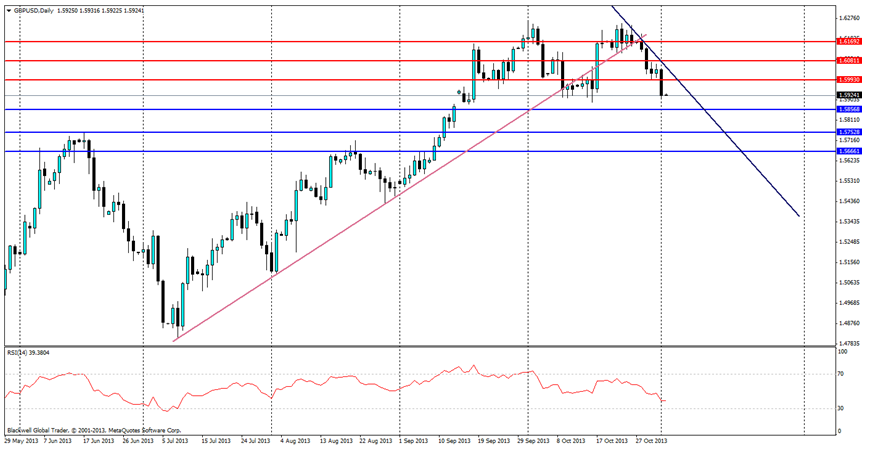

Summary:

The Pound has fallen in line with the Euro after recent US strengthening globally led to declines for most of the major pairs across the board. After hitting recent highs and forming a double top, the GBP/USD pair has looked trapped in the bearish trend line. This looks likely to continue as the UK economy has received positive news but markets are starting to taper off this news and play on technicals again.

This Thursday will be the main movements for the GBP/USD as the Bank of England holds its monthly review of interest rates, as well as its asset purchase programme. It is likely that there will be talk of this being tapered off as the economy has been rebounding strongly. However, they may wait till the US starts so that the pound does not appreciate heavily in global FX markets.

Technical movements have been bearish in the most recent week, with support levels found at 1.5856,15752 and 1.5666. The 1.5856 level will be the hardest for a bearish trend to continue, it may take a few days of movements to actually push through in-line with the current bearish trend line. The current resistance levels lie at 1.5993, 1.6081 and 1.6169. It’s unlikely that these will be tested in the coming days, unless UK data is incredibly positive and helps break the current trend in the markets.  NZD/USD" title="NZD/USD" height="489" width="869">

NZD/USD" title="NZD/USD" height="489" width="869">

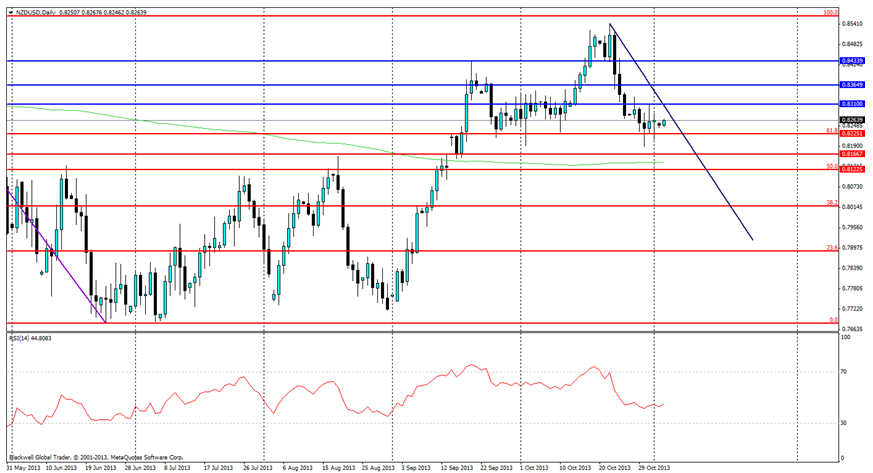

Summary:

The New Zealand Dollar fell last week as traders rushed out of commodity currencies and back into the USD after upping bets on the FOMC meeting and talks of tapering, as the US economic situation looks to improve. Markets will be looking for further direction this week in terms of major movements as the NZD has stopped its recent decline and has the potential to move in either direction.

Market outlook for news is looking weak for the NZ economy, and it’s likely that the NZD will trade heavily off the AUD and its upcoming announcements. The impact though will not be as severefor the NZD when compared to the AUD and its movements.

Market technicals point to heavy support levels at the 61.8 Fib level at 0.8255, 0.8166 and additionally at the 50 fib mark at 0.8122. These are likely to act as major points of support as traders will be looking to keep the NZD high. Resistance levels can be found at 0.8310,0.8364 and 0.8433 and are likely to hold for the time being especially the 0.8310 level which has acted as a major level over the last month of trading. USD/JPY" title="USD/JPY" height="489" width="869">

USD/JPY" title="USD/JPY" height="489" width="869">

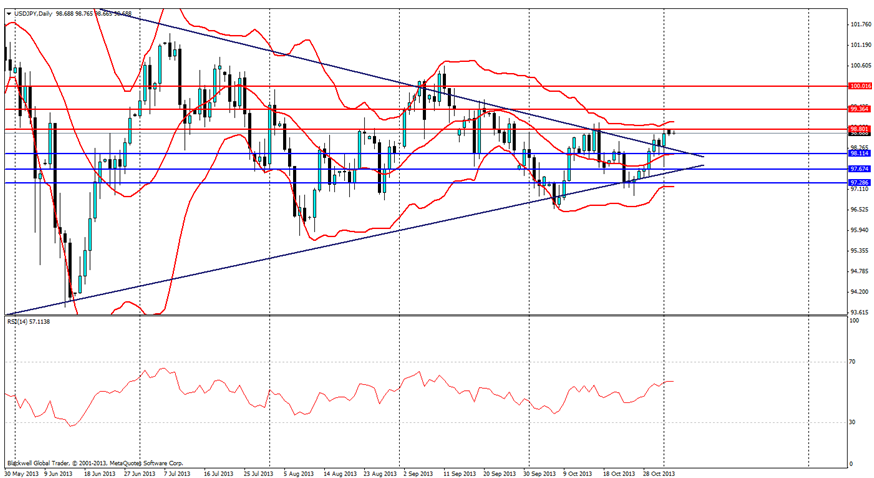

Summary:

The Yen has recently broken out of its triangle after pressure from the USD led to people moving out of the safety of the Yen. The markets are currently looking for more signs of action from the Japanese government in order to devalue the Yen, as talk has been of more stimulus and fiscal action in order to boost the economy. However, it's unlikely to be anytime soon given the fact that the Japanese economy is still trying to get used to Abenomics.

Overall market news will be weak for the Japanese Yen for the entire week, as very little information is to be released. The main focus for movements will be in the US as it releases its economic data through the week.

Current technicals show that the USDJPY is trying to move up and out of its triangle pattern as it converges together. Support levels can be found at 98.114, 97.764 and 97.286. The main level of support can be found at 98.114 as the pair looks to bounce off it, if the pattern tries to converge. Major levels of resistance can be found at 98.801, 99.364, and 100.00. Expect indication of future direction after today’s testing of the 98.801 mark. The RSI is also showing strong strength for the USD, however it remains to be seen if this will have much impact, but certainly don’t expect the JPY to push through Bollinger bands as it has historically pulled back on touching.

DISCLAIMER

The report provided by Blackwell Global Investments Limited ("Blackwell Global") is meant for informative reading and should not be relied upon as a substitute for extensive independent research . The information and opinions presented do not take into account any particular individual's investment objectives, financial situation, or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions and should tailor the trade size and leverage of their trading to their personal risk appetite.

Blackwell Global and all of its subsidiaries and affiliates endeavour to ensure that the information provided in this communication is complete and correct but make no representation as to the accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed in the report are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global. It should not be construed as financial advice for a purchase or sale of any foreign currency, contracts-for-differences, precious metals or any other products offered by Blackwell Global mentioned herein. Any projections or views of the market provided by Blackwell Global may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global will not accept liability for any losses incurred directly or indirectly made by readers and clients as a result of any person or group of persons acting on the information contained herein.

The Blackwell Global's Research team does not render investment, legal, accounting, tax, or other professional advice. If investment, legal, tax, or other expert assistance is required, the services of a competent professional should be sought. This report is prepared for the use of Blackwell Global's clients and may not be reproduced, distributed or published by any person for any purpose without the prior consent of Blackwell Global.