AUD/USD" title="AUD/USD" border="0" height="450" width="750">

AUD/USD" title="AUD/USD" border="0" height="450" width="750">

Summary:

The Aussie dollar looked to be trending lower last week as markets continued to push it down before nonfarm payroll was well below expectations, leading to a heavy sell down of the US dollar, causing a massive push for the AUD to 90 cents before the market pushed it back.

The week ahead looks likely to lead to further declining for the AUD as data is due out on motor sales in the Australian economy – a key metric akin to retail sales. Additionally, this week will be unemployment data for the Australian economy, which is expected to stay the same. However, any change will lead to massive movements across the board for the AUD.

Current resistance levels can be found at 0.9003, 0.9036 and 0.9141; with major resistance found at 0.9003 as the 90 cent mark acts as the ceiling for the AUD/USD. Current support levels are also found at 0.8944, 0.8898 and 0.8850. These levels are likely to be tested in the coming week as market sentiment still remains bearish for the pair given the strength of the 90 cent ceiling in place currently. EUR/USD" title="EUR/USD" border="0" height="465" width="751">

EUR/USD" title="EUR/USD" border="0" height="465" width="751">

Summary:

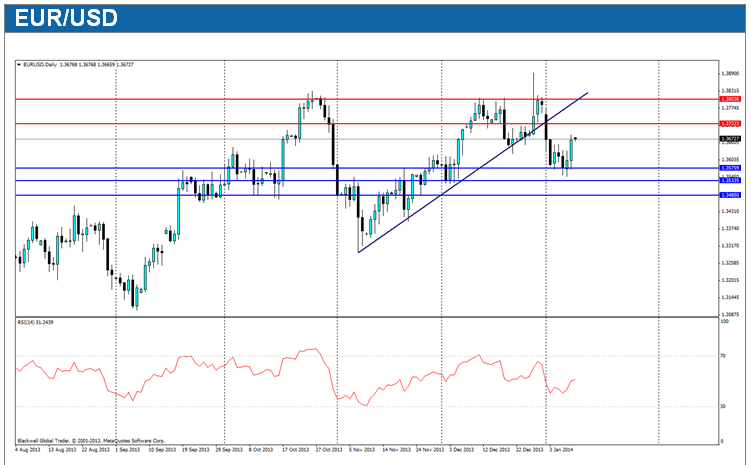

The Euro had a mixed week last week. After falling sharply on US economic data, it was able to claw back most of its losses after US nonfarm payroll was weaker than expected. Consumer confidence also lifted in the Euro-zone, aiding to the optimistic outlook from the ECB.

Data in the Euro-zone is relatively light, with exceptions for CPI data which is expected on Thursday. However, most movement moving news will come from the UK and US where data releases this week are going to be strong and likely push movements for the Euro

Current resistance levels can be found at 1.3722 and 1.3803; with 1.3803 acting as a hard level of resistance in the market. It’s unlikely that this level will be broken for some time, as market sentiment is uncertain and ranging is more likely than any directional movement. Support levels can be found at 1.3575, 1.3533 and 1.3485. These support levels are likely to hold, given the flat level of RSI showing no current directional movement.  GBP/USD" title="GBP/USD" height="426" width="451">

GBP/USD" title="GBP/USD" height="426" width="451">

Summary:

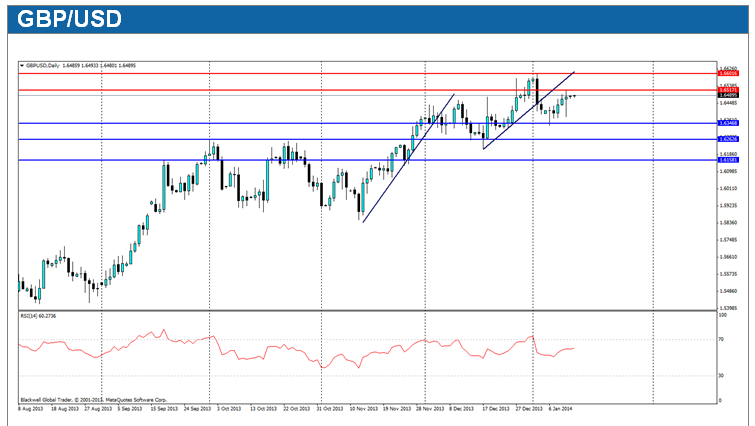

Trading in the Pound has slowed down after recent movements upwards have been met with heavy selling pressure, as markets believe the Pound may be overextended in the current market. Current market sentiment remains bullish though, with resistance, however, given the current market and strong USD.

The markets are set to be busy, with a raft of data out on the Pound this week. With CPI as well as PPI data due out on Tuesday, followed by Core Retail Sales and normal Retail Sales due out on Friday. This is expected to show a minor slowing in the growth of retail sales, however a boost could lead to a massive jump for the Pound.

Current market technical show that the Pound is starting to drift upwards to resistance levels on the back of slightly buying pressure. Current resistance levels can be found at 1.6517 and 1.6601; with major resistance found at 1.6517. Current support levels can be found at 1.6346, 1.6262 and 1.6158; with major support found at 1.6346. Current RSI shows buying pressure is still strong, so downward movements could be expected of data movements rather than technical.  NZD/USD" title="NZD/USD" height="426" width="451">

NZD/USD" title="NZD/USD" height="426" width="451">

Summary:

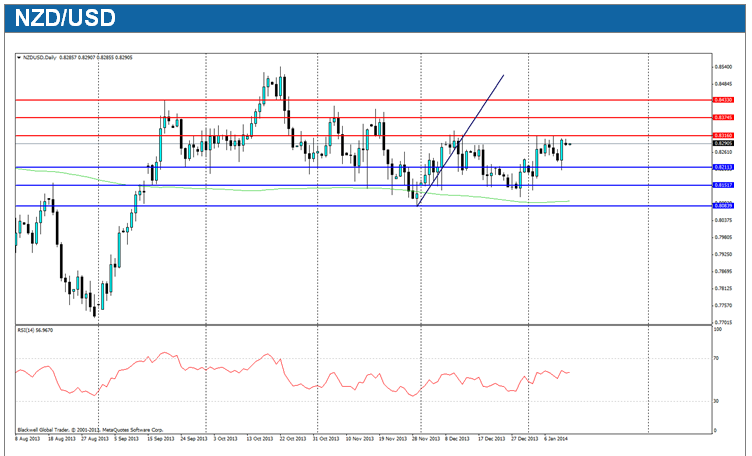

The New Zealand Dollar has continued its consolidation and ranging heavily after a week of data which painted the NZ economy in a positive light, but at the same time the USD strengthened, leading to little change over the last week.

Traders in the coming week willhave little to chew over when it comes to the New Zealand economy as the only major bit of news is due out this eveningon property valuation rises for the economy. Business confidence is also expected out, and is forecast to be optimistic about the future of the Kiwi dollar.

Market technicals show that resistance can be found at 0.8316, 0.8374 and 0.8433; with major resistance at 0.8316. Current support levels can be found at 0.8211, 0.8151 and 0.8083. Overall though, current market sentiment remains bullish, but consolidation is more likely than large rapid movements.  USD/JPY" title="USD/JPY" height="426" width="451">

USD/JPY" title="USD/JPY" height="426" width="451">

Summary:

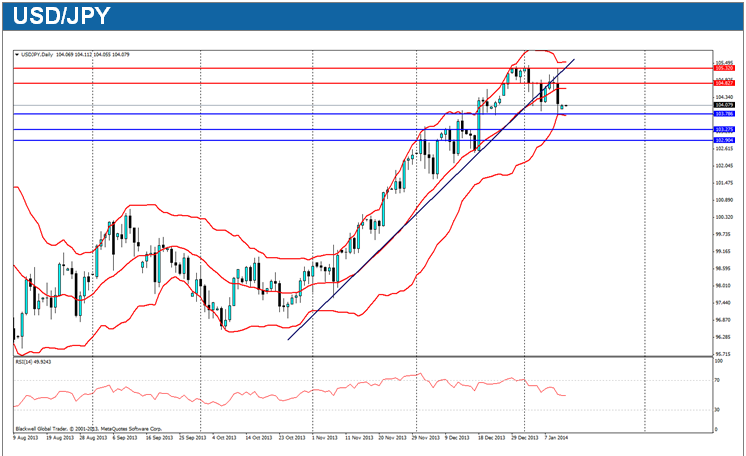

The Yen clawed back massive ground against the USD after a much weaker than expected nonfarm payroll. However, market movements are still strongly bullish for the USD/JPY pair and after a light week, the Yen will likely look to move lower as abenomics looks to make more waves.

The week ahead is expected to be hectic for trading of the Yen, with the account balance due out tonight, which is expected to show widening of the deficit. Additionally, domestic good data as well as the tertiary index is due out and this is likely to have a heavy impact on the Yen trading session. Abenomics will also be a central focus most likely this week, as it's expected the Bank of Japan will look to stimulate more.

Looking at market technicals, we can see that current resistance is at 104.827 and 105.320; with the current 105 mark acting as a price ceiling. Market levels of support can be found at 103.786, 103.275 and 102.904. Current RSI data shows that USD still has strong buying pressure on the Yen, however, this has tailored off after the recent nonfarm data. However, it's unlikely to fall any further without an improvement in the Japanese economy.

DISCLAIMER

The report provided by Blackwell Global Investments Limited ("Blackwell Global") is meant for informative reading and should not be relied upon as a substitute for extensive independent research . The information and opinions presented do not take into account any particular individual's investment objectives, financial situation, or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions and should tailor the trade size and leverage of their trading to their personal risk appetite.

Blackwell Global and all of its subsidiaries and affiliates endeavour to ensure that the information provided in this communication is complete and correct but make no representation as to the accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed in the report are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global. It should not be construed as financial advice for a purchase or sale of any foreign currency, contracts-for-differences, precious metals or any other products offered by Blackwell Global mentioned herein. Any projections or views of the market provided by Blackwell Global may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global will not accept liability for any losses incurred directly or indirectly made by readers and clients as a result of any person or group of persons acting on the information contained herein.

The Blackwell Global's Research team does not render investment, legal, accounting, tax, or other professional advice. If investment, legal, tax, or other expert assistance is required, the services of a competent professional should be sought. This report is prepared for the use of Blackwell Global's clients and may not be reproduced, distributed or published by any person for any purpose without the prior consent of Blackwell Global.