Last week was remarkably calm on the currency front, particularly with regard to the USD/CAD pair. Despite a number of surprising developments, the rate did not stray beyond a range of only 100 points. One of the most highly anticipated events last week was U.S. Federal Reserve (Fed) Chair Janet Yellen’s appearance before Congress. Ms. Yellen’s tone appeared particularly upbeat regarding the state of the economy, noting that other key rate hikes would be appropriate if the job market and inflation continue to develop in keeping with the Fed’s expectations. Ms. Yellen added that it would be unwise to wait too long to withdraw monetary easing measures, as the Fed could be forced to raise its bellwether rate quickly. Such movements could disrupt markets and plunge the economy into recession.

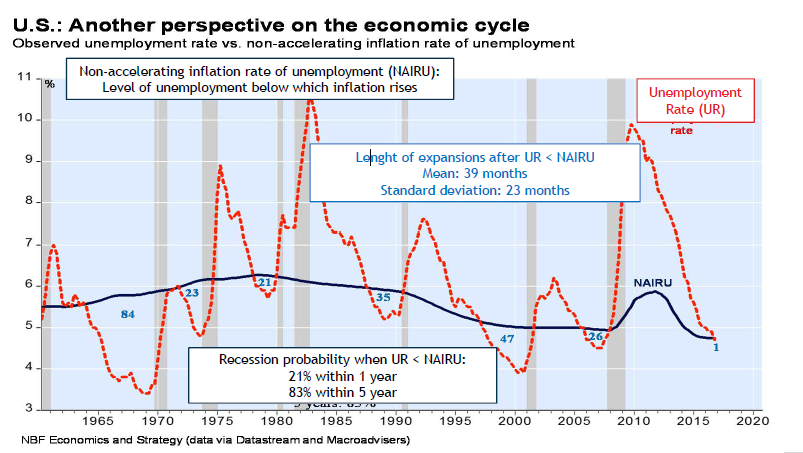

Our Chief Economist and Strategist Stéfane Marion stressed that the U.S. economy was at the beginning of a mature expansion phase, leaving a great deal of leeway for Ms. Yellen to tighten her monetary policy in the months to come. Moreover, considering how dependent the Canadian economy is on economic health south of the border, our monetary policy could also follow that of the United States in the medium term, as Mr. Marion foresees three key rate hikes in Canada in 2018. In the wake of Ms. Yellen’s remarks, Canadian and U.S. bond yields reacted by rising, as markets priced the likelihood of a key rate hike by May 2017 at 56% (up from 49%). Despite these developments, the USD/CAD pair has not seen any major movements as North American stock markets saw another week of gains.

U.S. economic data for January released in the middle of the week likely confirmed Ms. Yellen’s comments, as Inflation and Retail Sales outstripped analysts’ expectations. Consumer prices also saw a generalized rally, with the variation in the core Consumer Price Index (CPI), excluding energy and food, rising an annualized 2.3%. Retail Sales saw monthly growth of 0.4% while analysts expected a variation of 0.1%. Excluding automobile sales, growth even reached 0.8%: the sustained job creation in recent months appears to be translating into solid consumption in the United States.

There were also a number of notable developments in terms of international relations. Canadian Prime Minister Justin Trudeau met with U.S. President Trump on Monday in Washington. Considering the protectionist stance favoured by the President, this meeting was highly anticipated north of the border. However, President Trump reassured Mr. Trudeau that Canada was not the main target of his plans to renegotiate U.S. trade relations, particularly with regard to the North American Free Trade Agreement (NAFTA), with Mexico the primary focus. In other trade agreement developments, European officials ratified the Comprehensive Economic and Trade Agreement (CETA) between Canada and the European Union after more than 7 years of negotiations and fierce opposition from many European legislators. The agreement will eventually remove 99% of non-agricultural tariffs between the partners, but the impact on the Canadian economy should remain muted in comparison to the impact changes to NAFTA could bring.

This week, we’ll be keeping an eye on Canadian Inflation and Retail Sales as well as New and Existing Home Sales in the United States.