Range of the Week : 1.2900-1.3400

Last week our attention was on the release of Canadian and American employment indicators and the Bank of England’s monetary policy decision. Several economic indices were also published.

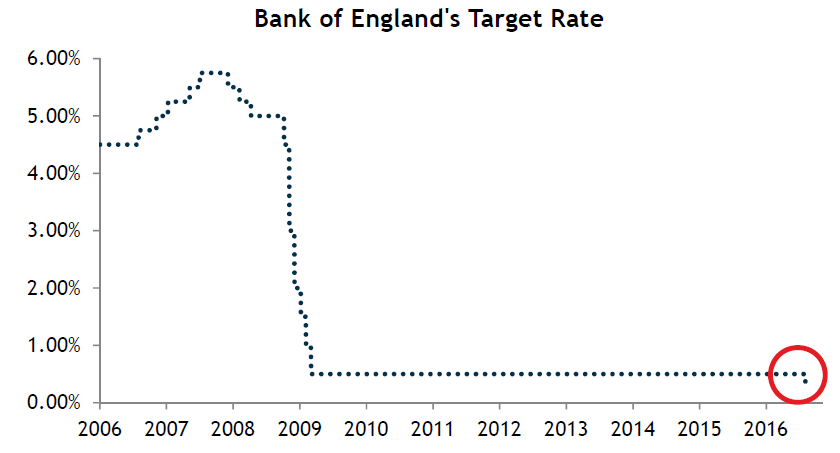

As expected by analysts, on Thursday morning the Bank of England lowered its key interest rate by 0.25% at its second meeting since the Brexit vote. This was the first time in seven years that the BoE had lowered its rate, which dropped to an all-time low of 0.25%. It also announced that it would consider more easing of monetary policy. The reasoning behind this decision included drastic drops in several economic indicators, such as the Markit composite PMI, which signalled a significant contraction in economic activity. A recent survey of construction purchasing managers also showed a second consecutive drop in production in July, for the worst performance since June 2009. Everything suggests that the British economy has taken another step toward recession.

On Friday morning market observers were once again surprised by new U.S. jobs data, which showed 255K more jobs in July and a 5K upward revision of jobs in June, whereas the market expected only 180K new jobs. The gains were also broadly based, being distributed across the more cyclical sectors like manufacturing and construction as well as the services sector. In the hours that followed, the USDCAD immediately climbed over 150 points, and expectations also rose of a hike in the U.S. federal funds rate.

The situation in Canada’s labour market was quite different, with the economy losing 31K jobs compared to an expected increase of 10K jobs. The report was even more disappointing due to the fact that full-time employment fell by 71K jobs, only partly offset by the creation of 40K part-time jobs. This weakness was consistent with potentially negative GDP growth in the second quarter.

Other releases of economic indicators included the U.S. manufacturing ISM for July, which was 55.5, down from 56.5 for June but still indicating economic expansion (higher than 50). Our economists therefore believe that the U.S. economy is well positioned at the start of the third quarter, and these indicators are consistent with their expectation of a rebound in GDP in the second half of the year. In addition, the release of income and personal spending indicators suggest that consumers are continuing to spend: in June income was up 0.2% and spending grew 0.4%.

However, our economists doubt that this pace will be sustainable in the long term if job creation falls over the next few months.

This week we will be watching new releases of U.S. indicators of wholesale inventories and retail sales. In Canada, we can expect releases of data on housing starts and the new housing price index.