Investing.com’s stocks of the week

Range of the Week : 1.2700-1.3300

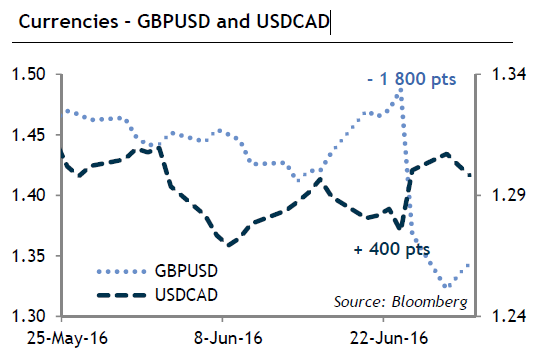

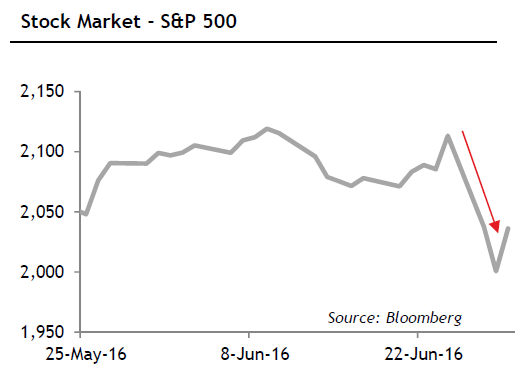

Investors seemed confused last week as they were trying to digest the Brexit news. We therefore observed choppy price graphs on all asset classes, and the release of some economic data fueled this volatility. Our economists also updated their forecasts, which we thought could be relevant to share.

In the beginning of the week, market sentiment still seemed to be uncertain: stock indices, crude oil and interest rates were down, while the U.S. dollar remained strong. However, economic data offered some support mid-week:

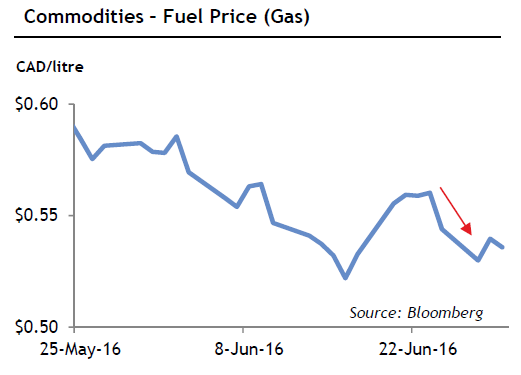

The release of a significant drop in U.S. crude inventories on Wednesday gave strength to WTI, however prices could not recoup the losses suffered following the vote in the U.K. on June 23rd, ending the week around USD 49/barrel.

Personal spending in the United States was released coming in up 0.4% in May, in line with expectations. As consumer spending has been the main driver behind U.S. economic growth in recent months, the positive result provided reassurance in the context of weak global demand.

Canadian GDP for April printed slightly up at 0.1%, also in line with consensus. Energy sector weakness continues to impact certain resource linked sectors of the economy, but the benefits of a weaker Canadian dollar are beginning to be seen in the manufacturing and other currency sensitive areas of the economy. The publication by Statistics Canada of a 2% increase in the number of companies in the country for the first quarter, the fastest pace since 2008, is a positive demonstration of the pickup in momentum of the Canadian economy. However, our economists revised their GDP forecast downwards for 2016 from 1.3% to 1.2% in light of the Brexit uncertainty.

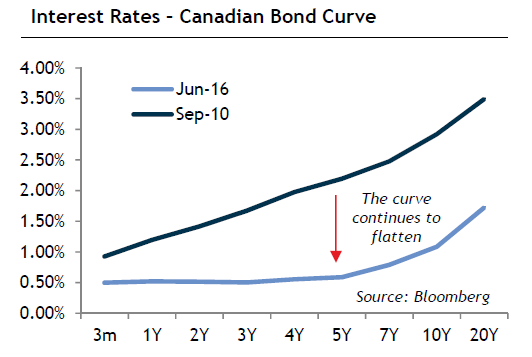

Volatility should remain high over the coming weeks as market participants around the world are trying to evaluate the impact of United Kingdom’s exit of the European Union. The race to succeed David Cameron as Prime Minister by September, the response of nationalist parties in other European countries and central banks’ comments will be important elements to monitor. Our economists indeed expect the U.S. Federal Reserve to postpone its next rate hike to second half of 2017.

This week, the anticipated data release in the United States will be nonfarm payroll report on Friday. Durable goods and factory orders will also be released. In Canada, job data will be published on Friday as well.