Range of the week : 1.2300-1.2800

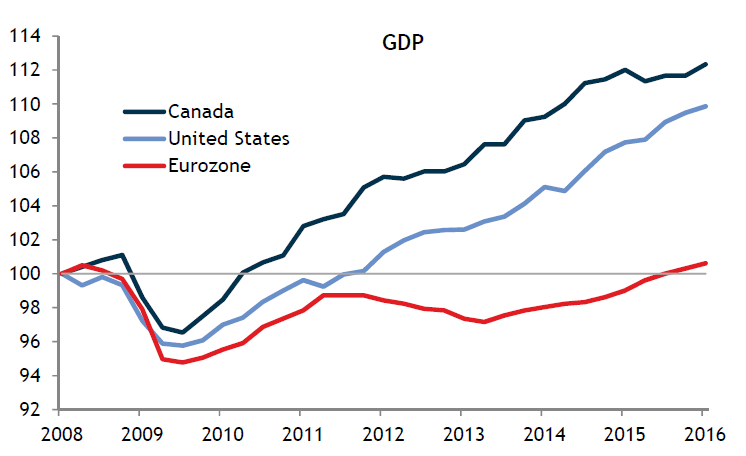

Is the U.S. economy running out of steam? The GDP data released last week would seem to provide clear proof: growth slowed to an annualized rate of only 0.5% in the first quarter of 2016, bringing the average for the last two quarters to 1%. This poor performance represents the worst pair of consecutive quarters since 2013 and was mainly due to declines in inventories and international trade. Other economic data released last week also appeared to suggest a slowdown: durable goods orders, personal spending and new home sales all fell short of the consensus figures.

The U.S. Federal Reserve (the Fed), in its monetary policy update on Wednesday, was naturally very aware of the slight slowdown in economic activity south of the border. Given this context, the Fed did not change its target range for the federal funds rate. On the other hand, the committee (the FOMC) pointed out that the fundamentals, like the labour market and real household income, are improving and consumer sentiment remains high. It is interesting to note that the Fed’s leaders withdrew the sentence in the previous press release on the risks related to global developments. The FOMC has therefore left open the possibility of a rate hike in June, but investors strongly doubt it. In the midst of all this turmoil, the greenback continued on a vertiginous fall against the major currencies, after having reached a 13-year peak in January.

In concrete terms, the DXY index fell 2%, and the USD declined 1% against the loonie. So the real question is: Can the all-powerful U.S. dollar stage a comeback? In light of the most recent economic data, there is practically no expectation in the markets of any new interest rate hikes this year. So some positive news and a change in tone at the Fed may breathe new life into the USD. For example, last week saw large fluctuations in the values of two major currencies, the Japanese yen and the Australian dollar. After the Bank of Japan refused to inject more monetary stimulus, the yen jumped over 3% against the USD! And the Australian dollar, which moves much like the Canadian dollar, fell over 2% following the release of disappointing economic figures. In sum, the currency markets are still able to turn volatile on a dime.

In Canada, the news that garnered the most attention was the release of GDP data for February. A slowdown was to be expected after the oversized gains in January. As expected, the Canadian economy contracted 0.1% compared to the drop of -0.2% predicted by the economist survey. Here we see the positive impacts of a weak Canadian dollar. Despite a decline in February, manufacturing production is still near some of the highest levels seen in years, undoubtedly benefiting from strong exports. It should be mentioned that the average exchange rate in February was 1.3500, close to 1000 points above the current rates.

In terms of the economic news this week, Friday should be particularly busy when the U.S. and Canada simultaneously release employment data. The U.S. labour market has been strong lately, with the private sector creating over 230K net jobs, on average, in the last six months. However, our economists expect more modest figures for April. In Canada, a slowdown is also expected following an astounding quarter for job creation.