Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Range of the week : 1.2400-1.3000

Last week was relatively light in terms of important new economic data and interventions, but investors appear to be increasingly optimistic about the outlook for the Canadian economy. The USDCAD hit a new low, approaching 1.26 and ending the week down approximately 1%. Interest rates also rose approximately 10 to 15 basis points and the S&P/TSX 60 index was up almost 1.5%. This positive wind of change was due to various factors.

First, investors appear to have been very encouraged by Canadian retail sales and inflation data, which both exceeded expectations. Retail sales for February were up 0.4% while market watchers were expecting a drop of -0.8%. Low gasoline prices therefore appear to have helped consumers, who were left with extra cash to spend, and this positively contributes to economic growth. Assuming no change in March, real retail sales (excluding the effect of inflation) will have grown 8.4% on an annualized basis in the first quarter, for the best performance in six years.

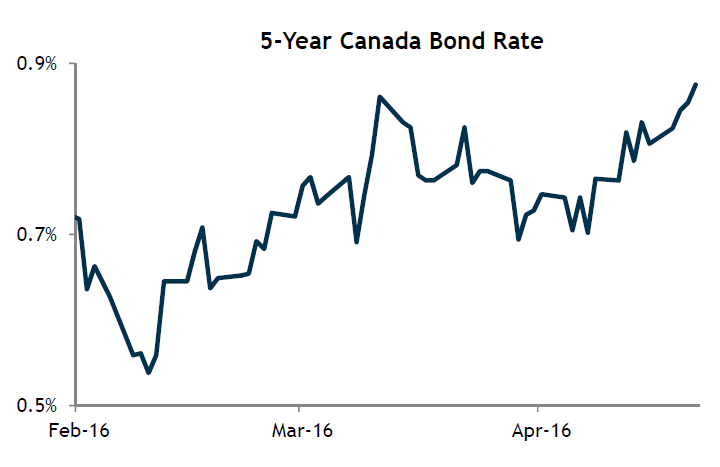

The inflation figure for March was 0.6%, bringing the annual rate to 1.3%. According to our economists, this surprising result may be due to the impact of a weaker Canadian dollar, which can affect inflation after a certain delay. Prices for basic goods rose 1.1% in March, or twice as fast as the 0.4% monthly norm. Rising interest rates therefore appear to reflect a buoyant outlook for future inflation. However, given the Canadian dollar’s rally in the past few weeks, the currency’s impact on inflation should be limited over the next few months.

It will be very interesting to see whether the change in Canadian GDP in February, to be released on Friday, will be as strong. Our economists believe that a contraction should be expected following the massive gains recorded in January, in particular since sales have fallen in the manufacturing and wholesale sectors. We will also be given a sense of U.S. GDP for the first quarter of the year, and the Federal Reserve will announce its rate decision. No rate hike is expected this month: investors are expecting only one rate increase between now and the end of the year, with a probability of approximately 60%.