Investing.com’s stocks of the week

Range of the week : 1.2700-1.3300

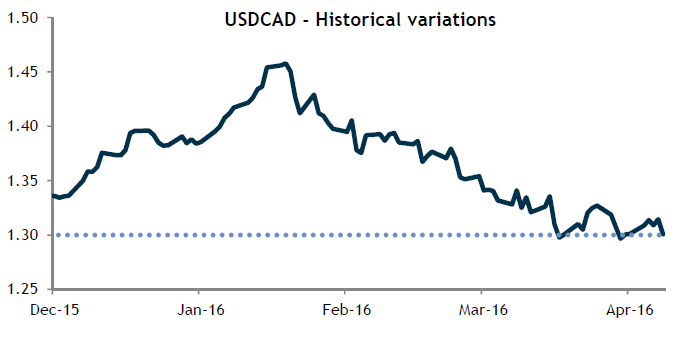

The USDCAD continued to fall last week in response to remarks made by members of North American central banks and the release of employment data in Canada. The pair dipped under 1.3000 for the third time since peaking at 1.45 in January. But the news that had by far the greatest impact was that the Canadian economy had created over 40K jobs in March. This far exceeded expectations of 10K additional jobs. The unemployment rate dropped 0.2%, from 7.3% to 7.1%. Furthermore, the details in the jobs report were also encouraging, since most of these new jobs were full-time and in the private sector. It therefore appears that the strong economic growth in January was also supported by some strength in the jobs market.

In other news, Carolyn Wilkins, a senior executive at the Bank of Canada (BoC), mentioned China’s importance to Canada as a trading partner and indicated that the BoC expects the Chinese economy to continue to grow at a rate of approximately 6% per year. This suggests that demand for our commodities will remain strong. Wilkins mentioned issues related to financial stability and the liberalization of China’s currency, but her comments did not seem to suggest that Canadian monetary policy would ease in the coming months. The markets give the probability of a cut to Canada’s key interest rate in 2016 at only 25%.

The minutes of the U.S. Federal Reserve’s March meeting on its interest rate decision revealed that FOMC members had a wide range of opinions on the economy and the speed of future rate hikes. Given this news, a rate hike in April seems off the table, but our economists note that the Fed may still announce hikes in June and December of this year. To add to the confusion surrounding future U.S. monetary policy, Janet Yellen, Chair of the Fed, speaking at a panel discussion with her predecessors Ben Bernanke, Allan Greenspan and Paul Volcker, said that the U.S. labour market was close to full employment and that inflation cannot remain subdued for much longer. These remarks contrasted sharply with her previous comments calling for great caution. We will be closely monitoring the U.S. dollar as this debate plays out, since the volatility may continue.

In commodities, oil prices were up by almost 8% on the week, approaching USD 40/barrel. Some market participants believe that this increase was due to U.S. output, which declined in 10 out of the last 11 weeks, or by the almost 5-million-barrel decrease in U.S. oil inventories. In any event, the price of oil remains highly sensitive to changes in supply and investors will pay close attention to the outcome of Sunday’s Doha meeting concerning a potential freeze in output.

This week, the key economic indicators to watch in the U.S. are retail sales and inflation and, in Canada, manufacturing sales. On Wednesday the BoC will announce its key rate decision; the market expects it to leave the rate unchanged.