Range of the week : 1.3000-1.3550

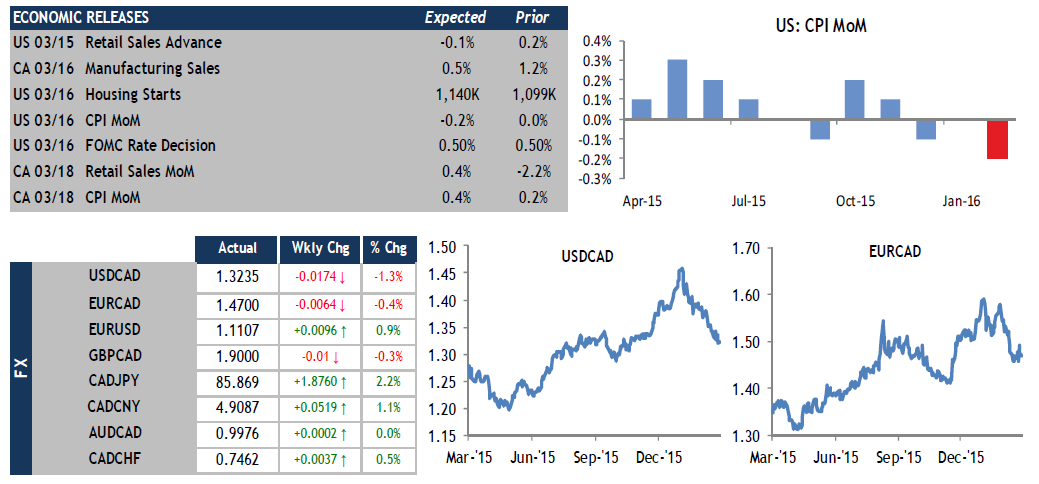

Last week, the Bank of Canada (BoC) got the ball rolling for the central banks by being the first to update its monetary policy, speaking before the European Central Bank (ECB), which announced its decision on Thursday, and the U.S. Federal Reserve, which will address the markets on Wednesday of this week. To no-one’s surprise, the BoC maintained its key interest rate unchanged at 0.50%. The Bank acknowledged that Canadian GDP had growth slightly faster than it had expected: the BoC expected GDP to be flat in the fourth quarter of 2015, but it grew 0.8%. The press release nevertheless clearly stated that the near-term outlook remains broadly the same as it was in January, suggesting that we should not expect to see spectacular growth in Canada. According to our economists, the BoC is still in stand-by mode, waiting for the federal budget expected on March 22. Accordingly, the BoC’s intervention in April should take into account Ottawa’s contribution. Stay tuned.

It is interesting to note that before the Canadian employment figures were released on Friday morning, the BoC was painting a rather positive picture of employment conditions in Canada. But the figures released on Friday revealed more difficult conditions. Even if the net loss of 2.3K jobs was not as bad as expected, the loss of over 50K full-time jobs is cause for concern. The environment remains particularly difficult in the oil-producing provinces. More specifically, Alberta has not seen an unemployment rate this high in over 20 years. However, one bit of good news is that British Columbia appears to continue to compensate as best it can for the weakness in the other provinces. In short, it is increasingly clear that the Canadian labour market has slowed since 2015, which was a surprisingly good year despite weak economic growth.

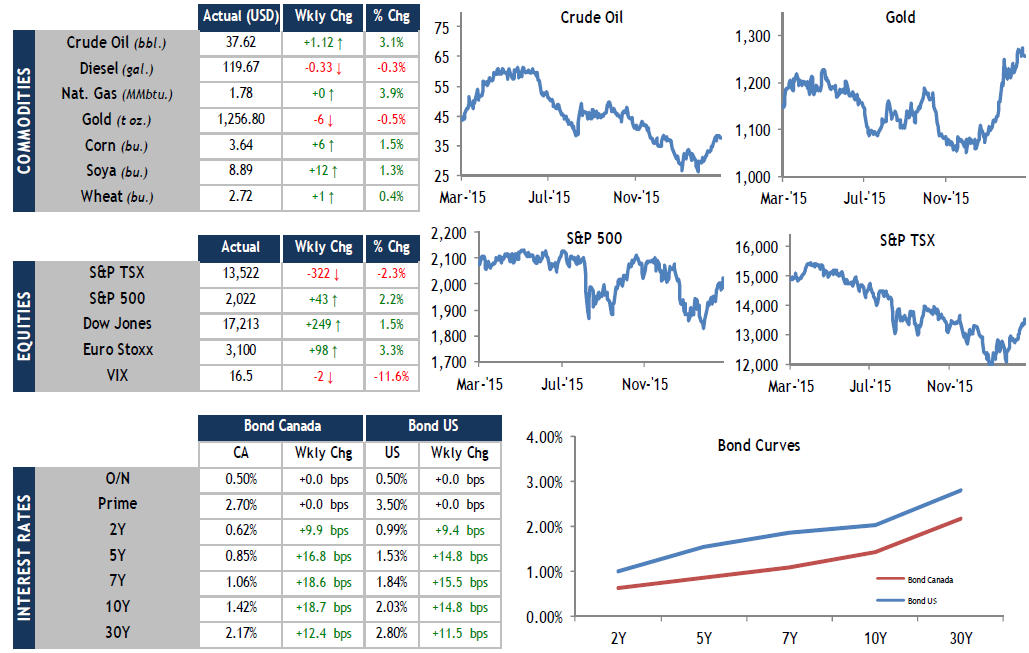

In all this turmoil of Canadian economic news and events, our dollar continued to rise, even if it may be quite difficult to arrive at an extremely positive view of the country’s economic position. The loonie appreciated by more than 100 points against the greenback. To explain this movement, some market watchers have mentioned the rising price of oil, which approached US$39/bbl last week. The bond market also seems to have welcomed recent developments, as Canadian interest rates increased by nearly 10 points on average last week.

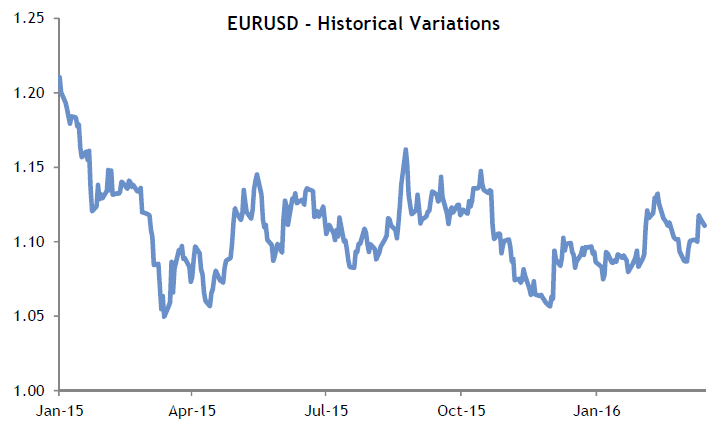

Like the BoC, the ECB also announced a monetary policy update. Investors had high expectations for lower rates and more monetary easing (QE). This is exactly what the institution announced. In an instant, the euro fell sharply against the U.S. dollar. However, a few minutes later, Mario Draghi (President of the ECB) suggested that there may be no more rate cuts! The euro bounced back close to 400 points and appreciated by 150 points on the week. A reversal like this is rare, but it underscores how highly volatile the currency market has been since the beginning of the year.

Several important economic indicators will be released this week. The most closely watched in the U.S. will be retail sales and inflation for February, the change in industrial production and, of course, the Fed’s rate decision. In Canada, market watchers will be paying attention to manufacturing sales and retail sales in January, as well as the inflation indicator for January.