12/FEB/2012

FX WEEKLY OUT LOOK

Highlights in the Foreign Exchange Market

• Greek Prime Minister Lucas Papademos appealed to Greeks last night to support deep budget

cuts needed to win a second aid package while leaders of the two biggest parties urged their

lawmakers in parliament to pass the austerity bill today or risk the financial meltdown.

• The Bank of England decided to expand its asset purchase program by another GBP 50 billion last

week to a total of GBP 325 billion as markets expected, and voted to maintain the key policy rate at

0.50%.

• Central banks' efforts have reduced global tail risk for the moment and seem to have a neverending

supply of liquidity. With the continuous dovish Fed stance and the ECB's second long term

refinancing operation scheduled for February 29, equity markets have not had a correction in over

a month and investors seem to be standing on the side waiting for the right opportunity. The

progress on Greece remains slow but the market is quite willing to look through the noise and

continue believing that an agreement will be reached.

- Dollar Rebounded

It looked as if risk markets started to lose momentum as Greece headed closer to securing the EUR 130b second bailout from EU/IMF. Friday's selloff in stocks could be seen as position squaring ahead of the crucial austerity package vote in Greek parliament. It could also be seen as a sign that investors were indeed looking past and jumping ahead the Greek events and reversing their positions for short term. We'd like to point out that DOW has so far failed to sustain above prior high of 12876 made in 2011 and risk of reversal is starting to build up. CRB commodity index showed sharp fall on Friday and ended the week in red. In currency markets, Euro, Sterling, Swiss Franc and Canadian dollar showed sign of short term topping against dollar. Aussie was less weak but is also vulnerable to deeper fall. The initial reaction this week to the Greek vote should reveal whether markets were just nervous ahead of the weekend, or they're reversing the underlying trend.

ECB left the main refinancing rate unchanged at 1%. Policymakers appeared to be more optimistic about the economic outlook. In the policy statement, the term 'substantial' was removed when describing 'downside risks to the economic outlook'. At the press conference, President Draghi said that 'hard' data have provided support the improved economic prospect. He also stated that the central bank was less pessimistic than the IMF's latest projections. The BOE expanded the asset purchase program by +50B pound to 325B pound and left the Bank rate at 0.5%. As mentioned in the policy statement, 'the underlying pace of recovery slowed during 2011, with activity falling slightly during the final quarter. While policymakers noted that 'some recent business surveys have painted a more positive picture and asset prices have risen', the pace of expansion in the country's major exporters 'has also slowed and concerns remain about the indebtedness and competitiveness of some euro-area countries'. More in As Expected, BOE Added More Stimulus while ECB Stood Aside.

RBA unexpectedly left the cash rate unchanged at 4.25% in February, in contrast with consensus of a rate cut by -25 bps. The decision, in spite of growing uncertainty in the sovereign debt crisis in the Eurozone, indicated policymakers' confidence in China's demand and US' economic recovery. More in RBA Unexpectedly Paused After 2 Successive Rate Cuts. Later in the week, RBA lowered 2012 inflation forecast to 3.00%, down from prior projection of 3.25%. Underlying inflation are expected to be at 2.75%, unchanged from prior projection. However, average growth in 2012 are expected to be at 3.5%, sharply lower than prior projection of 4.00%. The forecasts are based on assumption of keeping interest rate on hold at 4.25%. Overall, RBA expect inflation to "remain around the midpoint of the target range for most of the next couple of years" and that provides “scope for easier monetary policy should demand conditions weaken materially." Two important data from China weighed down on investor's sentiments last week. CPI jumped back to 4.5% yearly. The data might reinforce officials' concern that inflation is not going away yet and could complicate the plan to add stimulus to revive growth, lowering the possibility of policy loosening. Trade surplus widened sharply to $27.3b in January. However, that's due to sharply decline in imports, by -15% to $122.7b. Export dropped -0.5% to $149.9b, continuing its gradual down trend. Economists viewed steep decline in imports as a sign of extremely weak domestic demand.

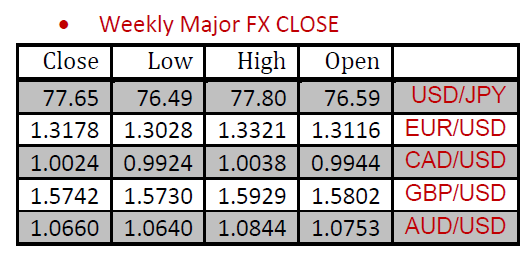

After the improvement witnessed in the U.S. dollar prices before the end of trading session on Friday, has seen most major currencies, a significant decline against the dollar. Euro moved sharply lower from a high of 1.3320 on Friday. Expect the pair to range trade between 1.3085 and 1.3320 ( during this week ) a break of either level should trigger the next direction. Following table shows the price movements of major currencies during the past week.

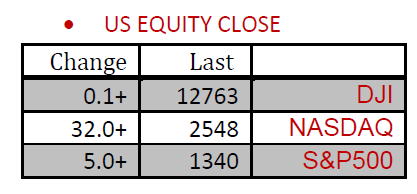

U.S. stock indexes experienced sharp volatility during the trading week. But they managed to round the end of trading with positive results supported the results of U.S. economic data released on Friday. Following table shows the closing prices for the U.S. stock indexes.

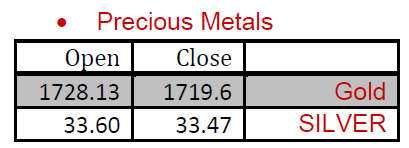

Precious metals prices, led by gold was unable to maintain the gains achieved during the past week of trading to end trading week, close to the lowest levels at 1719 dollars an ounce, down from the highest levels recorded during the week at 1752 dollars per ounce. The following table shows the opening and closing prices of precious metals in a week.

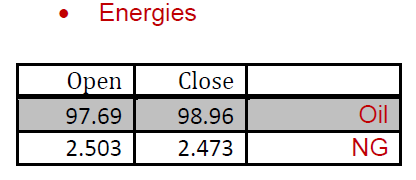

Crude oil was the biggest gainer during the trading week, taking advantage of thepolitical conflict happening between Iran and the United States, after that saw crude oil prices decline with the beginning of the week at levels of $ 95 a barrel enablesprice of a barrel of regression to trim its losses before the end of trading week, and it closed at 98.40, the following table shows the opening and closing prices of energy contracts during the last week .

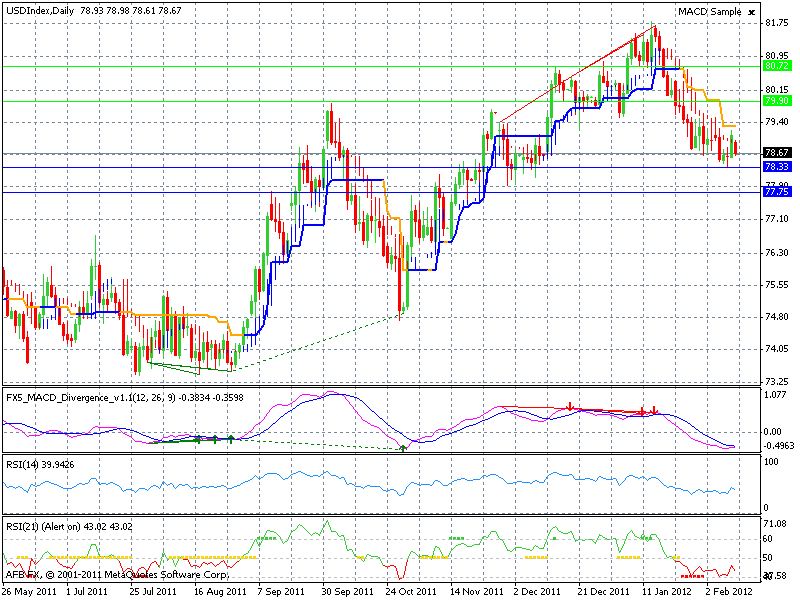

- Chart of the Week

This week we will take a close look at the U.S. dollar index chart and the expectations of the dollar index movement for the week.

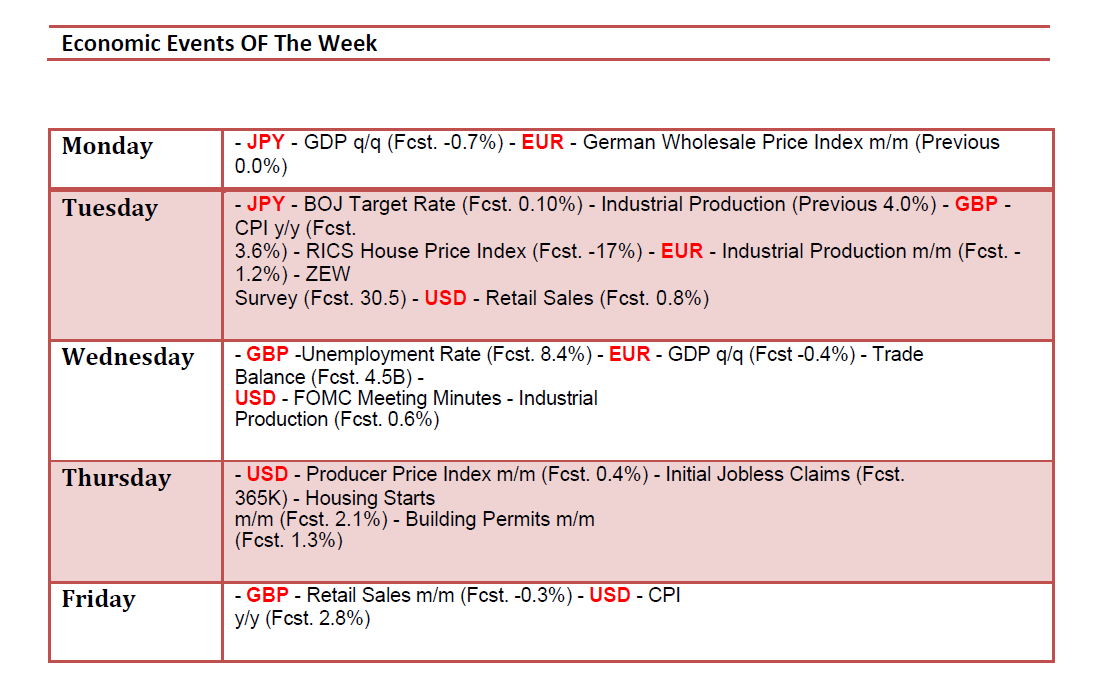

After some temporary attention to the US, the focus certainly returned to Athens in a very busy week that left the greenback almost unchanged. Apart from Greek news, we have GDP in the euro-zone and Japan, employment figures in the UK and Australia, and the FOMC Meeting Minutes as the main events lined up this week. Here is an outlook on the major market-movers coming our way. Technical approach refers to index movement within a narrow range between levels of 78.33 and 79.80 break important resistance levels at 79.80 could push the markets to levels of 80.70 (the highest levels recorded by the index during the two weeks), the RSI indicator refers to the presence in the oversold areas and that may give the US index some upward momentum during the trading week.

AFB FX Chief Technical Analyst

Mohammed ALMariri