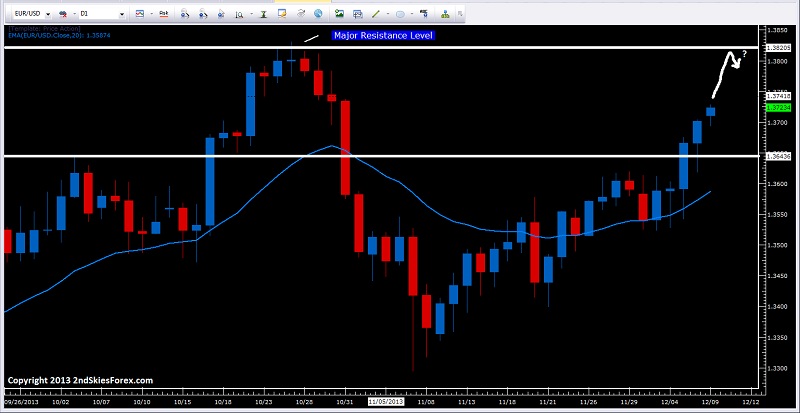

EUR/USD – Appproaching Key Resistance Level

Still truckin’ along on this current bull run from 1.3300, the pair has now gained 4 days in a row, with today potentially being the 5th. The pair is now approaching a major resistance level at 1.3820 which is the yearly high. Bears can look for price action signals to sell here, potentially on the 4hr or 1hr charts. You could also sell on weakness heading into the level with tight stops above. Meanwhile bulls can look for a corrective pullback towards 1.3645/50 area. Short term bias is bullish with 1.3820 being a key test for the bulls ahead.

EUR/USD" title="EUR/USD" align="bottom" border="0" height="413" width="800">

EUR/USD" title="EUR/USD" align="bottom" border="0" height="413" width="800">

GBP/JPY – Looking Set To Test Big Figure at 170

After pulling back for 3 days last week and shedding about 300 pips, the GBPJPY found buyers again, suggesting bulls are happy to scoop up this pair on pullbacks and cheaper prices. Bids came in around 166 and held the line there, and over the last 48 hours, have only managed one bear close, suggesting heavy continual buying.

The pair is facing a stiff test here at 169/169.12 which is the yearly high. Although we could see a pullback here (and thus represent a good level for bears to get short), I suspect bulls will hold 166 again on pullbacks and eventually take out 169 to take on 170. Current levels to watch for pullbacks to get long and trade with the trend are 166.87 and 166.

GBP/JPY" title="GBP/JPY" align="bottom" border="0" height="411" width="800">

GBP/JPY" title="GBP/JPY" align="bottom" border="0" height="411" width="800">

Nikkei 225 – Strong Bounce Off 15,000

Finding heavy buyers just above 15,000, the Nikkei 225 index has climbed for 32 of the last 40 hours, gaining over +630 points since then. The Japanese index is approaching the major resistance we talked about last week at 15810 where sellers will likely be parked along with bulls taking profits ahead of time. I’ll look to sell around the level with small stops above. Downside targets will be 15700, 15630 and potentially a much larger sell-off towards 15,036 which is where the last +600 point bounce came from.