NOTE: I deliberately wrote the daily commentary today AFTER the market open, knowing damn well the Greece deal not going through would cause major problems and volatility.

Caution is recommended trading EUR based pairs as brokers are likely (if not already) changing margin requirements and trading options around EUR pairs to prevent another CHF debacle.

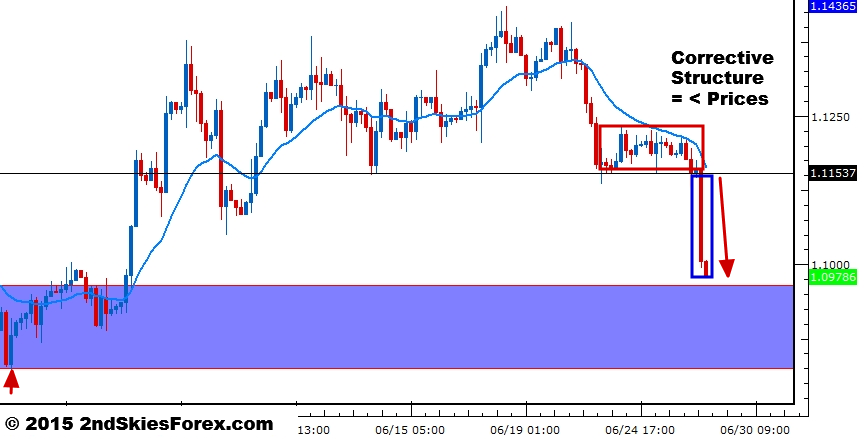

EUR/USD – Euro Slammed on Market Open on No Greece Deal (4hr chart)

Late last week, we talked about in our members trade setups commentary, the EUR/USD corrective structure, and a bearish move being likely from here to sell from.

To wit:

“EUR/USD corrective move on 4hr chart suggests the next leg is down – it's just in a strange location to recent PA, but am thinking lesser prices from here.”

As you can see, this is exactly what happened with this weekend open trouncing the pair for about 2 cents lower.

Everything depends upon a Greek deal at this moment. Just the fact none is in play yet (before the June 30th deadline) is already causing this kind of risk premium to the bear side.

A full blown no deal by June 30th and default would easily dice into this box/zone of support, and likely more.

I’m actually suspecting Greece leaving the EU would at least = a 1500+ move south (so sub parity), and could easily see us hitting 85 cents within a few months.

I’m guessing at some point along the way, the ECB would intervene to avoid a panic, and I’m sure the plunge protection team at the FED will be working overtime the next few days.

Regardless, until there is any deal, expect massive downside risk and volatility on EUR pairs.

The bottom of this key level/blue box is around 1.0824. Breaking below this sets up 1.0675 and 1.0540.