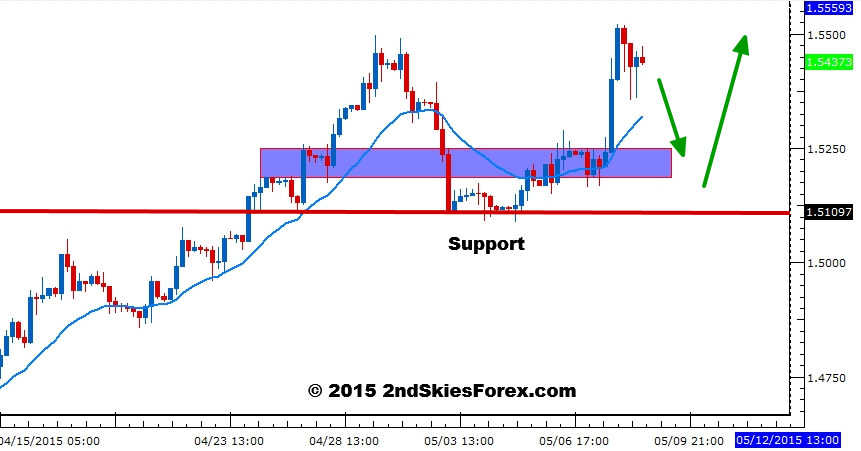

GBP/USD – (4hr chart)

Jumping a few cents shortly after the UK election results and conservative victory, the Cable should maintain a relatively solid bullish bias this week.

The pair tagged the ‘big figure‘ at 1.55 before pulling back. But notice the with trend pin bars to end the week. This suggests bids were willing to step in on dips intra-day, even going into the weekend.

I’m suspecting a small pullback will be in order before another bullish upside attack resumes. There is a ST support zone coming in around 1.5250 and 1.5187 (blue box) while another key support level coming in at 1.5109.

Only a daily close below the latter negates my ST & MT bullish bias.

Euro Stoxx 50 – Corrective Phase Near Key Resistance (1hr chart)

Bouncing hard off the 3500 ‘big figure‘ shortly after the UK election results came out, the Eurostoxx 50 index has gained 150 points in a couple days. This is one of the largest two day gains in the last several years for the European index.

Notice the small corrective phase price action structure near the key resistance zone between 3657 and 3673. I’m suspecting the index is going to attack this zone and try another leg up.

If it breaks through this key resistance zone from here, then there is room for a move towards 3736 and perhaps 3800 if the momentum can be sustained this week.

Only a daily close below 3530 and 3500 negates this ST bullish momentum.