EUR/USD

After forming an impressive rally off the 1.2950 support level, gaining almost 160 pips on Thursday, the pair did an about-face on Friday, touching 1.3100 and bottoming at the same intraday support level. This has effectively created a short term range between 1.3125 and 1.2960.

Should the selling pressure continue, the next major support does not come in till 1.2875 which is the December swing low. Bulls can watch for intraday price action signals to buy off the support level while bears can look for a breakout pullback setup, or a rally to fade the pair around the 20ema.

EUR/USD - 1" title="EUR/USD - 1" width="624" height="468">

EUR/USD - 1" title="EUR/USD - 1" width="624" height="468">

GBP/JPY

Rallying impressively for 7 of the last 8 days, the pair has rejected off the 144.70 level forming a large bearish pin bar in the process. If the pair aggressively attacks on Monday the 144.70 level, then it may buckle, but a corrective price action rally to the level would offer a good opportunity to sell. If the bearish pressure continues, 140.50 is the next major support on deck.

GBP/JPY" title="GBP/JPY" width="624" height="468">

GBP/JPY" title="GBP/JPY" width="624" height="468">

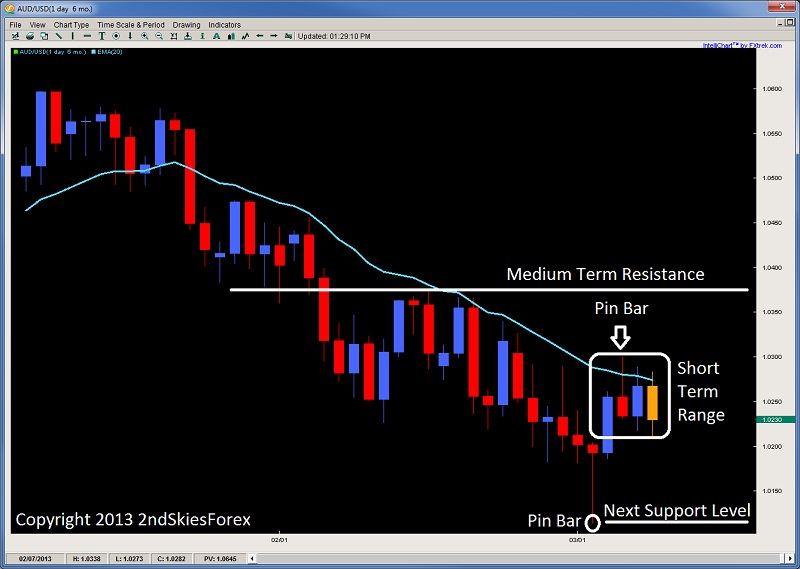

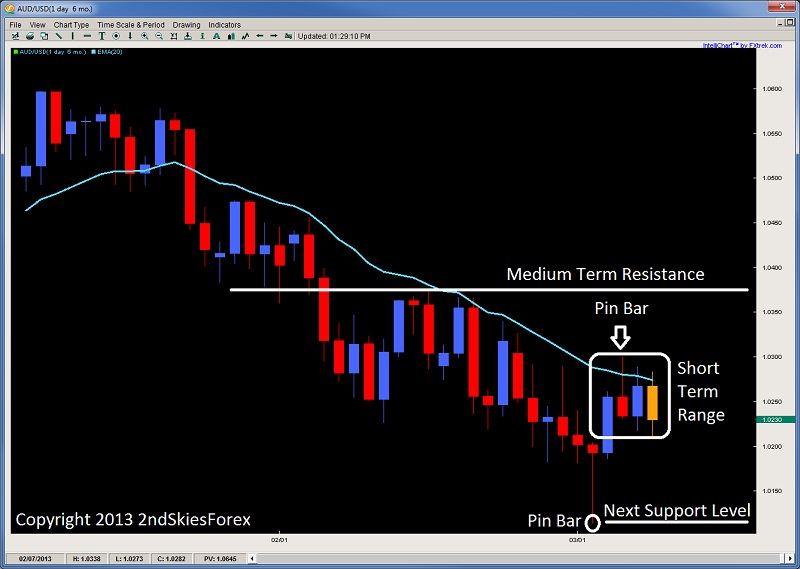

AUD/USD

After forming two pin bar signals in the last week, the AUD/USD has formed a large range after the most recent bullish leg off the yearly lows at 1.0115. The medium term structure is still in a downtrend, but short term, if 1.0200 can hold, then more upside seems on the cards, assuming it can break 1.0300.

Watch for the intraday price action range on the 4hr chart which shows the consolidation between the 1.0210 and 1.0300 levels. If the high of the 1.0300 gets broken, then 1.0360 is up next. However a break of 1.0210 will challenge 1.0181 and 1.0115.

AUD/USD" title="AUD/USD" width="624" height="468">

AUD/USD" title="AUD/USD" width="624" height="468">

Original post

After forming an impressive rally off the 1.2950 support level, gaining almost 160 pips on Thursday, the pair did an about-face on Friday, touching 1.3100 and bottoming at the same intraday support level. This has effectively created a short term range between 1.3125 and 1.2960.

Should the selling pressure continue, the next major support does not come in till 1.2875 which is the December swing low. Bulls can watch for intraday price action signals to buy off the support level while bears can look for a breakout pullback setup, or a rally to fade the pair around the 20ema.

EUR/USD - 1" title="EUR/USD - 1" width="624" height="468">

EUR/USD - 1" title="EUR/USD - 1" width="624" height="468">GBP/JPY

Rallying impressively for 7 of the last 8 days, the pair has rejected off the 144.70 level forming a large bearish pin bar in the process. If the pair aggressively attacks on Monday the 144.70 level, then it may buckle, but a corrective price action rally to the level would offer a good opportunity to sell. If the bearish pressure continues, 140.50 is the next major support on deck.

GBP/JPY" title="GBP/JPY" width="624" height="468">

GBP/JPY" title="GBP/JPY" width="624" height="468">AUD/USD

After forming two pin bar signals in the last week, the AUD/USD has formed a large range after the most recent bullish leg off the yearly lows at 1.0115. The medium term structure is still in a downtrend, but short term, if 1.0200 can hold, then more upside seems on the cards, assuming it can break 1.0300.

Watch for the intraday price action range on the 4hr chart which shows the consolidation between the 1.0210 and 1.0300 levels. If the high of the 1.0300 gets broken, then 1.0360 is up next. However a break of 1.0210 will challenge 1.0181 and 1.0115.

AUD/USD" title="AUD/USD" width="624" height="468">

AUD/USD" title="AUD/USD" width="624" height="468">Original post