Climbing 6 of the last 8 days, the Euro has been looking impressive in gaining +450 pips in the process. On Friday, the pair formed an inside bar at a key resistance level 1.3263. It should be noted the pair is stuck between 1.3200 which was prior resistance, and the 1.3312 which was the A bar’s high and also role reversal level in late February. If 1.3200 holds, then 1.3312 should be under attack. Above this is 1.3357 and 1.3450. Below 1.3200 puts 1.3150 and 1.3060 in play. EUR/USD" title="EUR/USD" width="1758" height="808">

EUR/USD" title="EUR/USD" width="1758" height="808">

USD/JPY – Pin Bar at Key Level. More Upside?

Down 800+ pips from the yearly highs, the USD/JPY has fallen 9 of its last 12 days. On Friday, the pair formed a long tailed pin bar signal off a key role reversal level in 96.52. Intraday lows were actually just 2 pips south of 95, with the pair bouncing over 280 pips off the lows. The intraday charts show massive buying off 95, so this could be a legitimate with trend setup. I wouldn't buy on the break above the pin bar, as the risk and SL would have to be large, imbalancing the risk to reward ratios. So I’ll consider pullbacks towards 96.52 and 96, while targeting 99 and perhaps 100. USD/JPY" title="USD/JPY" width="1758" height="808">

USD/JPY" title="USD/JPY" width="1758" height="808">

GBP/USD – Also Formed Inside Bar Setup

Like the Euro, the pound has also formed an inside bar setup, but between the two, this one looks a little stronger. Notice how in the last 8 days, the bull bars were much more impulsive, with them getting larger as they climbed? This shows an increase in buying pressure, and the inside bar on Friday also has a downward wick, showing a rejection intraday, or buyers willing to come in on pullbacks. If we get a strong intraday 1hr or 4hr close above 1.5630, then 1.5800 should come into focus. If this key level holds, then 1.5500 and 1.5400 will be under attack. GBP/USD" title="GBP/USD" width="1758" height="808">

GBP/USD" title="GBP/USD" width="1758" height="808">

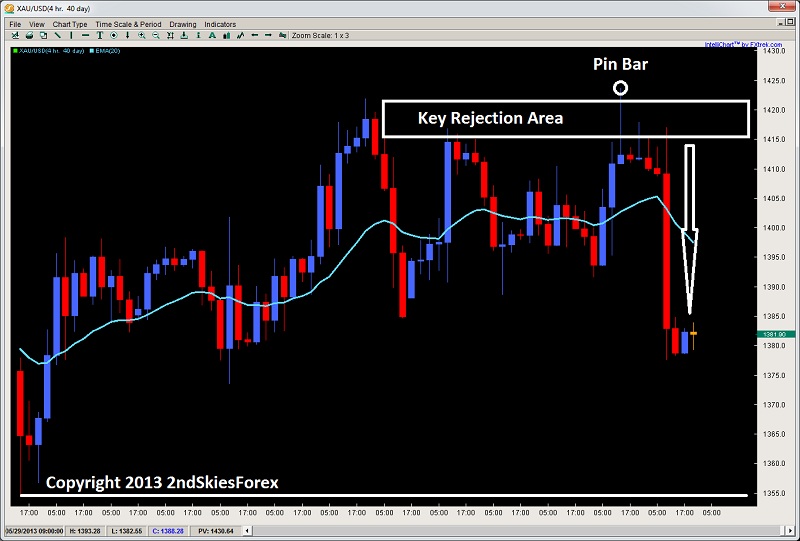

Gold Forms Pin Bar At Aforementioned Level

On Tuesday last week, we recapped a sell trade recommendation at 1415 in my market commentary which sold off over $28. We recommended another sell off the level if it offered a good signal. To end the week, the precious metal formed a bearish pin bar signal which was with trend. Notice how 4 of the next 5 candles also showed upside rejections, communicating any attempt to rally found sellers. The result was a larger $44 sell off, so anyone entering on a retrace to the 1415 level would have profited handsomely with a well over 3.5:1 reward to risk play. Now the PM is consolidating on the key 1380 level. If this fails, then 1360 is up next, but aggressive selling will likely attract more with trend traders in assumption the trend will resume.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Forex Price Action Setups: June 9 - 14, 2013

Published 06/09/2013, 12:35 AM

Updated 05/14/2017, 06:45 AM

Weekly Forex Price Action Setups: June 9 - 14, 2013

EUR/USD – Inside Bar At Resistance Levels

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.