EURUSD – Looking to Sell After Short Term Bounce

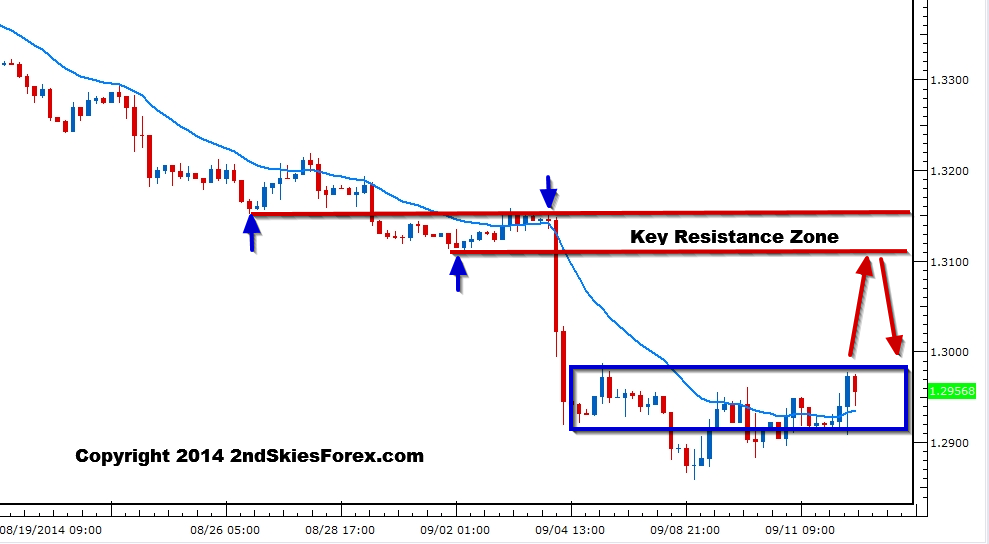

While the Euro has been struggling to lift off the bottom near 1.2900, it is short term forming a corrective structure that shows elements of a potential bounce near term (4hr chart below).

Overall though, I prefer to be a seller on a retracement. The first layer of resistance comes in at 1.3110 with a role reversal level at 1.3150.

Hence, I’ll look to sell on weak/mild pullbacks into this resistance zone, in anticipation of the downtrend resuming so we can trade with the trend.

GBPUSD – Approaching Key Resistance

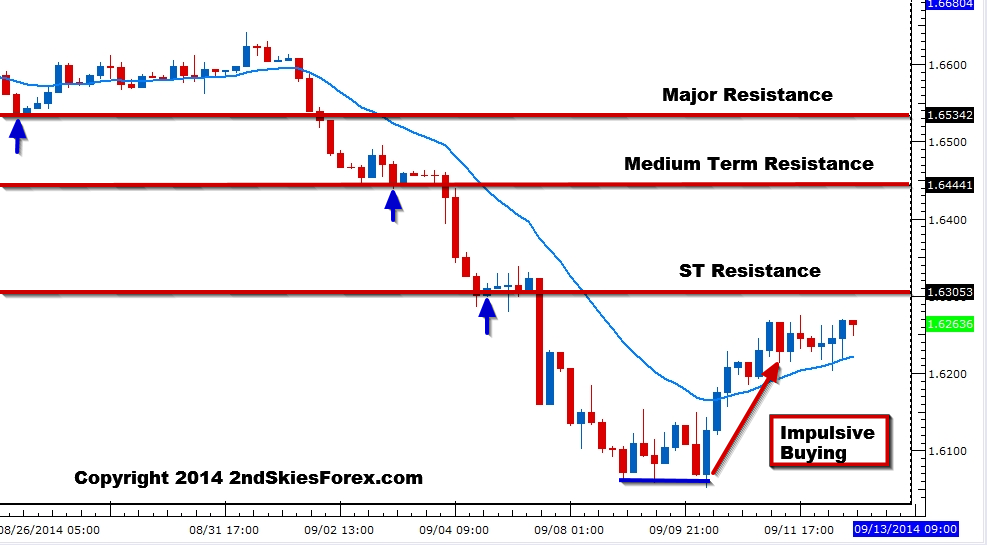

After bouncing from the 1.6060 support level as we anticipated in our Sept. 9th market commentary, the Cable has consolidated just below the first key resistance at 1.6305, with a slight bullish underpinning short term (4hr chart).

In trading cable this week, the near term price action and risk premium will be heavily dominated by the Scottish independent vote, and any of the latest poll results.

For now, I prefer being a seller into resistance, and that is how most of the institutional orders are trading cable at the moment.

Aggressive traders can look to sell at 1.6305, while more conservative traders can sell near 1.6440 and 1.6533.

USDJPY – Heavily Bullish, Buying on Pullbacks

Closing bullish for the 5th week in a row, the USDJPY has broken above the key resistance at 105.30, adding 200 pips from there to close the week.

We tweeted about the intra-day support and resistance levels to watch on Friday, and both of those played out to perfection, so congrats to the intra-day traders who profited from this.

We are maintaining a heavy bullish bias, and will buy on pullbacks, likely into several layers of key support as we see a long term move up for likely weeks to come.

The first intra-day layer we’d be open to buying on a corrective pullback would be ~106.03. Below here, there is a large support zone between 105.35 and 104.75. I’d be open to buying in this support zone as I think this will attract a lot of institutional players who will buy on the pullback to trade with the trend.