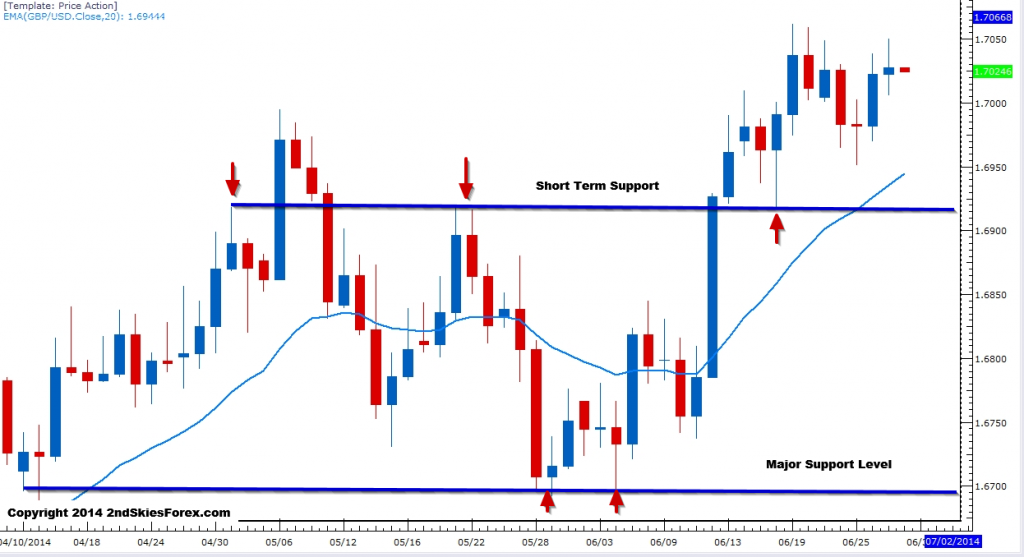

GBPUSD – Too High to Buy, Too Strong to Sell

After forming a mild 4 day corrective price action pullback, the cable has rallied off the 1.6950 level, and is once again pressing up against the multi-year resistance at 1.7060. Because of the quick recovery after the mild pullback, and the underlying strength, we will pass on selling at the major resistance ahead.

On the other side of the coin, we’d like to be buyers, but the pair is too high in our estimates, and hasn’t done the dirty work of clearing the major resistance ahead, so we’ll wait fora deeper pullback towards 1.6830 or 1.6730 before looking to get long. Another scenario we’d be open to getting long on, would be a daily close above 1.7060, then waiting for the pullback to the role reversal level to get long.

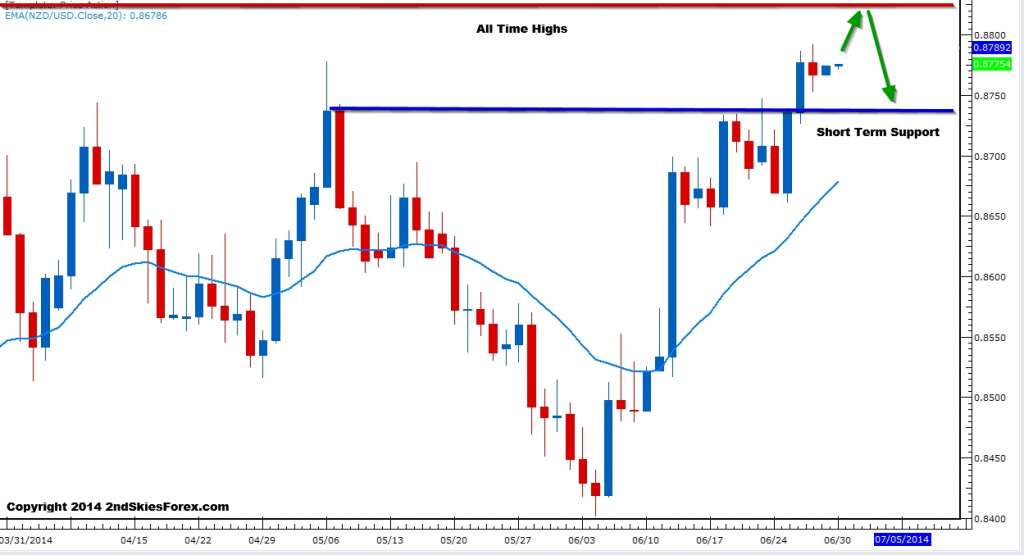

NZDUSD – Inside Bar at Key Resistance

Climbing for 9 of the last 17 days, the Kiwi has gained an impressive ~400 pips and is approaching a key resistance level at 8800. With Friday’s close, the pair formed an inside bar at said key resistance, with the prior candle showing little rejection by the bears.

I’m suspecting a breakout to the upside, but the all time highs are just above at 8842, so I’m thinking bulls will take profit ahead of the key level.

Our Trade Idea: Look to sell near 8842 with a tight stop above, looking for a further correction towards 8690, offering up a good risk to reward scenario.

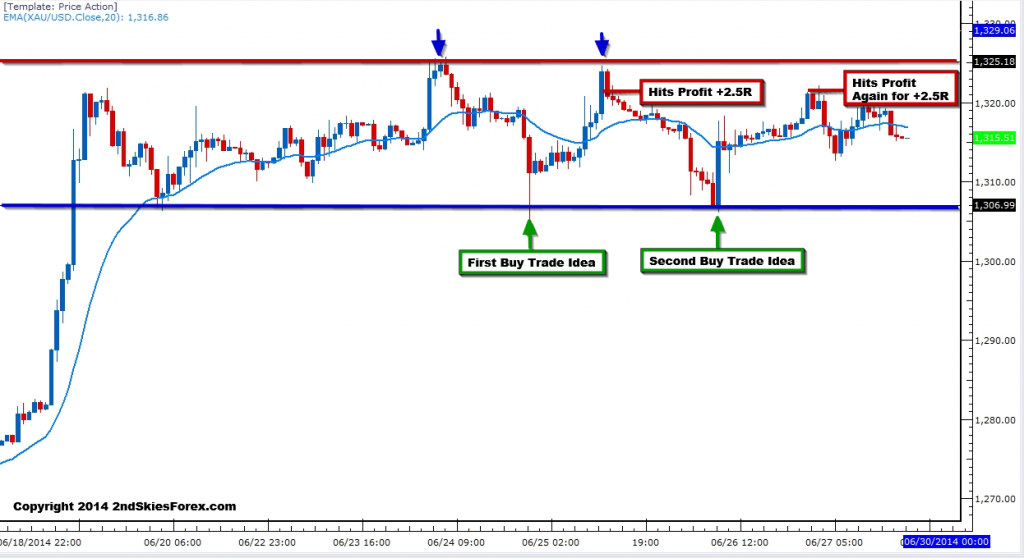

Gold – Buy Setups at Range Support Continue to Profit

After the impulsive bullish move back on June 19th, we suggested in our daily market commentary on June 23rd to get long on pullbacks towards 1309, targeting 1320. One day later the precious metal bounced over $20 where members profited heavily. Then we suggested back on the 25th to get long again at 1306, which also held again, hitting the same 1321 target, offering another 1500 points in profit so congrats to all the members who profited from this.

For now, the range is still in play, so watch the 1306 level to potentially get long. If this fails, then 1300 and 1285 are up next as levels for bulls to re-enter.

Key upside range resistance comes in at 1325, which if the bulls clear, sets up 1330 and 1342. Watch the range for the next directional clues.