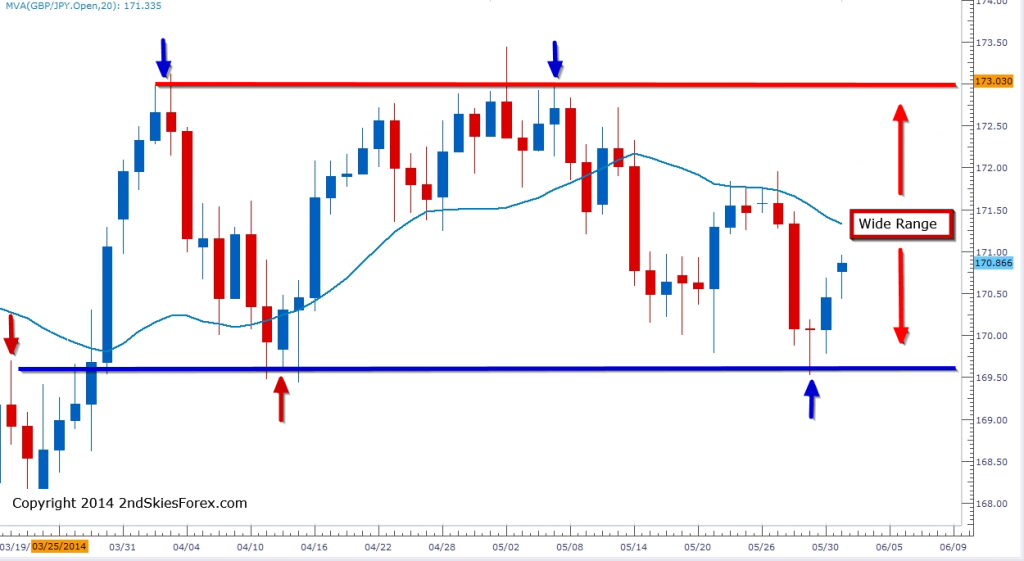

GBPJPY – Wide Range to Play

After breaking out of the ascending triangle, the GBPJPY has now entered a wide range between 169.60 and 173. With volumes continually declining and the summer trading settling in, I’m suspecting this wide range will play out for at least the next week or two.

Our Trade Idea: Look to play the range for now on both sides targeting the middle of the range as your first target, and 10% shy of the opposite side of the range for your second target. We do not need a price action signal to form at the range barriers to take the range as we are assuming it will hold until we get a clean break and close on either side.

NZDUSD – Role Reversal Level Holds

In our private members commentary on May 29th, we talked about the role reversal level holding and getting short on a pullback into 8515. The next day the pair did just that, literally hitting the level to the pip so hopefully you got in that and have locked in at least some profit.

Our Trade Idea: For those short already, hold for a break of 8450 with the potential to move lower towards 8420. For those not already short, look for corrective pullbacks into the 8515 level to get short for a potential move lower with tight stops above.

Gold – Expecting a Pullback, Still Bearish

After breaking below the key support level at 1267 and closing for 5 days bearish, the precious metal hit the 1240 level that we talked about in our May 27th commentary. I’m expecting a pullback in the precious metal before a likely move lower. For now, the bearish bias remains until we can get a daily close minimally above 1277 so I’ll look to trade with the trend.

Our Trade Idea: Look for a corrective pullback to get short at 1275 with stops above 1280. Downside targets are 1251, 1240 and a potentially much larger move towards 1221 and 1184 with the downside being the line of least resistance.