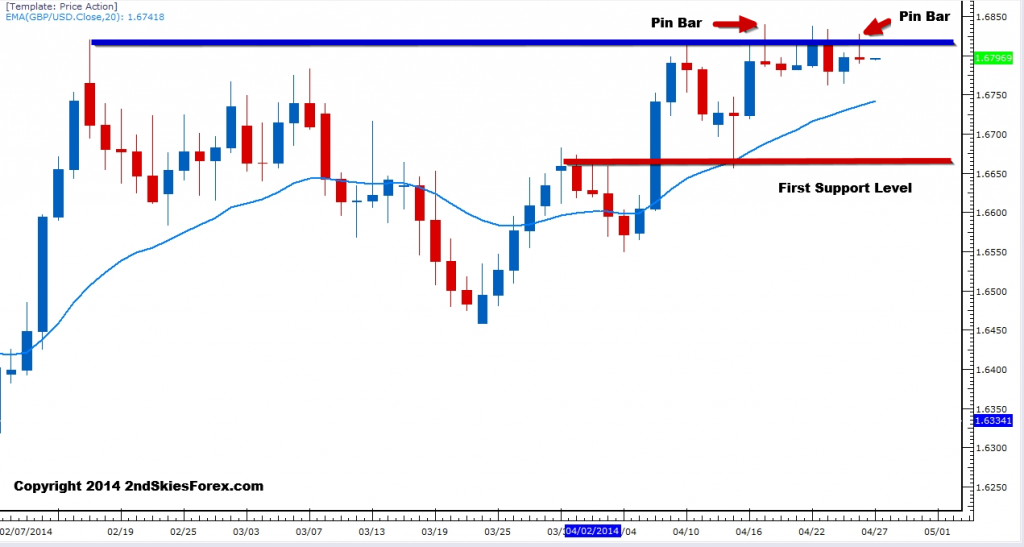

GBPUSD – Knockin on Major Resistance, But…

Stuck in an 80 pip range for the last 7 days, the GBPUSD has formed two pin bars off the key resistance at 1.6840 that we’ve been talking about in the members commentary lately. Hanging at the upper levels suggest bulls are crimping the bears out of the market, and will attempt to push for a breakout, especially since the last pin bar was smaller than the first.

Bears wanting to short should wait for a small corrective push up to 1.6840, while bears will need to wait till a small pullback towards 1.6670/6700, or a breakout pullback above 1.6840 before getting long. Keep in mind we have the Nov. 09′ resistance at 1.6875 further above, but nothing till the ‘big figure’ at 1.7000.

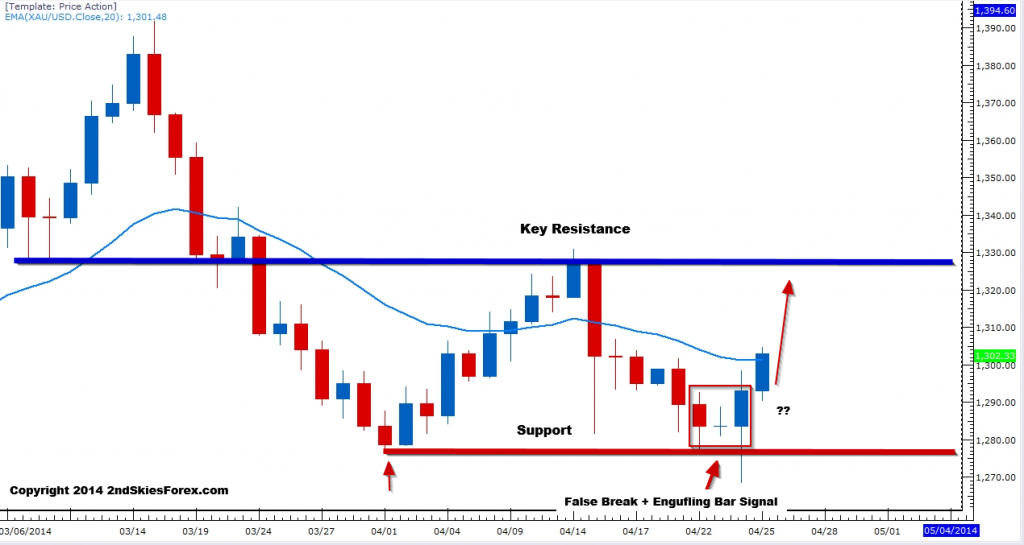

Gold – False Break + Engulfing Bar Signal At Support

In our April 24th commentary, we shared a live trade for +750 pips, and talked about the false break + engulfing bar signal at the key 1277 support. Note how this was a classic false break at the support level, combined with a strong-bullish close. This told us the false break + engulfing bar signal was worth considering for a buy setup.

For this week, if the bullish price action continues, I could see the PM continue up to the next resistance area between 1320 and 1330. A daily close below the lows last week puts 1249 and 1233 in focus.

Dow Jones – Falls Lower After Pin Bar + False Break At Key Resistance

As discussed in our members commentary on April 24th, the Dow Jones made a tiny false break at the key resistance we discussed in our weekly market commentary. We can see on late Thursday and Friday as well, the US index fell significantly lower from this resistance following the pin bar + false break.

This to us was obvious and as predicted because of where it formed, being how firm this area/level held in the past. If the bearish momentum continues next week, I could see a further retest of the key support at 16K. Watch the current 4hr pin bar for a corrective or impulsive push, for if its the former, then this would suggest bears are still in control short term.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Forex Price Action Outlook

Published 04/28/2014, 03:32 AM

Weekly Forex Price Action Outlook

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.