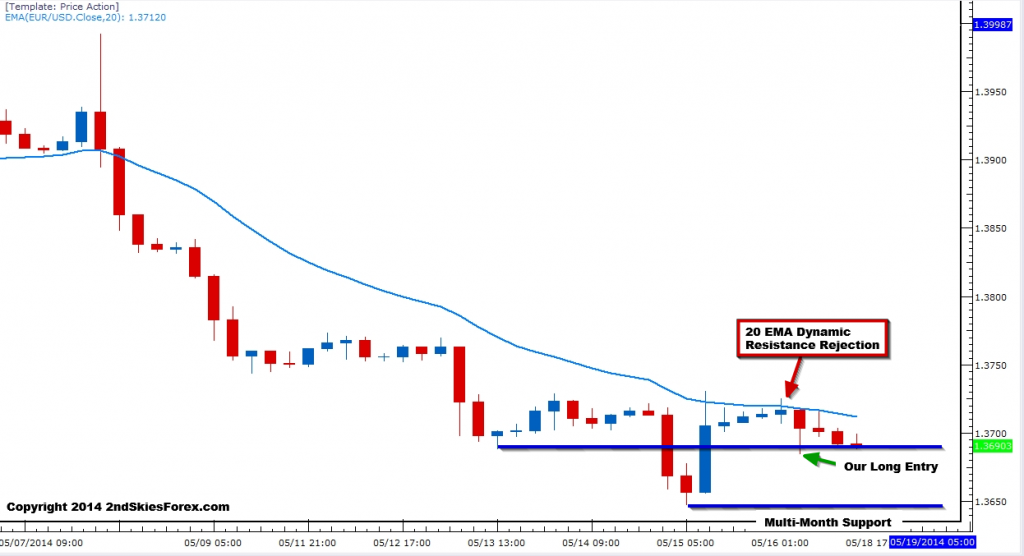

EURUSD – Pin Bar Signal Active, But…

Our Euro pin bar signal that we posted last Friday is active on the pullback into the 1.3689/70 area. The pair ended last week with some mild selling off the 4hr 20 ema and dynamic resistance, which is less inspiring for our long play. If the pair resumes selling to start the week, then it will likely test the bulls which bought up the pair at 1.3642.

Our Trade Idea: Holding current long with stops tightly below Thursday’s low. Will need to clear 20 EMA for more upside. A daily close below 1.3642 will likely open up fresh downside to 1.3500.

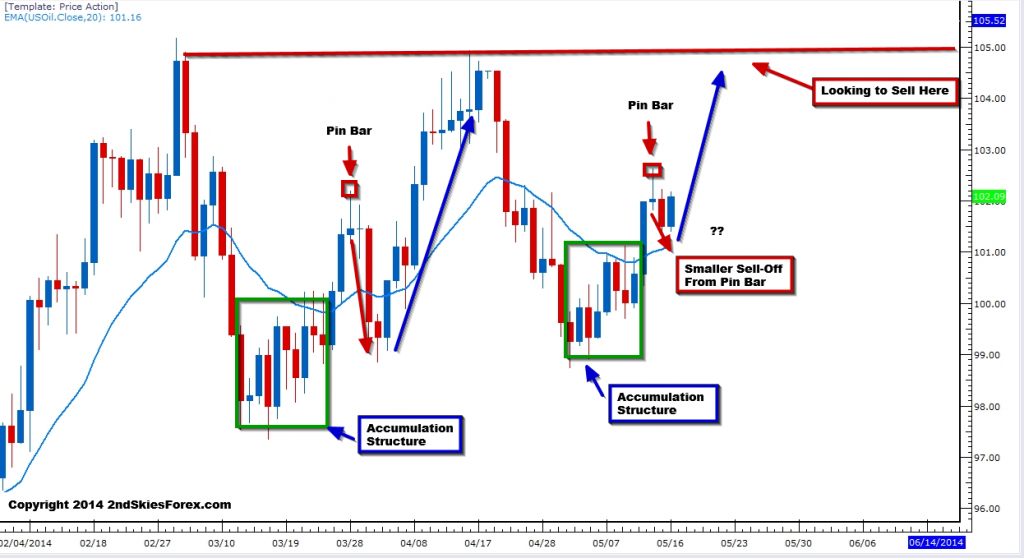

WTI Crude Oil – Series Of Higher Lows, Possible Sell Signal

After forming a double top at 105, instead of the commodity forming a double bottom range low, it formed a HL (higher low), suggesting the bulls were willing to buy it at a worse price. The structure of the last two accumulation periods suggested a decent pullback before the big push up. But after the small pin bar signal, WTI Crude was bought back up a day after, suggesting bulls holding the upside pressure.

Our Trade Idea: I’ll look to sell at the 105 key level with stops above the March highs. Downside targets are 102.45 and 100. A daily close above 105.20 will put pressure on 107.50.

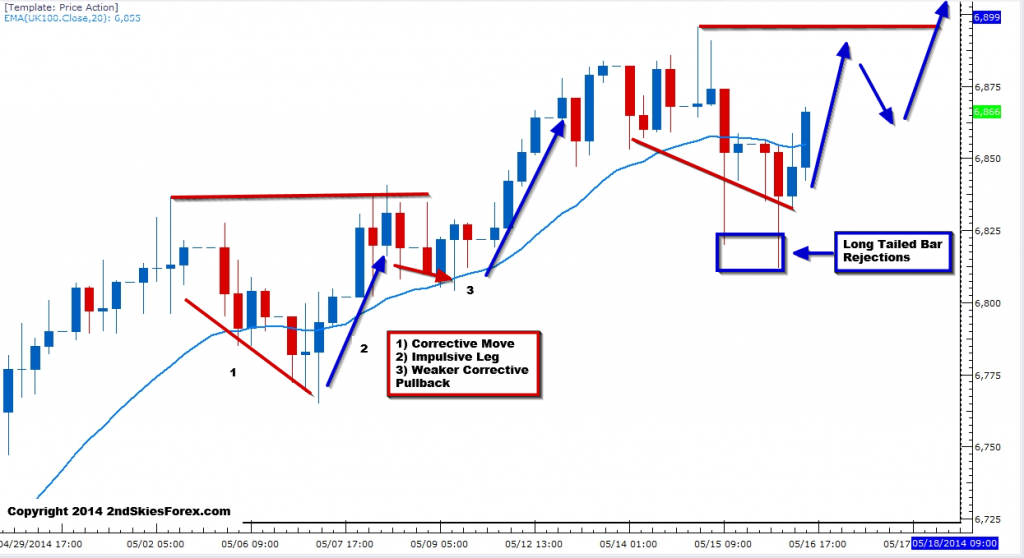

FTSE 100 – Event Area Holds After Long Tailed Bar Rejection

After forming a more stout corrective pullback, the FTSE 100 found buyers with two long tailed bar rejections just above the 6815 support and event area (an event area is just a key support and resistance zone where price created a strong rejection or directional move prior). The two bull close ‘recovery’ of the daily 20 ema suggests bulls will gun for the yearly highs around 6893.

Our Trade Idea: If we get a similar price action context and structure, with a challenge of the swing highs, and a weak corrective pullback back into the 20 ema, I’ll look to get long with stops tightly below the dynamic support. Upside targets will be the 6890 yearly highs, and 6950 which is the rising channel resistance line on the daily chart.