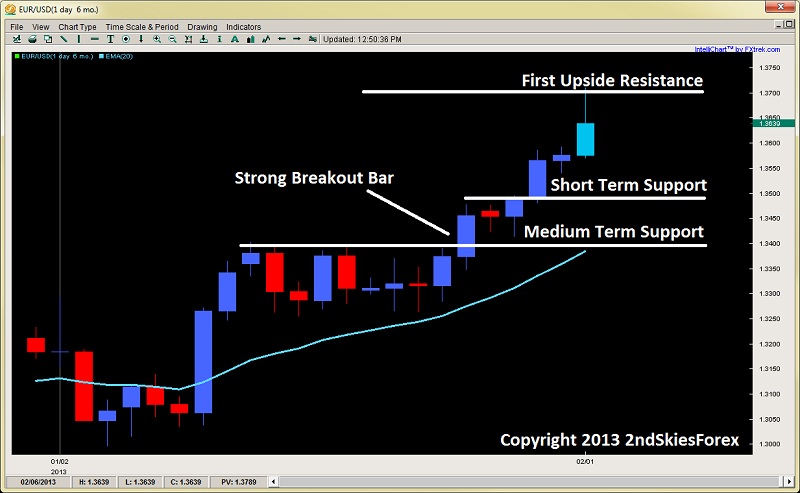

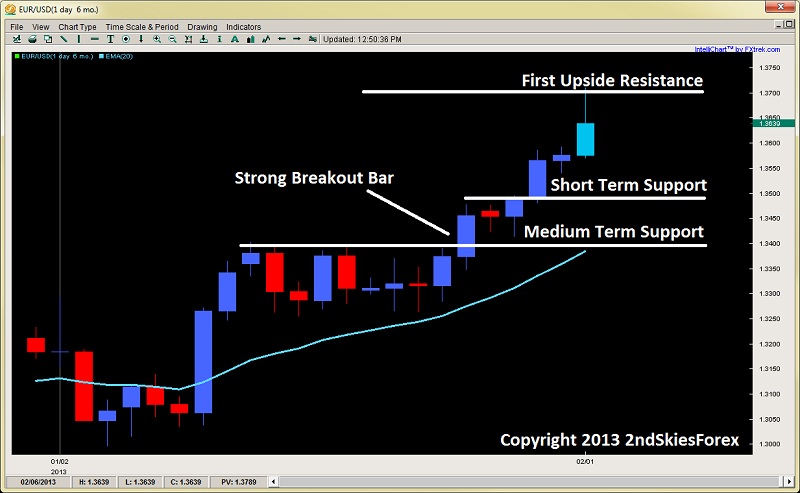

EUR/USD

Gaining 6 out of the last 7 days, Friday’s NFP was a wild ride with the pair touching an intraday low of 1.3585, then screaming up in 1hr up to 1.3700, only to sell off another 60pips. Intraday support comes in at 1.3585 (Friday low) where the pair found strong buyers, while sellers can look for intraday price action signals off 1.3700 with tight stops above. A downside break of the level sets up 1.3500 while a 1.3700 break targets 1.3830.

EUR/USD" title="EUR/USD" width="524" height="334">

EUR/USD" title="EUR/USD" width="524" height="334">

EUR/JPY

Trending and holding it a little stronger, the EUR/JPY has been holding its own and closing not to far off the weekly highs. What I am noticing is on the 4hr charts, the pullbacks are getting short and shorter, which communicates the pair is highly imbalanced on the buy side. I’m not sure how much more can pile in, but I’ll be looking for climax price action signals for a potential reversal in the near future. Until then, I’ll look to buy on pullbacks towards 124 and 123, assuming it is corrective.

EUR/JPY" title="EUR/JPY" width="524" height="334">

EUR/JPY" title="EUR/JPY" width="524" height="334">

GBP/JPY

Another trending JPY pair, the GBP/JPY has been one of the underperformers lately. It did just form a major intraday breakout above 144.75, heading straight for 146.50 before pulling back. On Friday formed an intraday pin bar off the key breakout level (144.75). These rejections on both side of the market communicate short term range play, so bulls can look to buy off 144.75 while bears can look to sell off 146.50 off corrective moves heading into the level.

GBP/JPY" title="GBP/JPY" width="524" height="334">

GBP/JPY" title="GBP/JPY" width="524" height="334">

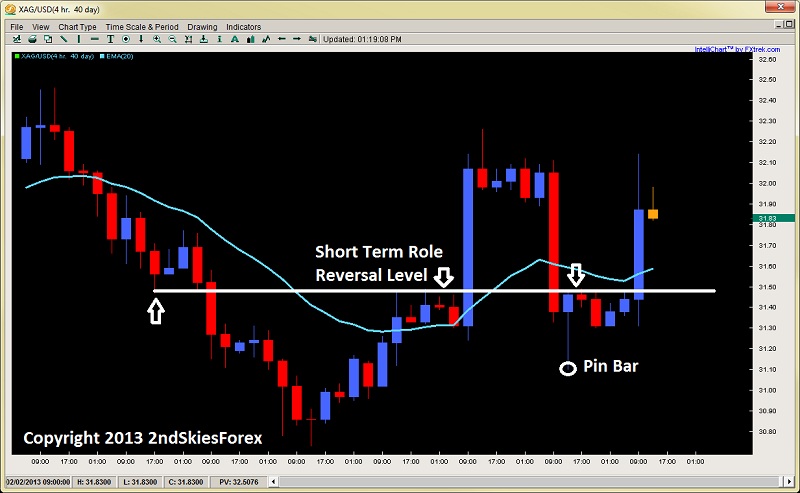

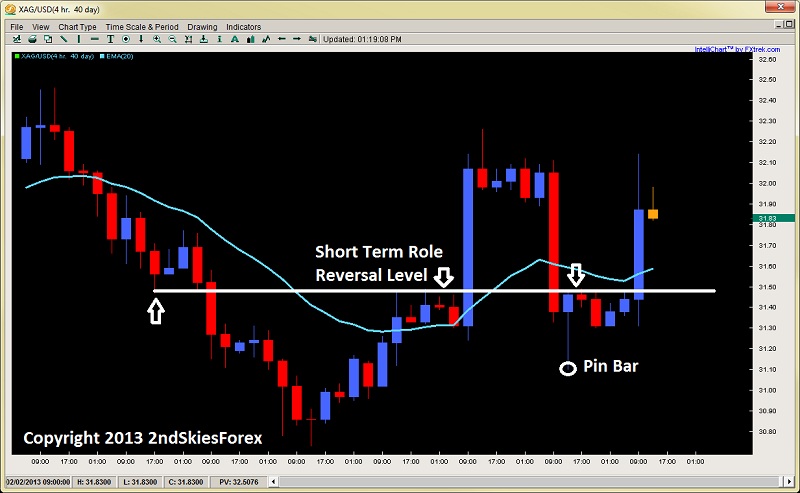

Silver

Outperforming Gold as of late, the shiny metal held most of its gains to end last week. Notice the pin bar signal which followed after such a large bear bar on Thursday. After such strong selling, the pin bar held, and then found higher prices, suggesting the metal is underpinned. The overall contraction towards the recent swing highs suggests likely higher prices. I’ll look for intraday buying opportunities either at $31.50 or $31.15. Bears can look for possible sell signals off $32.30.

XAG/USD" title="XAG/USD" width="524" height="334">

XAG/USD" title="XAG/USD" width="524" height="334">

Original post

Gaining 6 out of the last 7 days, Friday’s NFP was a wild ride with the pair touching an intraday low of 1.3585, then screaming up in 1hr up to 1.3700, only to sell off another 60pips. Intraday support comes in at 1.3585 (Friday low) where the pair found strong buyers, while sellers can look for intraday price action signals off 1.3700 with tight stops above. A downside break of the level sets up 1.3500 while a 1.3700 break targets 1.3830.

EUR/USD" title="EUR/USD" width="524" height="334">

EUR/USD" title="EUR/USD" width="524" height="334">EUR/JPY

Trending and holding it a little stronger, the EUR/JPY has been holding its own and closing not to far off the weekly highs. What I am noticing is on the 4hr charts, the pullbacks are getting short and shorter, which communicates the pair is highly imbalanced on the buy side. I’m not sure how much more can pile in, but I’ll be looking for climax price action signals for a potential reversal in the near future. Until then, I’ll look to buy on pullbacks towards 124 and 123, assuming it is corrective.

EUR/JPY" title="EUR/JPY" width="524" height="334">

EUR/JPY" title="EUR/JPY" width="524" height="334">GBP/JPY

Another trending JPY pair, the GBP/JPY has been one of the underperformers lately. It did just form a major intraday breakout above 144.75, heading straight for 146.50 before pulling back. On Friday formed an intraday pin bar off the key breakout level (144.75). These rejections on both side of the market communicate short term range play, so bulls can look to buy off 144.75 while bears can look to sell off 146.50 off corrective moves heading into the level.

GBP/JPY" title="GBP/JPY" width="524" height="334">

GBP/JPY" title="GBP/JPY" width="524" height="334">Silver

Outperforming Gold as of late, the shiny metal held most of its gains to end last week. Notice the pin bar signal which followed after such a large bear bar on Thursday. After such strong selling, the pin bar held, and then found higher prices, suggesting the metal is underpinned. The overall contraction towards the recent swing highs suggests likely higher prices. I’ll look for intraday buying opportunities either at $31.50 or $31.15. Bears can look for possible sell signals off $32.30.

XAG/USD" title="XAG/USD" width="524" height="334">

XAG/USD" title="XAG/USD" width="524" height="334">Original post