GBP/USD" title="GBP/USD" height="242" width="474">

GBP/USD" title="GBP/USD" height="242" width="474">

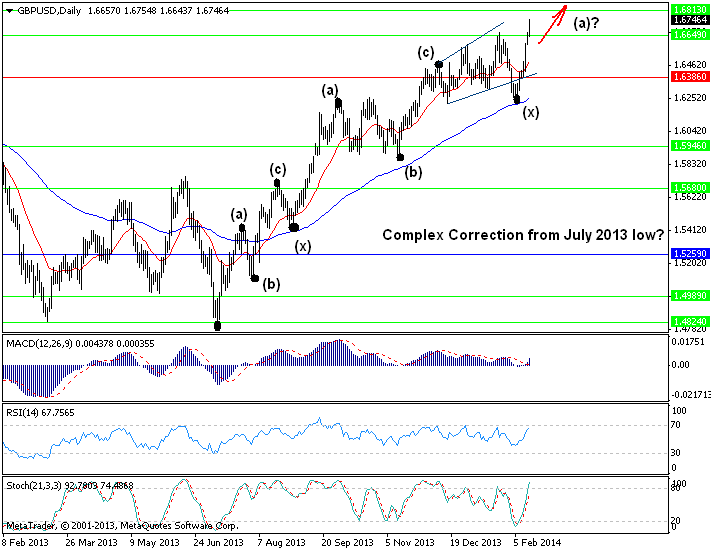

GBP/USD: 1.6746

Short-Term Trend: Uptrend

Outlook: A very important event happened last week. GBP rallied much stronger than expected and then moved above the 1.6740 level. That way it completely negated the previous wave count on the weekly chart which implied the rally from July 2013 low was wave E of a big Contracting Triangle from the Jan 2009 low. Now, this rally is considered the beginning of a much bigger move higher. Shorter-term, as long as the prices hold abv 1.6480, the bulls are fully in charge and gains twd 1.70/1.71 are expected. The market is a bit overbought, so a minor pullback toward 1.6650 is likely this week and if such a pullback occurs, I will use it as a buying opportunity.

On the downside, only below 1.6480 will negate and will risk weakness toward 1.6220.

Strategy: The short from 1.6610 was stopped out at 1.6530 with 80 pts profit. Longs are now favored at 1.6650 against 1.6480.