- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Weekly Focus - Trade Talks Enter Critical Phase As Brexit Deadline Draws Closer

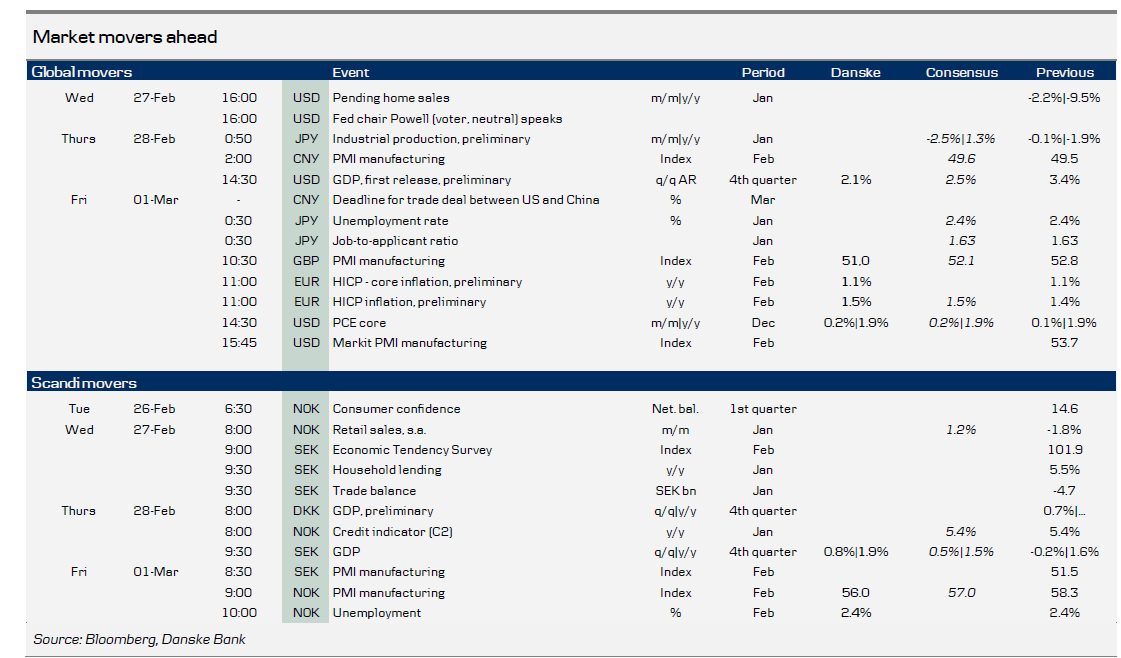

Market movers ahead

Focus in China will continue to be on the US-China trade talks as we approach the 1 March deadline next week. High-level trade talks are likely to continue but we do not expect a final deal to be concluded by 1 March.

In the US, a number of data releases are scheduled for next week, including PCE core inflation, ISM manufacturing and the housing market numbers. Furthermore, Powell testifies before the Senate Banking panel and House Financial Services committee.

The UK focus remains on Brexit. Next week there will be a second so-called 'meaningful vote' on a full Brexit deal on Tuesday 26 February if PM Theresa May is able to secure a new deal with the EU27 (not the case at the time of writing).

Weekly wrap-up

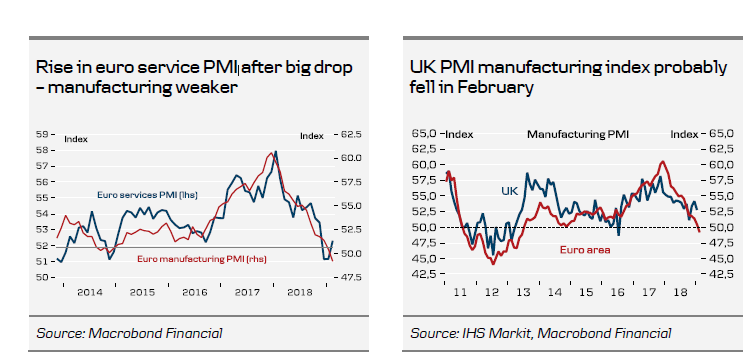

Economic data was mixed this week but we see tentative signs of a bottom. Chinese credit jumped higher in January and metal prices continue to send an early signal of a bottom in Chinese growth soon (see Market Movers). Euro PMI data also surprised on the upside, driven by a strong services PMI reading.

On the Brexit front, things still look uncertain. Sentiment improved a little this week after UK Prime Minister Theresa May had talks with EU President Jean-Claude Juncker, which were described as 'constructive'.

Trade talks are entering a critical phase as we near the 1 March deadline. For the third consecutive week, the US and China negotiated at the top level. This suggests to us that commitment to reach a deal soon is very high.

Market movers

Global

In the US, PCE core inflation numbers for December are due to be released on Friday. Based on the CPI, we expect PCE numbers to come in at 0.2% m/m (1.9 y/y), which is just below the Fed’s 2% target. On Thursday, BEA is scheduled to release initial Q4 GDP, which will implicitly also give us the PCE inflation data for December. We expect GDP growth to come in at around 2% q/q annualised (3.0% y/y).

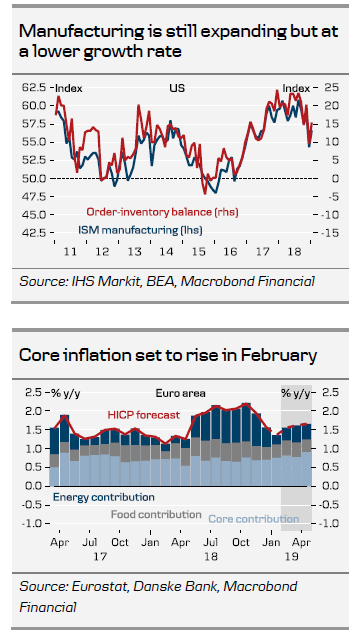

On Friday, we get ISM manufacturing data for February. The survey still indicates that the manufacturing sector is expanding in general. As consumption continues to strengthen, we expect the ISM index to stabilise around its current level. The coming week also brings housing market numbers for December on Wednesday. Recently, the housing market has started to show a bit of weakness, especially home sales numbers, possibly driven by higher mortgage rates. However, housing market data are quite volatile and we will continue to keep an eye on the housing market. Jerome Powell is set to testify before the Senate Banking Panel on Wednesday and the House Financial Services Committee on Thursday.

In the euro area, we are due to get the preliminary February HICP figures on Friday. These are an important piece of information for the ECB at its upcoming meeting on 7 March. In January, core inflation rose by 0.16pp to 1.09% y/y, while headline inflation decelerated to 1.4% y/y on the back of falling energy price inflation. With oil prices up some 30% since the trough in December, we expect headline inflation to rise slightly in February to 1.5%. Similarly, for core inflation, we see scope for a further small rise to 1.14% on the back of strengthening Phillips curve dynamics.

Not surprisingly, focus in the UK remains on Brexit. Next week, on Tuesday 26 February, there will be a second so-called ‘meaningful vote’ on a full Brexit deal if Prime Minister Theresa May is able to secure a new deal with the EU27 (not the case at the time of writing). If so, we still think the House of Commons will reject it, although we believe it is likely to be by a smaller margin than last time, as pressure is building. If May does not get a new deal or the House of Commons rejects the deal, there will be another indicative vote on Wednesday 27 February, which gives the members of parliament another chance to force Prime Minister May to ask for an extension of Article 50 to avoid a no-deal Brexit. In our view, the probability of a majority supporting this is likely to be 50:50. If not, it is likely Brexit will go down to the wire (EU summit 21-22 March, UK leaving the EU on 29 March if nothing else happens).

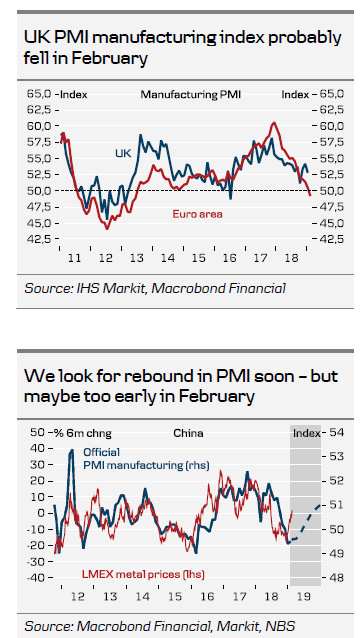

There are not many economic data releases next week but look out for the PMI manufacturing index on Friday, which probably fell. Stockpiling due to Brexit preparations means the index is higher than the equivalent euro area index.

In our opinion, focus in China will continue to be on the US-China trade talks, as we hit the 1 March deadline on Friday next week. High-level trade talks are likely to continue but we do not expect a final deal by 1 March. Instead, we expect the deadline to be extended and believe that a final deal will be closed at a meeting between Xi Jinping and Donald Trump in late March or in April.

Another item in focus next week will be the release of PMI manufacturing for February. The official version is due out on Friday and the private one (Caixin) on Saturday. We see several signs of growth bottoming in China in Q1, not least in metals markets (see chart). Thus, we look for a rebound soon in PMI. It is not clear whether it will come in February though. There may have been a negative effect because of Chinese New Year. We expect a broadly flat reading for PMI manufacturing in both the official and the private version.

In Japan, manufacturing PMIs have weakened significantly at the beginning of the year along with exports. It will be interesting to see whether industrial production confirms the current weakening picture with the January figures on Thursday. On Friday, we get another set of figures for the extremely tight labour market with the unemployment rate and jobs/applicants ratio for January.

Scandi

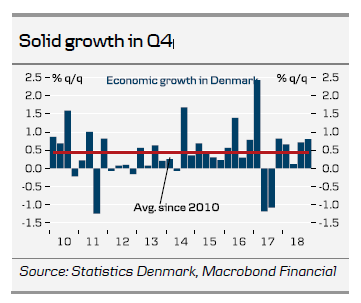

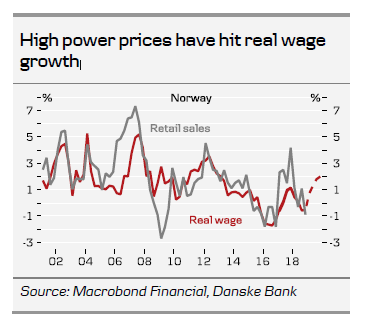

In Denmark, a busy week kicks off with January retail sales, which disappointed in H2 18 despite rising employment and real wages. Growing concern about the state of the economy in Denmark is probably a factor here. February business confidence follows on Wednesday. Sentiment was generally on the wane in H2 18 in every sector bar construction. Manufacturing confidence ended the year with another fall and the picture was unchanged in January, making it five months now in negative territory, so it will be interesting to see which way it heads next. Thursday brings the full national accounts for Q4. The GDP indicator published by Statistics Denmark a fortnight ago suggested strong growth of 0.8% in Q4 and overall growth for 2018 of 1.1%, and Thursday will give us a first insight into what was behind this. Recently, we have seen exports swimming against the tide and surprising on the upside despite the global slowdown. In contrast, retail sales suggest sluggish growth in private consumption.

Statistics Denmark’s jobless data for January are also due on Thursday. Unemployment has fallen steadily in recent years, with both the jobless rate and the total number of people out of work hitting their lowest levels since February 2009 in December.

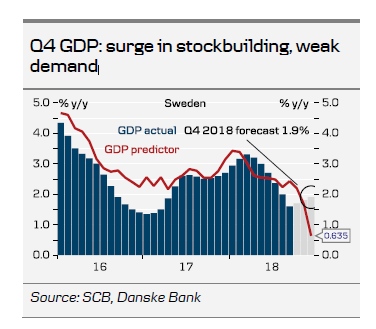

In Sweden, our monthly GDP predictor suggests a very weak Q4 print of 0.7% y/y, well below our official forecast of 1.2% y/y incorporated in Nordic Outlook – At a glance, 4 January. Actually, we are looking at some demand components on a quarterly basis that seem quite reasonable. It suggests final demand is again likely to be close to zero on a quarter-on-quarter basis (for a third quarter in a row), implying growth of just below 1% y/y.

However, GDP is likely to be considerably stronger, as implied by production and inventory data. The business sector production value index rose 1.6% q/q and business and trade inventories appear to have soared, contributing 1.3% q/q. Hence, Swedish corporates appear to be facing sagging demand, which causes rapid, involuntary stockbuilding. Hence, we expect GDP to print a ‘healthy’ +0.8% q/q/1.9% y/y (grey bars in chart), hiding that demand is around 1 percentage points weaker on both these accounts. If there is no rebound in final demand in Q1 19, GDP might look really ugly as inventories fall back.

In addition, there is a slew of monthly data to consider, including the NIER February confidence survey, January household lending, the trade balance and retail sales. We expect the latter to rebound following a weak December reading.

To read the entire report Please click on the pdf File Below..

Related Articles

Recent headlines appear to have shaken investor sentiment. It’s premature to read too much into a few days of weaker-than-expected survey numbers. More importantly, the latest...

For every trader, choosing a reliable broker is a cornerstone of success. Achieving consistent gains in trading is not a walk in the park as it is, and you don't want any extra...

Tariff talk and weak US data fueled a risk-off reaction Nvidia earnings may test market’s risk appetite More Fed rate cuts priced in; a “Fed put” reaction expected? Both dollar...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.