US Dollar Fundamental Analysis:

This week will be pivotal for the US dollar because several key releases are due, and shall they give the impression that the US economy is indeed slowing down it may cause a broad weakness and selloff in the US Dollar.

The most important events of all will be the FOMC rate decision and statement on Wednesday and the Non-Farm payrolls report on Friday. The ISM Manufacturing and ISM Non-Manufacturing PMIs will be released earlier in the week.

Also, Treasury secretary Mnuchin will speak on Monday and any comments about the exchange rate of the US Dollar or the tax reform could cause volatile swings in the market.

EUR/USD

Fundamentals

Traders continue to favor the Euro over the Dollar after pro-EU candidate Macron won the first round in the French election. The appetite for the Euro is not due to Macron winning the election alone, but it also has to do with an improving Eurozone economy after a prolonged period of stagnation.

The appetite for Euros in the market was evident last week when even after clearly dovish messages from ECB’s head Mario Draghi, the Euro failed to weaken substantially and ended the day marginally weaker before rising again the next day.

Right now, the dovish stance of the ECB is the only thing that prevents the Euro and EUR/USD currency pair from rising much higher. This week more economic data will be released from the Eurozone and ECB President Draghi will speak again on Thursday.

Continued improvements in the economy or a slightly neutral message from Draghi could help the Euro to rise.

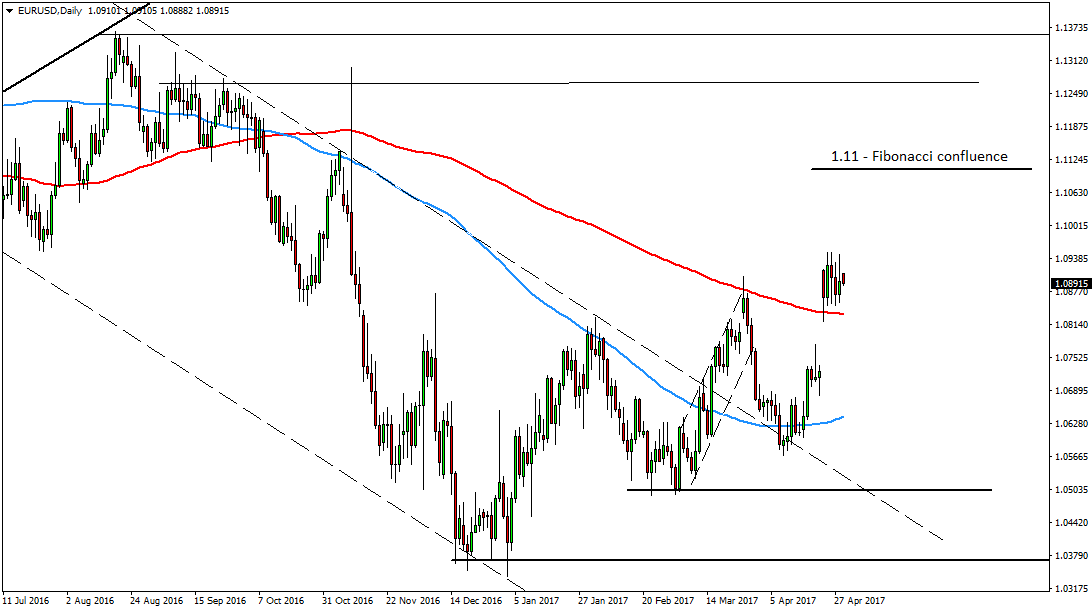

Technicals

While nothing much has changed on the daily technical picture since last week, the fact that EUR/USD didn’t even fill the gap and held above the 200-day moving average suggests that there is a noteworthy bullish bias in play.

Also, the pair is now trading above the yearly pivot point (which is at 1.0750).

Shall it advance higher, EUR/USD is likely to meet resistance in the 1.11 area which is a confluence of Fibonacci retracements and extensions.

To the downside, 1.0750 is the first support ahead of 1.0550.

GBP/USD

Fundamentals

Cable traded higher last week as expected in our previous weekly analysis amid the positive effect of the French election and the announcement of the snap UK election in June.

Will the uptrend continue or not this week will depend on the US data (see US Dollar fundamental analysis section above) and the UK data that is due on the calendar.

The Manufacturing PMI on Tuesday, the Construction PMI on Wednesday and the Services PMI on Thursday are the pivotal releases for the week out of the UK.

Although the rally in the Pound has been strong, robust numbers in the PMIs will likely be needed to take GBP/USD significantly higher. In this regard, shockingly disappointing US data could also be a catalyst that can send GBP/USD higher this week.

Technicals

The overall picture has switched to bullish after the head and shoulders breakout was confirmed two weeks ago. However, last week resumption of the trend was not particularly strong, and that sends some warning signs. At least, we should approach the situation with caution and look for extra confirmation before initiating new long positions here.

The Elliot wave count suggests that with the last swing up in the past week GBP/USD has completed a 5-wave structure after which a retracement should come. Taking this into consideration it appears that it would be better to wait for a retracement to initiate new long positions rather than buying the pair at current levels.

Support levels to the downside are 1.27 and 1.2550.

Resistance lies ahead at the 1.30 round number and 1.3120 Fibonacci confluence.

USD/JPY

Fundamentals

USD/JPY traded higher last week on the broad risk appetite that dominated markets after the first round of the French election.

In addition, the Bank of Japan was as dovish as it could be at last week’s meeting. They lowered their inflation forecasts adding that the QQE program of assets purchases will continue until they are convinced that the inflation target will be reached.

The BOJ core CPI measure will be released on Tuesday and we will be able to see how close are they to reaching their target.

In the end, how USD/JPY trades next week will depend largely on the US Dollar and economic releases from the US.

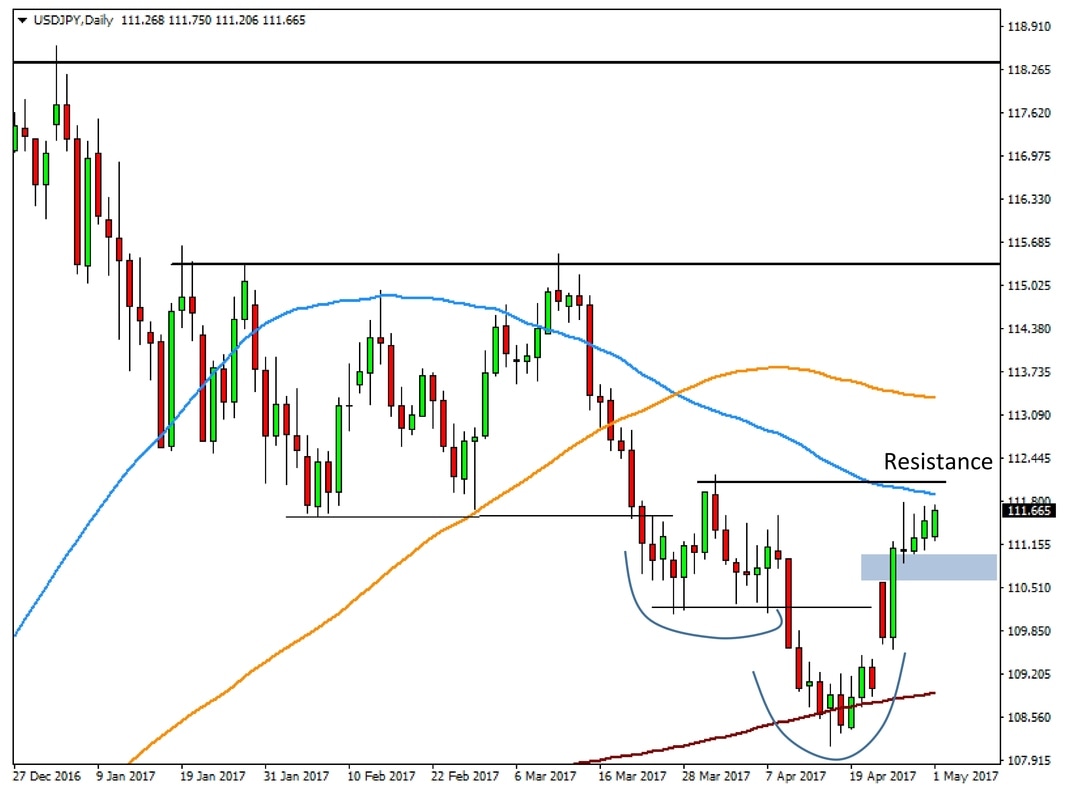

Technicals

While USD/JPY broke above the Fibonacci confluence we outlined last week (blue area on the chart), the follow-through price action has not been strong. In addition, USD/JPY is banging on the 55-day moving average and the resistance from the previous high at 112.

If USD/JPY takes a leg lower from here it could potentially start the process of forming an inverted head and shoulders pattern.

Immediate support down is at 110.50 before 109.50 - 109.

If the pair breaks above the 112 resistance, the next resistance higher would be 113.30 (100-day MA orange line on the chart) and then the highs at 115.