US Dollar Fundamental Outlook:

The US dollar underperformed last Friday in response to a considerably weaker Non-Farm Payrolls report of only 138 thousand new jobs created in May versus the 181 thousand expected.

Still, the unemployment rate dropped further to 4.3% and average hourly earnings showed a 0.2% increase as expected.

Overall, the jobs reports don’t seem to have changed the market expectation for a Fed rate hike at the June 14 meeting, but another one in September now seems less likely and that was probably the reason for the sell-off in the US dollar.

Only the ISM non-Manufacturing PMI index is the more important report from the US this week, hence there is little to spur investors’ desire for US dollar this week. How the US dollar trades this week will also be affected by developments elsewhere, primarily the ECB meeting and UK elections on June 8.

EUR/USD Fundamental Outlook:

Finally, the pivotal ECB June meeting is here. Many traders and investors expect the ECB to adopt a less dovish stance this Thursday. Regarding this, watching the ECB statement and President Mario Draghi’s words during the press conference will be the key for this meeting as the central bank is expected to leave interest rates and the pace of asset purchases unchanged.

Investors have driven the EUR/USD exchange rate significantly higher on the back of the notable improvements in the Eurozone economy in the past few months, including inflation data.

The minimum the ECB can do on Thursday is to change the statement to a less dovish one than it currently is. Dropping the “or lower levels” chunk of the line “interest rates will remain at present or lower levels for a considerable period of time” is one of the key parts of the statement that investors expect the ECB to remove.

If the ECB fails to do so, EUR/USD is likely to plunge hard and eventually drop below the 1.10 support.

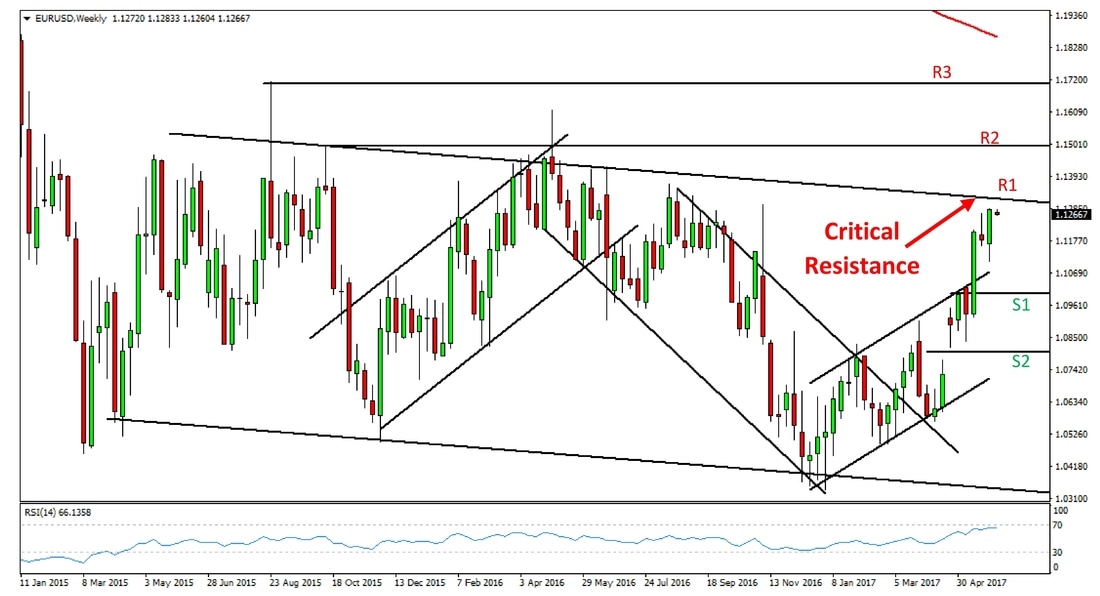

EUR/USD Technical Outlook:

The pair is now technically at a very significant point on the weekly chart, most importantly it has reached the falling resistance line of a sideways channel (slightly tilted down) in the 1.1300 – 1.1350 area (R1). EUR/USD has moved up substantially in the last 6 months and given the fundamental situation and a strong catalyst will likely be needed to push EUR/USD through this 1.1300 – 1.1350 multi-year resistance (R1).

1.1500 (R2) and 1.1700 (R3) are the next important resistance zones on the weekly chart. To the downside 1.1000 (S1) and 1.0800 (S2) will act as support.

EUR/USD weekly chart - Resistance ahead!

GBP/USD Fundamental Outlook:

Trading the pound carefully is recommended in what is to be the most volatile week since Brexit.

The Conservative party is heading into Thursday’s election with a reduced lead than it was initially expected in April when Prime Minister Theresa May called the snap election.

The key thing for the pound is, will the Conservatives win the election? And if yes, by how many seats? A strong majority of at least 326 seats for the Conservative party will be needed for the pound to rally on the announcement of the result and almost any other outcome is likely to cause a selloff the British currency.

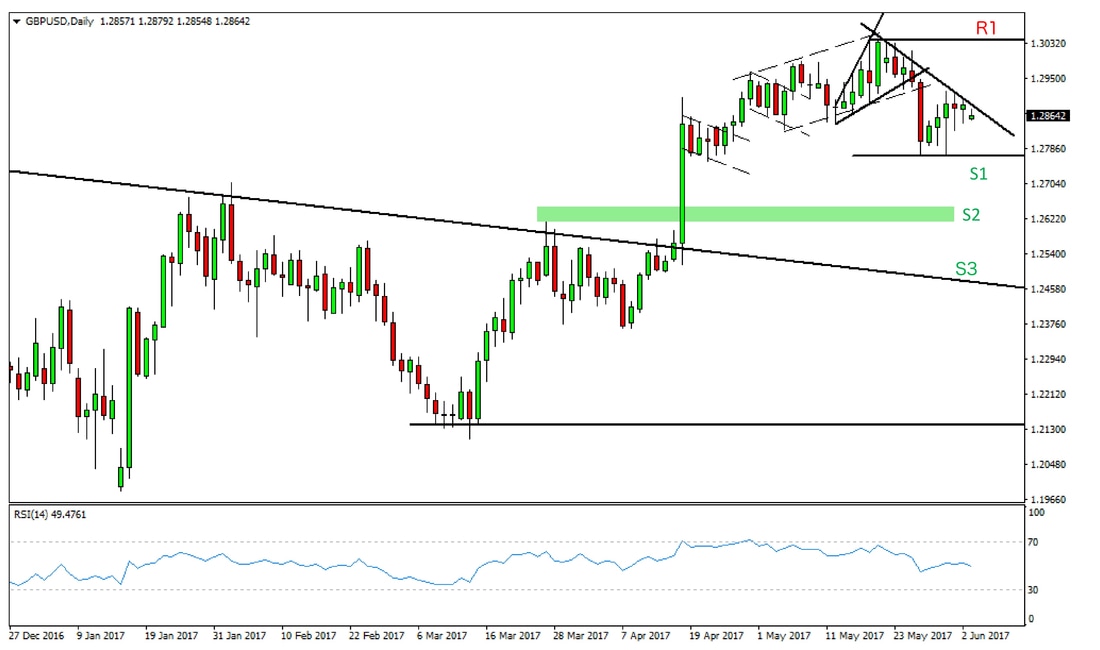

GBP/USD Technical Outlook:

The pair is likely to continue to consolidate in anticipation of the UK election on Thursday. How the price action on the chart develops from here will depend on fundamentals, so here are a few key technical points to keep in mind.

The pair is unlikely to break below the 1.2770 low (S1) until the election result is announced. If the outcome of the election is negative then GBPUSD will most definitely break below 1.2770 (S1) and probably reach the next support lower which is 1.2600 – 1.2650 (S2).

The third support to the downside is 1.2400 – 1.2500 (neckline of the inverted head and shoulders pattern which was broken in April).

On a positive election outcome, the pair will likely go quickly higher and reach the highs at 1.3000 – 1.3050 (R1).

GBP/USD Daily Chart – Range-bound for a few days, then breakout

USD/JPY Fundamental Outlook:

The yen was the biggest winner on the weak NFP report last Friday as traders priced out the probabilities for 2 more Fed rate hikes this year. The 10-Year Treasury note yield also dropped below a key support level, making further losses in the strongly correlated USD/JPY pair highly likely.

While no bouts of renewed risk aversion were experienced last week, any such instances could further accelerate the downtrend in USD/JPY. A strong bullish recovery seems extremely unlikely for the pair in the near-term, especially after the poor NFP report last week.

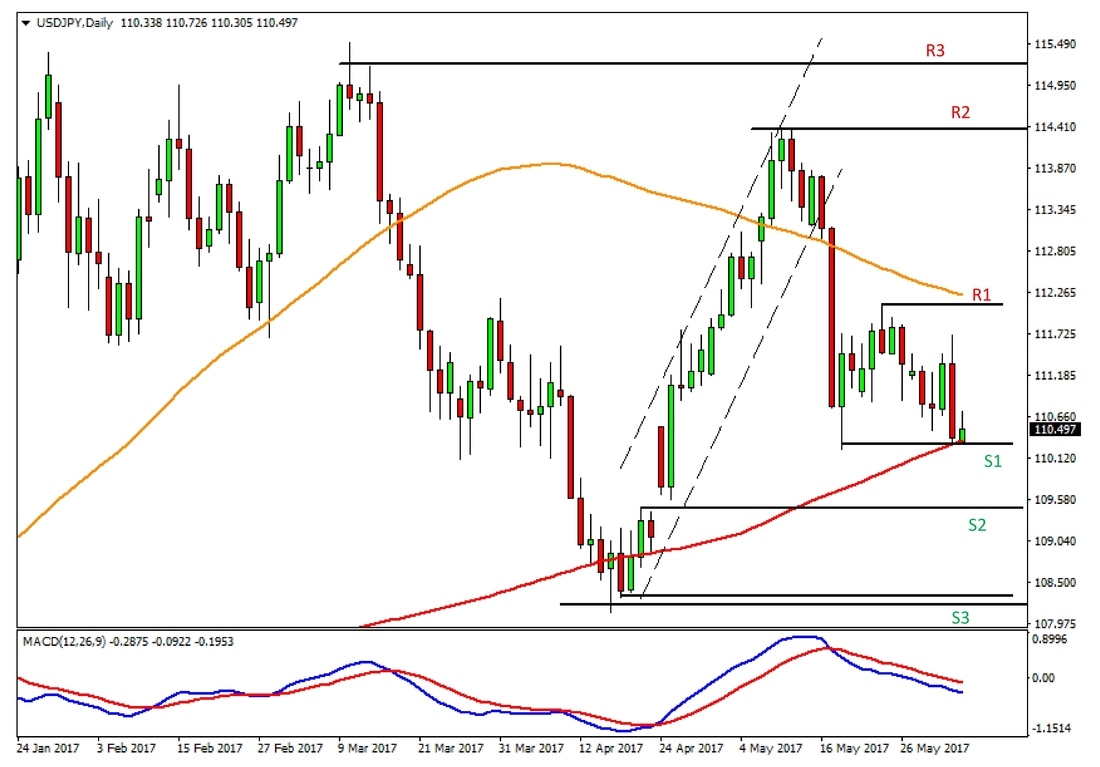

USD/JPY Technical Outlook:

The pair finally had another strong push lower last Friday after consolidating for 10 trading days. With the latest big red candle, the pair reached important support at the 200-day moving average (S1) close to the lows at 110.20.

If this support gives way to the downside then 109.50 (S2) is the next important support down.

108.00 (S3) is the third support zone to the downside.

In a so far unlikely scenario of a bullish reversal, 112.00 (R1), 114.40 (R2) and 115.50 (R3) will be resistance zones higher.

USD/JPY - Downside pressure prevailing so far.