Investing.com’s stocks of the week

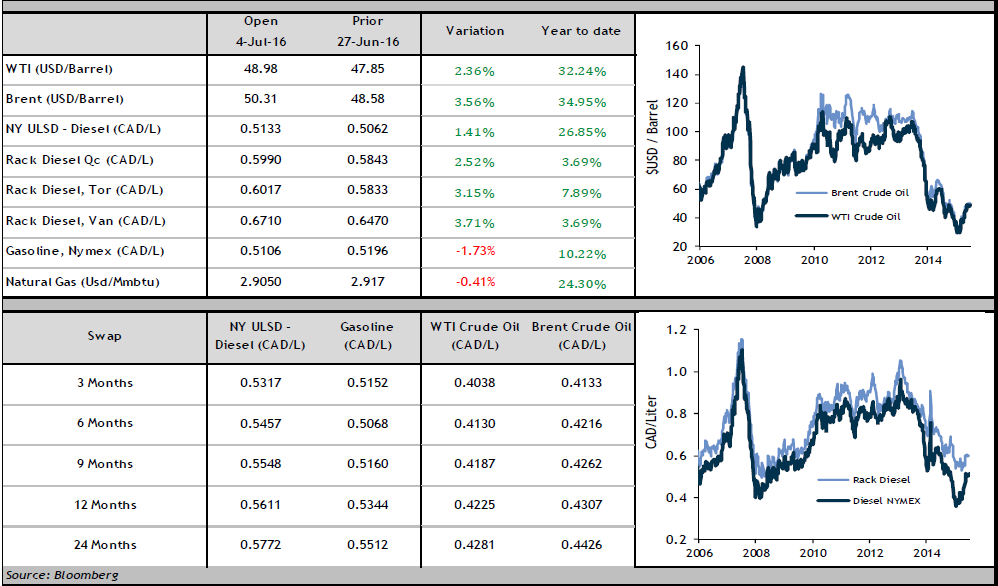

Energy prices in U.S. dollars were volatile last week as the markets reacted to the Brexit vote on June 24. Prices for WTI, Brent and diesel were up 2.83%, 4.01% and 3.86%, respectively.

Figures released on Wednesday by the U.S. Department of Energy (DOE) revealed a drop in crude oil inventories. Stocks fell -4.1 million barrels on the week, while the market had expected a drop of -2.2 million barrels.

In a recent report, JPMorgan Chase & Co (NYSE:JPM). suggested that China’s demand for oil may ease in the near term. According to the bank, China has been taking advantage of low prices since 2015 to build its strategic petroleum reserves. More specifically, Chinese oil imports rose 16% in the last year.

In the Niger Delta, the ceasefire between rebels and government forces negotiated on June 20 appears to be holding. The Government of Niger has announced that production has increased by 300 kb/day. While in the past the country has been able to produce 2.2 million barrels/day at full capacity, recent hostilities have reduced output to 1.4 million barrels/day. In the absence of a lasting agreement, it would be difficult to estimate the country’s future output. Certain analysts suggest that production may fall by 350 kb/day in the second half of 2016.

Some negative news in the market, such as the issues discussed above, could provide opportunities to budget some of your spending on diesel in Canadian dollars.