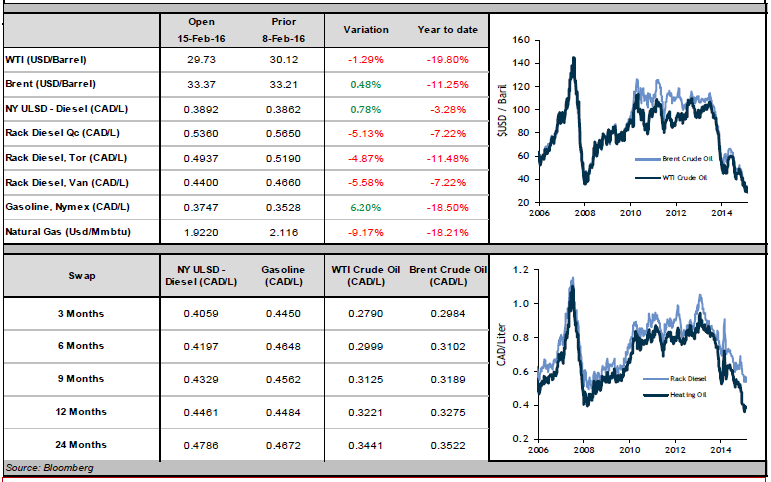

After setting a new 12-year low on Thursday, WTI crude found some strength and jumped 10% to end the week around $29 barrel (down about 7% for the week); Brent followed a similar trend. Despite the rally, WTI and Brent oil are still down 20% and 13% since the beginning of 2016.

Oil’s end-of-the-week rebound was certainly caused by statements made by the United Arab Emirates’ Oil Minister, suggesting that crude producers are willing to meet to discuss a supply reduction. If this story sounds familiar, it should; since the beginning of the year, we have reported similar remarks by Venezuelan and Russian oil ministers. A growing number of OPEC members support this meeting, signaling that they might be losing their patience with low crude prices. Conspicuously absent from this list, however, are oil-giants Saudi Arabia and Iran. While these countries appear to be committed to their current strategy, rising pressure from their OPEC allies and deteriorating fiscal conditions at home could lead them to change their minds.

On the topic of Iran and Saudi Arabia, the two countries seem to be engaged in their own mini-price war. With its sanctions about to be lifted, Iran has released its official oil pricing. Of note: Iranian crude is priced to be considerably cheaper than Saudi oil. The discount Iran is offering over Saudi’s black gold is the largest it’s been in almost two years, perhaps hoping to steal some of their rival’s clients. 2016 has been a rocky year for Saudi-Iranian relations; we will be closely monitoring how this translates in OPEC’s internal politics.

After a slump early in the week, refined products in both CAD and USD rallied on Thursday and Friday to erase their losses. Diesel in CAD and USD was basically flat, while gasoline in both currencies finished the week up about 4%. Hedging opportunities for fuel consumption remain attractive, and we encourage our unhedged clients to strongly consider fixing a portion of their exposure.