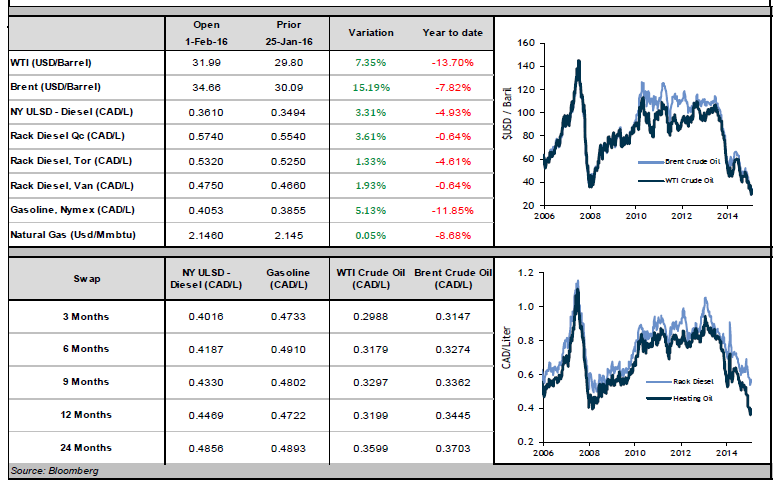

Oil’s upward momentum continued last week, ending every day since Tuesday in the green. Both WTI and Brent increased 6 USD/bbl. since their yearly lows set last Wednesday, and are trading in the low- to mid-$30s.

Much of oil’s strength this week was caused by rumors that Russia and OPEC might meet before the end of February to discuss cutting crude oil production. While some OPEC members have officially denied this suggestion, many news agencies were not only reporting that this meeting would be held, but also that Saudi Arabia would be willing to accept a global 5% reduction in supply. This 5% decrease could erase the current oversupply and return the market to equilibrium (especially because demand for oil is still growing). If this agreement is reached, energy prices could spike.

The CAD continued its rally last week after weakening to its lowest level since 2003 earlier this month. The loonie is over 4% stronger today than it was on January 20, when it reached that low. The slight resurgence of the loonie was caused by better-than-expected numbers on the Canadian economy, including StatsCan reporting that GDP grew by 0.3% in November. While this hardly counts as strong growth, it is better than the 0% growth in October and the -0.5% in September. This is good news for fuel consumers, who see their diesel costs decrease when the CAD strengthens.

Diesel mirrored oil’s gains this week, rebounding strongly since last Wednesday. 6 of the last 7 trading days have seen diesel in CAD end higher than it started, for a combined increase of roughly 6 cents. Diesel is now only 1 cent (Canadian) below its price on January 1. Prices are still however very competitive when taken into a broader context and opportunities to hedge your fuel consumption remains quite attractive.