Investing.com’s stocks of the week

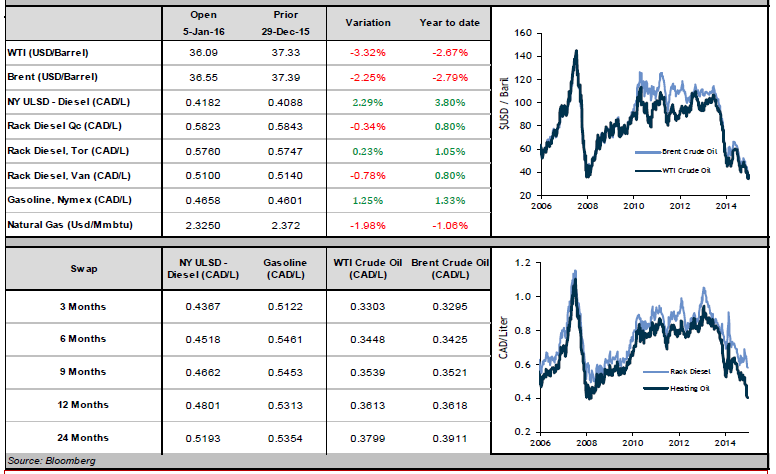

This past year was a difficult one for the global energy sector. In 2015, the price of WTI crude and the price of Brent crude fell by 30% and 35%, respectively. The decrease was less significant for one of the two primary refined products: measured in American dollars, diesel lost 39% of its value, while gas lost only 13%. Although it is difficult to predict the dominant trends and events that will influence energy prices in 2016, we believe that prices are near potential lows and that it could be worthwhile to take advantage of the current low-price environment by hedging a portion of your short-term and long-term fuel consumption.

Over the coming year, we will be watching two factors closely, as they have the potential to increase the price of black gold significantly. First of these influences is a reduction in American oil production, and the second is increased geopolitical instability and tension.

Other than the active oil rig count and the weekly inventory data published by the IEA, our focus this year will be on American oil production numbers. The last published figure from 2015 estimated a production of 9.2 million barrels per day—nearly double the levels we saw just 4 years ago. With global oversupply somewhere in the region of 1.5 mbpd, a return to supply/demand equilibrium seems to depend on a reduction in our neighbours to the South’s drilling activity.

Hardly a few days into 2016 and we already have a major international dispute: Saudi Arabia has cut diplomatic ties with Iran after its embassy in Tehran was invaded by protestors. This attack comes in response to Saudi Arabia’s decision to execute a prominent Shiite cleric, Nimr al-Nimr. This event highlights the continued religious and political tension between Shiite Iran and Sunni Saudi Arabia. Some commentators are already calling this the worst crisis between these two countries in 20 years. If this situation continues to escalate, expectations for Iranian oil exports are likely to fall. We should note that these two countries are among the world’s leaders in crude reserves and in potential crude production.

As the new year begins, please do not hesitate to reach out to us to review and revise your fuel risk management policies. We would equally like to take this opportunity to wish all of our clients a happy and profitable 2016!