Investing.com’s stocks of the week

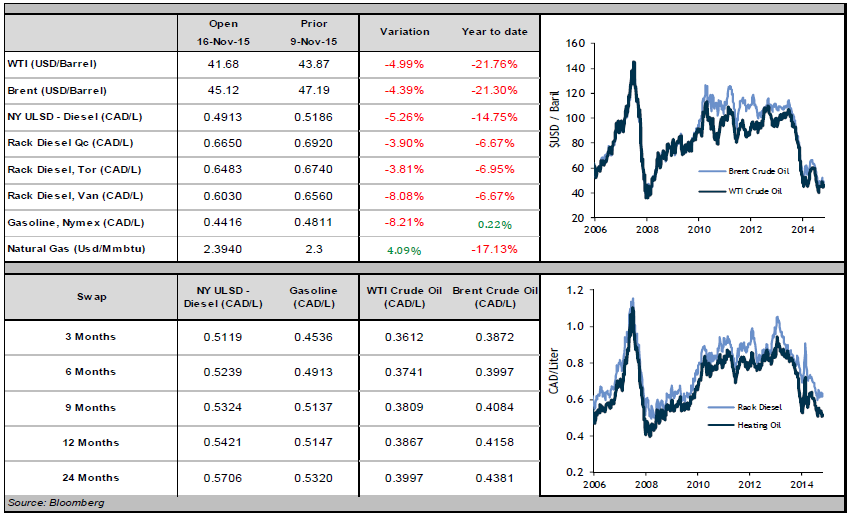

This week will be recalled as a return to psychological levels of $40 per barrel as oil halted a 3 day decline following Saudi Arabia’s oil minister saying that global markets will be better balanced next year as they see demand growing demand from Asia and a decline in non-OPEC/high-cost producers.

Petrobras unions are still maintaining a hard line and do not expect disruption to end soon as FNP leader Emanuel Cancella mentioned that workers strike unlikely to end soon.

Yours truly also assisted a well-sought after presentation by a leading bank’s commodities research department whereas after hearing all the facts that be pointing for a lower price, it predicted a target price between $60 and $80 by the end of 2016.

EIA inventory report was the straw that broke the camel’s back as Cushing inventories were up 2.24 million barrels and distillates up at 2.51, at which point $42 resistance was broke. Interestingly enough PADD2 (US Midwest) refinery utilization was up 8.2, most since July 2011. Talk of the town is the tankers cruising the Texas and eastern Asia coasts as crude seem to be piling up. Bear in mind that crude production, bottleneck and refinery capacity are two different plays and that the crack spread can be quite volatile.

Will the next OPEC meeting on December 4th bring its dose of fresh air? You bet. Venezuela and Russia are also holding a meeting on November 23rd which may be construed as a new axis to counterbalance the pressure subdued by the cartel.