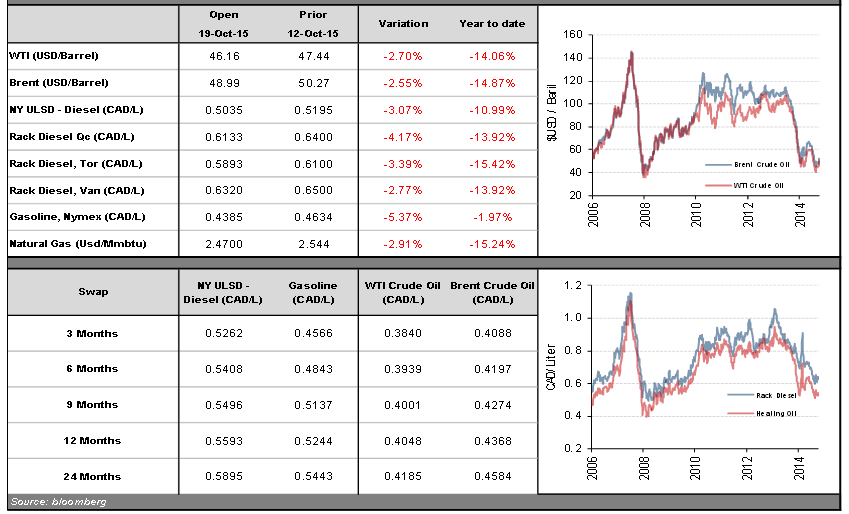

After posting one of their best performances of the year in the week of October 5, energy prices in U.S. dollars fell sharply over the following five days. WTI, Brent and diesel were down 4.4%, 3.7% and 6% on the week.

- Statistics released on Thursday by the U.S. Department of Energy revealed one of the largest increases in crude inventories of the year. Reserves surged 7.5 million barrels on the week, beating analysts’ expectations by 5 million barrels. This was the largest increase since April. The news should nevertheless be taken in context, since oil inventories have trended downward over the last few months.

- Canadian oil producers are beginning to feel pressure from other quarters besides weaker prices in the oil market. Parallel Energy Trust’s credit facility was not renewed by its bankers, and the credit facility of Lightstream Resources Ltd. may be scaled back for a second time this year. According to analysts at Moody’s, the energy sector should see its credit cut by at least 15% in 2015.

- The Canadian dollar is at levels not seen since July. It continued to build on recent strong performance, rising .5% against the U.S. dollar. This was mainly in response to disappointing economic indicators released in the U.S. Note that our dollar can nevertheless be expected to trend downward in the longer term. It should be remembered that a stronger Canadian dollar enhances our purchasing power when we buy fuel and reduces the price we pay.