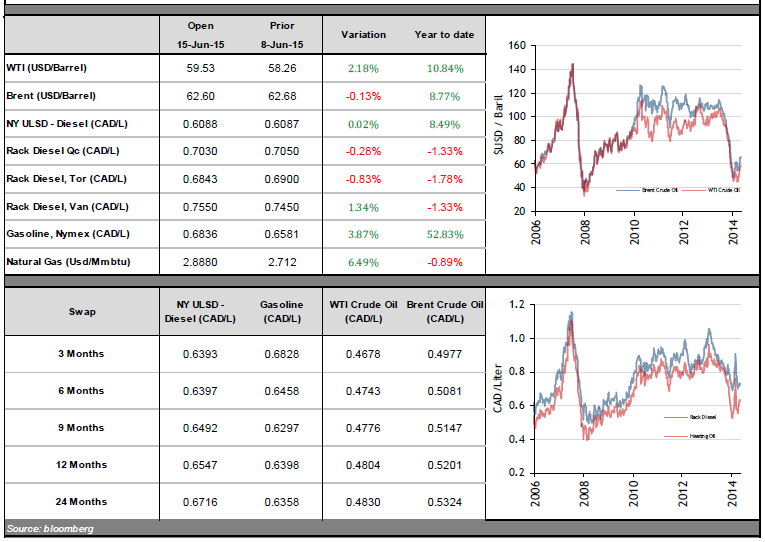

Energy prices in US$ posted positive returns last week; WTI crude, diesel and gasoline were up 1.8%, 0.9% and 4.6%, respectively.

Last Wednesday the U.S. Department of Energy (DOE) released data showing a drop in crude oil stocks. This weekly drop of 7 million barrels per day was the largest since July 2014 and shows that output in the U.S. continues to slow.

The U.S. could add US$23 billion to GDP by significantly raising exports. This was the result of a joint report prepared by the Harvard Business School and the Boston Consulting Group. An increase in oil exports would benefit producers with no impact on consumers. This increase in exports would come from removing restrictions on oil product exports and could generate 125,000 new jobs south of the border by 2030.

Saudi Arabia posted output of 10.25 million barrels per day in May, a record level. OPEC’s leader said that it had increased production to meet growing demand from buyers.

The price of gasoline in Canadian dollars continued to rise, trading at just under $0.70 per liter in New York, its highest level in close to nine months. This recent increase, evidence of the ongoing rebound, is amplified by the start of the driving season.