Commentaries

Three months after the last meeting of the member countries of OPEC, Saudi Arabia appears to be winning its gamble. The collapse of prices for Crude Oil is affecting production as well as supporting demand. The number of drilling rigs in operation is falling quickly, as North American oil producers continue to cut back on investments. On the other hand, it should be mentioned that the full impact of these cuts will not be felt for another few months!

• Crude oil inventories in North America nevertheless continue to rise, and are now at unprecedented levels. In a report released on Monday, February 23, Evercore mentioned that U.S. production growth should slow in the last quarter of 2015 before entering a period of decline.

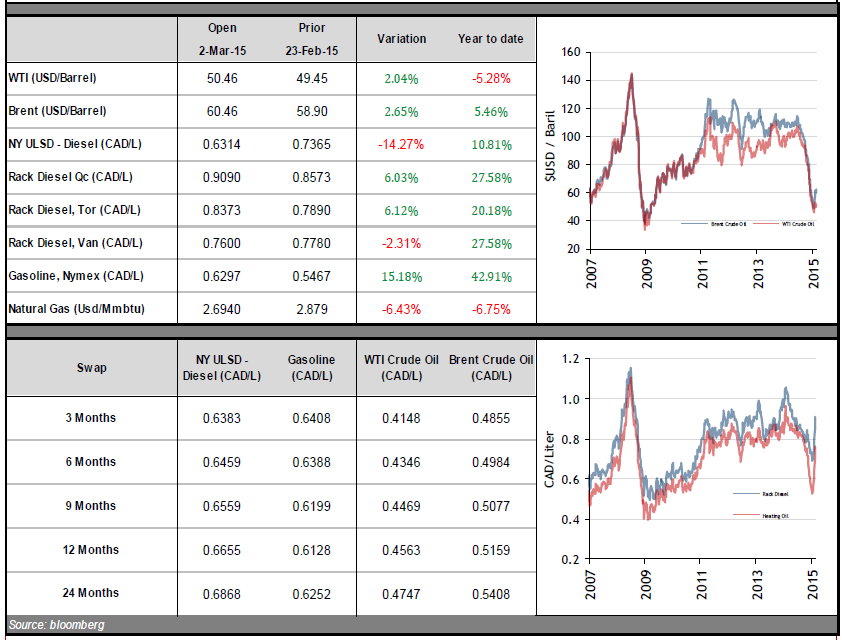

• Diesel and Heating Oil inventories are down sharply due to low temperatures on the east coast of North America, and this has led to considerable price volatility. Expressed in Canadian dollars, March 2015 contracts on diesel prices rose 8.5%, while the fixed price for a 12-month term was up only 1%. This rebound in prices suggests that the worst of the correction is now behind us. Diesel traded in New York at an average price of $0.5350/L in January, compared to an average price for February that will be just under $0.65/L. Have a good week.