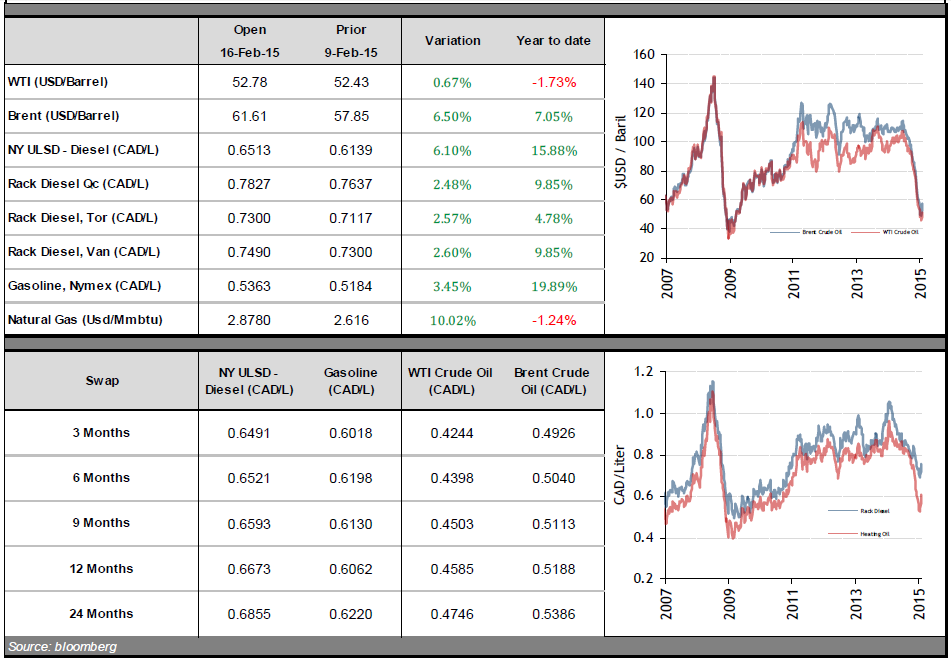

Prices for WTI and Brent crude rose for a third week in a row, up 2.2% and 6.4%, respectively. These increases led to a significant jump in prices for refined products such as gasoline and diesel.

Since the markets closed on January 30, 2015, the price of diesel traded in New York, in USD/gallon, has risen 22.6%. The increase was more modest when measured in Canadian dollars: 14.3%. We see this as a very positive sign, and believe that the worst of the crisis is now behind us. While the markets may still be highly volatile, we believe that the current situation represents a good opportunity to implement hedges.

On Thursday, Apache (NYSE:APA) announced that it will pull 70% of its drilling rigs out of operation by the end of the month. Apache now expects that output will be flat, in contrast to the 12% growth forecast it made just last November when it published results. This announcement was well received by analysts, who believe that investment cutbacks may curtail growth in U.S. output sooner than previously expected.