Investing.com’s stocks of the week

Commentaries

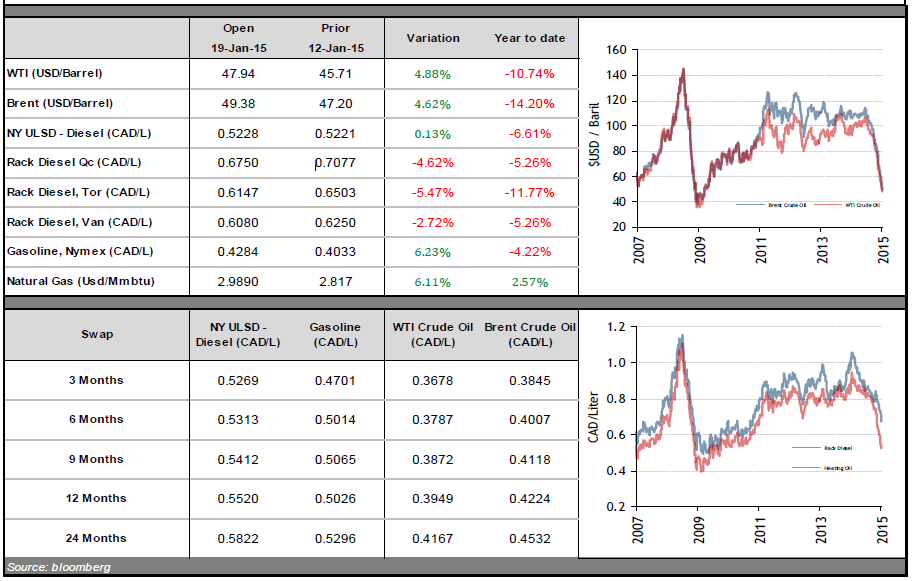

After a correction that has lasted several weeks, energy prices are finally showing some signs of stabilizing, with the price of WTI rising slightly at the end of last week. Prices rose 5.64% and 4.3% on the day on Wednesday and Friday, respectively, showing that buyers have begun to take positions for a turnaround in prices. The latest update from the International Energy Agency (IEA) caught our attention.

•In its latest monthly report, the IEA said that the sharp drop in oil prices will have a major impact on the crude output of non-OPEC countries. Many wells become unprofitable at prices below $50/barrel, and falling investment should reduce the output of non-OPEC countries by 350,000 barrels/day. Columbia and Canada are the two countries most affected by this slowdown. For now, the IEA does not foresee an impact on global production of petroleum products. The IEA also believes that the rebalancing will take place gradually, but that we are still far from the levels seen over the last few years.

•Many lay-offs were announced over the last few days, lending credence to the IEA’s latest comments. On Thursday the giant Schlumberger announced that it was cutting 9,000 jobs, or 8% of its workforce. Earlier in the week Canada’s Suncor said that it was shedding 1,000 jobs.

•We are closely monitoring drilling operations in the U.S. Over the last 6 weeks the number of active platforms has fallen by 209, representing the steepest 6-week decline since July 1987.

•Clearly it is impossible to know where prices may go over the next few weeks and months, but we can now say that the worst of the correction is behind us.