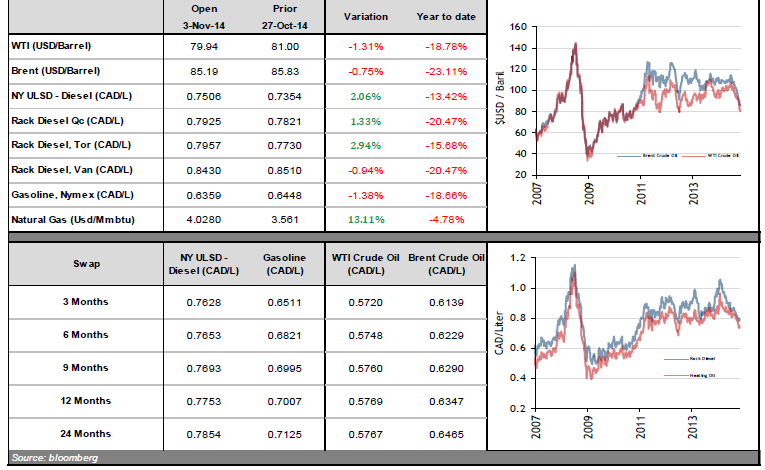

Prices for WTI crude, diesel and gasoline have plunged lately, and a rebound should be expected at one point. We would like to take this opportunity to remind our clients that the products we offer are solely for hedging purposes; transaction-related credits or debits are to offset fluctuations in sourcing-related costs.

The cold season is fast approaching, and this could support demand for crude oil from refineries, which need to ensure sufficient inventories for the coming months. October was a particularly difficult time for energy prices: WTI crude, Brent crude and diesel dropped 11%, 9% and 5%, respectively. It is also worth noting that the Canadian dollar is still trending downward. The loonie has fallen 6% since July 1, and more problems can be expected over the coming months. A depreciating dollar is bad news for Canadian consumers, who are obliged to pay more for imported goods, including fuel.

When prices are expressed in Canadian dollars, the gasoline and diesel markets are finally starting to show signs of stabilizing, and we believe that this represents a good opportunity. A growing number of analysts expect that the member countries of OPEC will decide to cut production levels at their next meeting on November 27, 2014. The cartel’s production quotas currently stand at 30 million barrels per day, and a cut of at least 1 million barrels per day is needed for prices to rise again. You can contact us at any time if you have questions about the market outlook and/or you want to review your protection strategy.