All the news has been bad in the energy market following a substantial correction in Brent and WTI crude oil prices. The situation demands some caution as we wait for prices to stabilize before actively recommending that customers implement new hedges against future price increases.

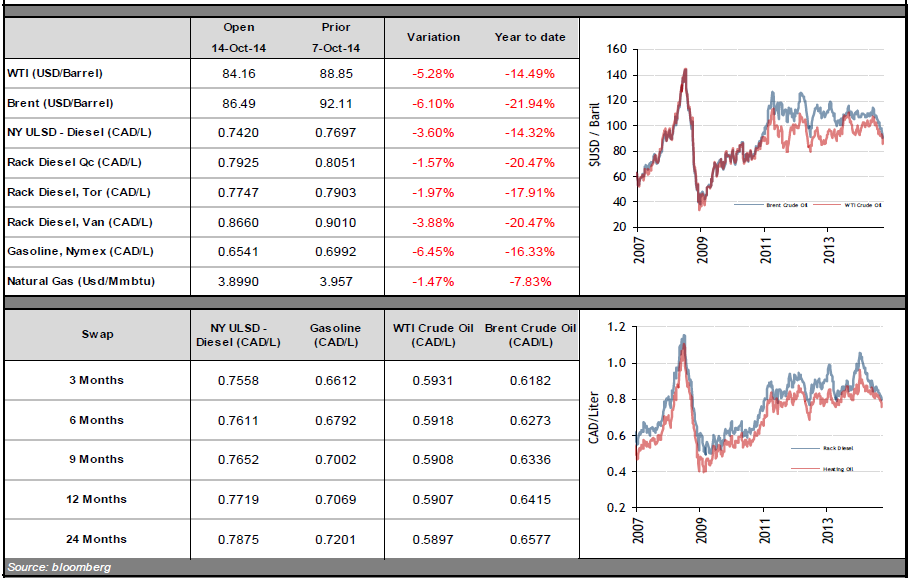

Since peaking in June of this year, prices for WTI and Brent crude are down 20% and 22%, respectively. The drop over the last few weeks has mainly been due to production increases by OPEC member countries in September. Over the last month, the cartel’s production rose 402,000 barrels per day to an average of 30.47 million barrels per day (million bpd). Production in September was the highest level seen in close to 12 months.

There has been strong competition for market share among the main oil producing countries. Iran and Saudi Arabia have been competing for the Asian oil market, and this has resulted in markedly lower prices for the region’s main oil consumers. It remains to be seen whether Iraq will join this price war. OPEC’s next scheduled meeting is on November 27, and 11 of the 20 analysts surveyed by Bloomberg expect the organization to scale back production quotas. It should be recalled that in the second half of 2012, OPEC member countries cut production by 2 million bpd. That drove prices up 27% from June 28, 2012 to September 14, 2012.

A recent discussion with our colleagues in Calgary would indicate that Canadian oil producers had not anticipated the correction in oil prices. Many of them did not take advantage of rising prices last summer to forward price their production, so now they find themselves in a precarious position.