Investing.com’s stocks of the week

Last week was marked by a major downturn in WTI oil prices. After oil inventory numbers were released on Wednesday, crude oil dropped to its lowest level in 2017. Analysts had expected an increase of 1.3 million barrels in inventory, but the actual reading showed a jump of 8.2 million barrels.

- According to analysts at RBC, markets are focusing too much on US inventory levels, which are likely to remain high throughout the year. Hence, markets should pay more attention to the size of inventory reductions taking place internationally. Oil inventories in Europe currently appear to be stabilizing and levels in Japan are below normal.

- In Libya, oil output has dropped 11% in the wake of armed conflicts over the past 10 days. The fighting has led to the closing of the country’s largest export terminals, bringing production down by 80,000 barrels/day to 620,000 barrels/day.

- On Friday, markets reacted to North American jobs data and the loonie strengthened against the greenback. Economists had expected a loss of 5,000 jobs in Canada in February, but 15,300 new positions were actually created.

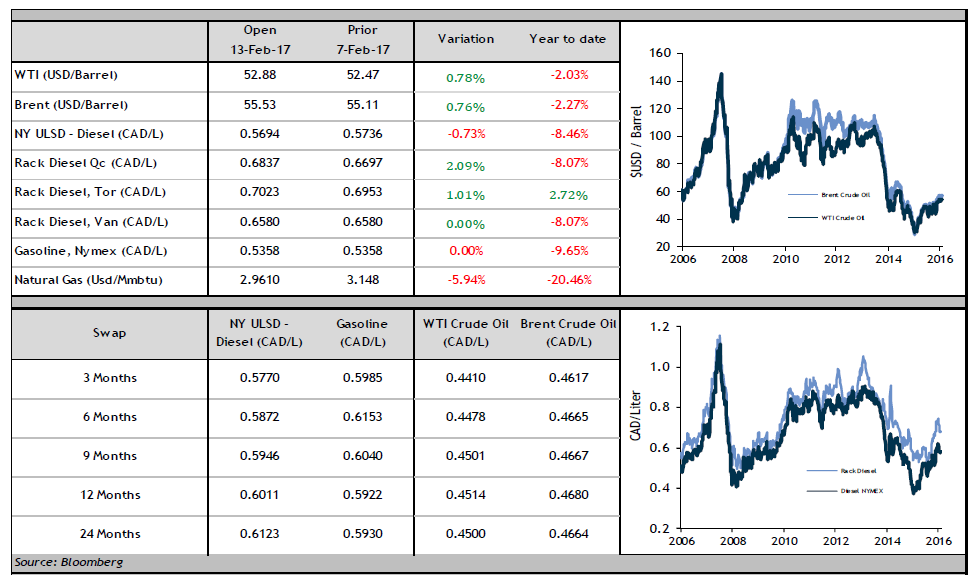

Diesel prices in CAD/L ended the week down 3 cents CAD/L. Given this market trend, we encourage clients to contact us to discuss fuel hedging strategies.