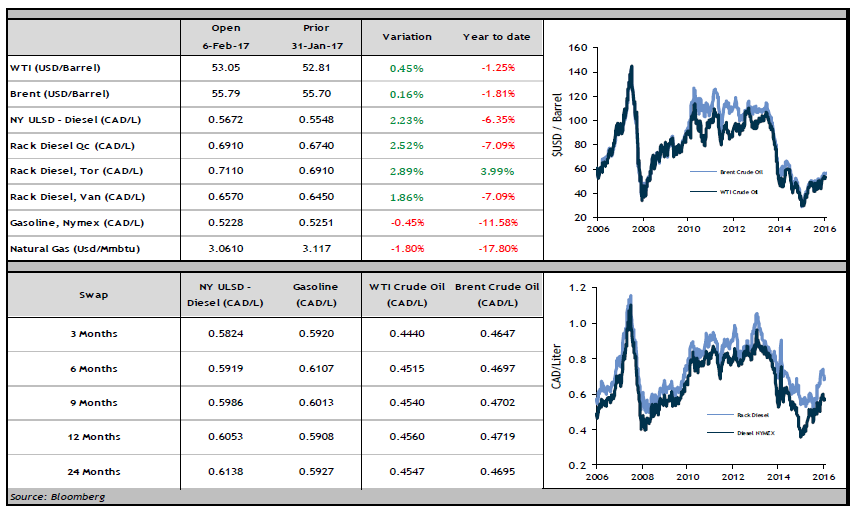

Crude oil rose modestly over the past week. WTI oil started the week at 52.77 USD/barrel and finished at 53.05 USD/barrel.

Among the items with an impact on markets:

President Trump stepped up pressure on Iran in the wake of ballistic missile tests. Numerous groups connected to the missile program will be facing sanctions shortly, according to National Security Advisor Michael Flynn. Sanctions against Iran could affect crude oil prices, as the country produces 3.8 million barrels of oil per day.

Saudi Arabia has increased its crude oil pricing for March sales as OPEC member countries are implementing production cuts.

Asian crude oil demand is high due to colder temperatures and an increase in industrial activity. Moreover, Asian oil purchases from regions outside the Middle East suggest that OPEC’s output cuts are having an effect.

Russia reported that it has slashed oil production by 117,000 barrels/day, putting the country ahead of its target reduction. Energy Minister Alexander Novak noted that January’s production cut was double the anticipated level.

We encourage clients to contact us to review their fuel hedging strategies in CAD/L.