Investing.com’s stocks of the week

Last week was marked by the U.S. Federal Reserve (Fed), which delivered a 25-basis point key rate increase. What shook up markets was the news that 11 of the 17 voting members of the Fed anticipate at least three rate hikes next year. The result was a higher greenback, which has a negative impact on diesel prices in CAD/L.

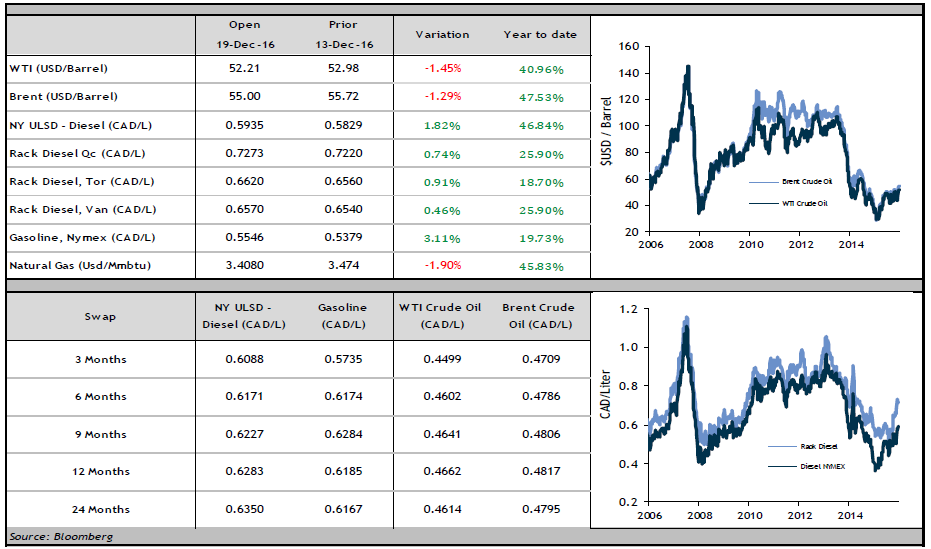

WTI oil prices dropped 1.8% over the week, while diesel in CAD/L rose 1.6%.

Among the other items making news last week:

- Investment bank Goldman Sachs (NYSE:GS) upgraded its forecast for WTI oil and sees prices reaching 57.50 USD/barrel in the first half of 2017. The bank says that output cuts by OPEC members and non-member nations, combined with growing demand for oil will help reduce inventory levels over the next 12 months.

- Libya reopened one of its largest oilfields and the country is preparing for its first exports in two years from its largest crude oil terminal. Rebel attacks in recent months have hampered the country’s oil output.

- Russian Energy Minister Alexander Novak stated that all Russian producers have agreed to reduce their output further to the recent agreement with OPEC. Russia had committed to reduce production by 300,000 barrels/day beginning in January 2017

Given the volatility in energy markets and the USD/CAD pair, we encourage our clients to contact us to review your hedging strategies in CAD/L.