Investing.com’s stocks of the week

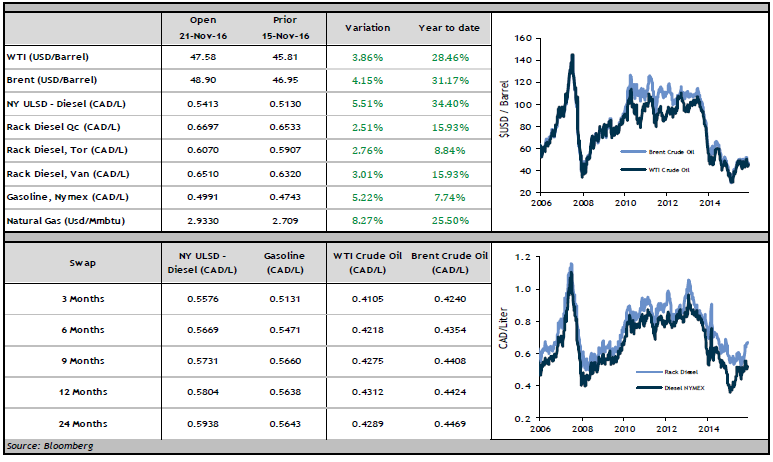

Energy prices have experienced a very volatile week, as markets await the outcome of the OPEC meeting that will begin on November 30. WTI oil prices started the week at 43.32 USD/barrel and closed it at 45.69 USD/barrel.

A number of developments drove oil prices higher over the past week:

Saudi Energy Minister Khalid al-Falih believes that OPEC will reach an agreement at the end of the month, and implementing output quotas of 32.5 million barrels/day would allow for a balance to be quickly struck between supply and demand on oil markets. Other OPEC members have also shown optimism that an agreement will be reached at the end of the month.

Hedge fund manager Pierre Andurand, who expects OPEC to reach an agreement, is calling for crude oil at 70 USD/barrel for 2017.

Chinese production levels have fallen to their lowest level in the past seven years. Although China is an enormous consumer of energy, current crude oil prices have led to a plunge in the number of active wells.

President-Elect Trump stated during the election campaign that he wanted to cancel the nuclear agreement with Iran. If the new president moves forward with this measure, 1 million barrels of crude oil per day would be taken off markets, which would have a positive impact on prices.

As we await the OPEC meeting and contend with volatile crude oil prices, we encourage our clients to get in touch with us to discuss hedging strategies for fuel costs.