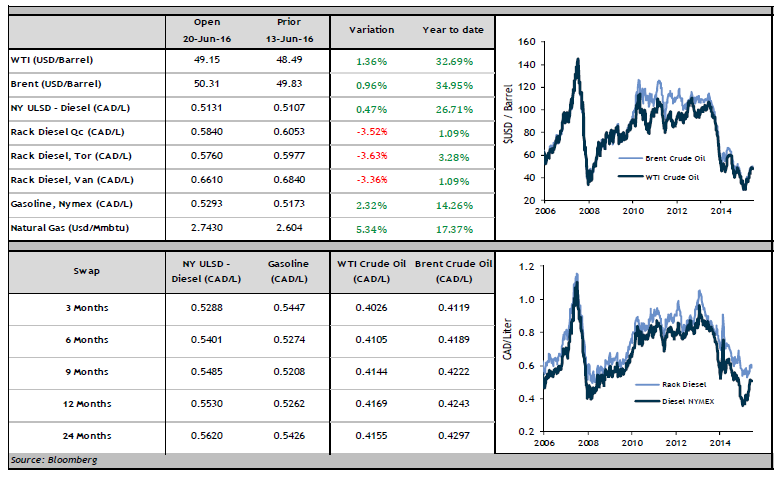

Crude oil extended its losses from last week as WTI touched USD 46/barrel on Thursday before bouncing back above USD 47.95/barrel and ending the week down 2%. Brent essentially followed the same path and ended the week down 3% around USD 49.15/barrel.

- American crude inventories continued to drop and decreased by 933K barrels last week. The Energy Information Administration also announced a drop in American production for the 18th time in the last 19 weeks. However, this data did not have a large impact on crude price, which was down on Wednesday and Thursday after the releases. The uncertainty surrounding Brexit and U.S. dollar fluctuations therefore seem to have dominated the commodity market.

- The price rally on Friday might partially by due to the sharp drop in USD, which lost almost 1% during the day due to growing concerns related to Brexit.

- The weakening of crude oil prices was offset by a weaker USD for the price of refined products in Canada. Diesel lost only 1% in CAD/liters while the price was down 2% on the week in USD/gallon. Gas lost 3% in CAD/liter and in USD/gallon.