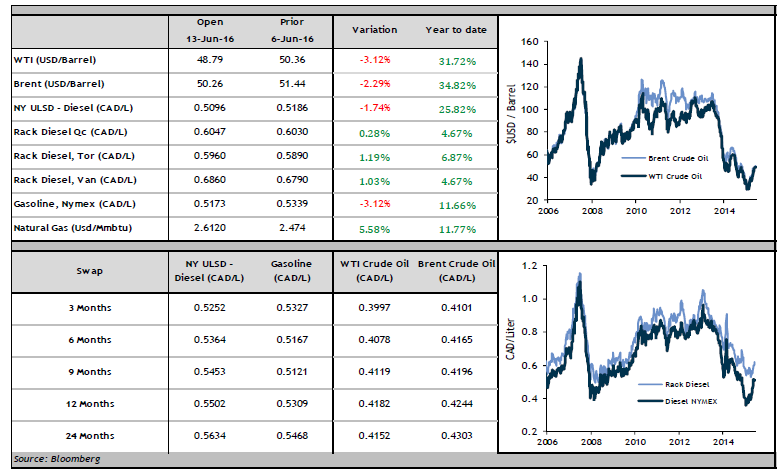

WTI crude oil finally reached the important technical level of USD 50/barrel this week and was trading even above USD 51.50/barrel mid-week, closing the week close to 49.00 USD, up almost 1%. Brent gained almost 2% to close around USD 50.50/barrel.

U.S. crude inventories dropped 3.23 million barrels, down for the fourth time out of the last five weeks. Wild fires in Fort McMurray, Alberta are one of the main causes behind these inventory draws, on top of increased refinery demand, which helped support the oil price.

Oil prices also benefit from a drop in production from Nigeria of close to 500K barrels per day since the beginning of the year, according to the Energy Information Administration. This decrease is caused by ongoing militant attacks that have been happening since the election of President Muhammadu Buhari in February. A major pipeline that belongs to Shell (LON:RDSa) has been the target of attacks for the second time last week and could not be repaired yet.

However, the USD recovery at the end of the week put a downward pressure on crude prices, as the WTI returned below USD 50/barrel on Friday.

Diesel ended the week up by more than 2% in USD/gallon, taking the local price at CAD 0.51/liter. The USD strength has therefore limited the impact of the increase on prices in CAD, up 1% on the week. Gasoline lost almost 3% in USD/gallon and almost 4% in CAD/liter to close the week at CAD 0.53/liter.