Last week, Goldman Sachs (NYSE:GS) officially switched its opinion of the oil market, shedding its largely bearish view and becoming bullish. The influential bank highlighted unexpected supply disruptions, like the million barrels per day lost due to wildfires in Alberta (which seem to finally be under control), as major factors that will slow supply growth and lead the market to equilibrium earlier than expected. Other important institutions have also argued that energy markets should rebalance soon in recent months—some stating this even before the situation in Alberta dented global supply. If and when the markets return to supply-demand equilibrium, we should expect to see prices rise.

Rystad Energy, a well-respected oil industry consultant, recently announced that oil discoveries in 2015 reached their lowest level since 1953. Discovered oil reserves have been falling steadily for the past 5 years. As it typically takes 5-10 years before new reserves are brought to production, this exploration slump might not have an immediate impact on energy prices. However, this statistic is a sign of just how badly the industry is suffering, and perhaps also an indicator that global oil supply could fall in the coming years (which would cause prices to increase).

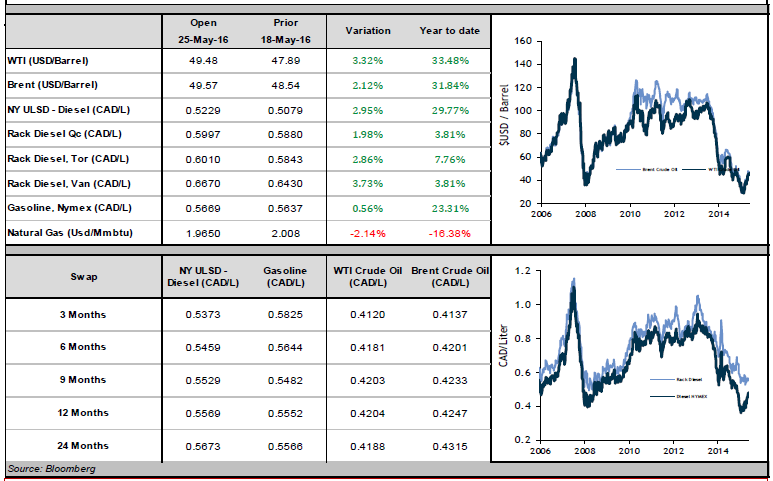

Although crude did not make great gains last week, refined products in New York had stronger weeks. Diesel and gasoline in USD/gal. increased by 4% and 2%, respectively. The loonie weakened by 2% over that period, which caused diesel and gasoline prices in Canada to jump 5% and 4%, respectively. Although diesel is trading over 0.50 CAD/L for the first time since November, the price is still 40% below its high set before the oil market crash in 2014. Have a great week!