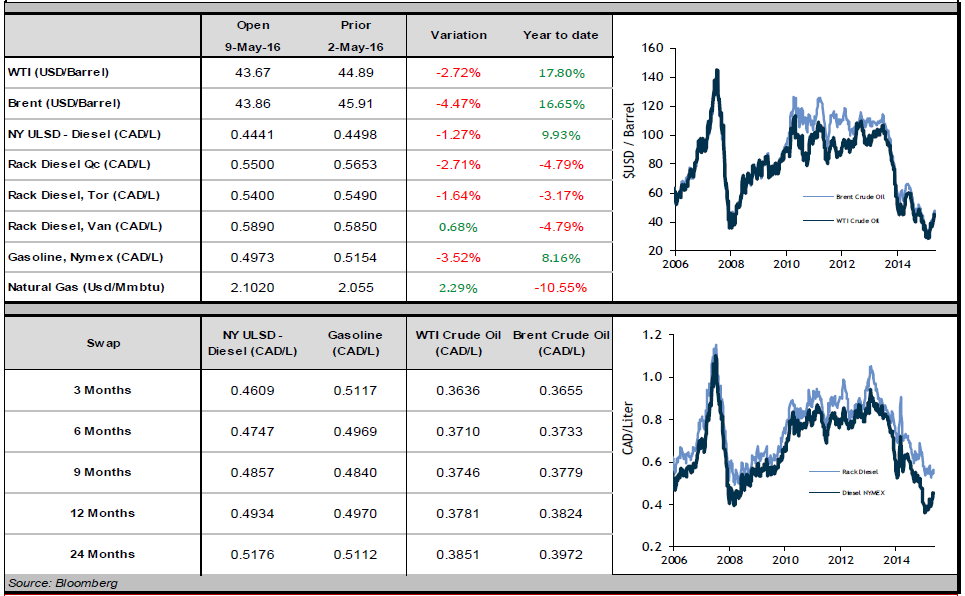

Crude gave up some of its recent gains last week, with WTI falling by 2% and Brent by 4%. Both benchmarks are currently trading close to 45 USD/bbl., and are up 20% year-to-date.

One of the most closely-followed stories in the oil market over the past few days is the wildfire near Fort McMurray, Alberta. The worst fire in the history of the province has forced 3 major oil companies to reduce or halt their production, while more firms consider doing so. Analysts estimate that the loss of supply could be on the order of 500,000 to 1.2 million barrels per day (although it is most likely closer to the lower end of that spectrum). It should be noted that the fires are to the south of the city, while most of the oil fields are to the north; the shutdowns are not because the production itself is threatened or damaged, but because many of its workers are being evacuated from the area. The supply should be able to come back online soon after the area is deemed safe, which, for the sake of those who live and work around Fort McMurray, we hope is soon.

On Wednesday, Statistics Canada announced that Canada’s trade deficit reached -$3.4 billion in March, its most negative value ever and much worse than experts were expecting. The deficit, which is a measure of total exports minus total imports, plunged as exports fell nearly 5% in March. The CAD lost 3% this week, as speculators bet that the Bank of Canada could lower rates if economic data does not improve in the coming months. A devaluation of the loonie hurts fuel consumers, who see their costs rise when the CAD weakens.

Refined products struggled last week, as diesel fell by 4% and gasoline slid 7% when denominated in USD/gal. The CAD’s fall undid a lot of this decline: diesel in CAD/L was down only 1% and gasoline decreased 4%. Diesel and gasoline are currently trading at 0.46 CAD/L and 0.51 CAD/L, respectively.