Investing.com’s stocks of the week

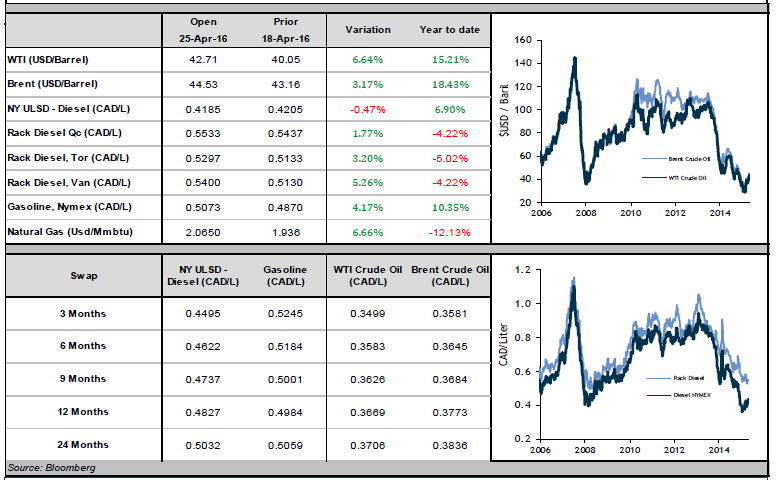

No deal was reached in Doha on April 17, yet crude had a very strong week. Brent and WTI had increased by 12% and 16% (respectively). Both benchmarks are currently trading in the mid-$40s and are near their highest levels year-to-date.

Oil’s strength early last week was credited to a petroleum workers’ strike in Kuwait, an important OPEC member country. Although the strike only lasted a few days, it likely reduced supply by 200,000 barrels per day. April has been a difficult month for production outages: energy consulting firm PIRA estimates that, globally, there was a loss of 900,000 barrels per day over the month due to operational issues. Many analysts and institutions, including the International Energy Agency, predict that the global oil market will return to equilibrium by the end of the year thanks to falling American production. If the current disruptions are not resolved by then, or if new outages occur, a possible shortage could cause a spike in energy prices.

In last week’s newsletter, we noted that Libya is one of few countries with a lot of extra oil production capacity. We also noted that the reason for this is that Libya is in the middle of a civil war; the violence and turmoil understandably make “business as usual” impossible. However, Mustafa Sanalla, Chairman of Libya’s National Oil Co. (known as the “NOC”), stated on Thursday that in the “next weeks, we will see the formation of one united NOC,” and an increase in Libyan production. The expert consensus is that, until Libya resolves its internal conflict, this is wishful thinking. As increasing Libyan oil supply would be a major development, we will continue to closely monitor the situation, but we do not expect to see any miracles in the near term.

In New York, diesel ended the week up 6% and gasoline closed up 5%. As usual, the Canadian dollar appreciated along with energy prices, so diesel and gasoline were only up 4% and 3% (respectively) at home. Diesel is currently trading around 0.44 CAD/L, over 10 cents higher than its low in mid-January.