Investing.com’s stocks of the week

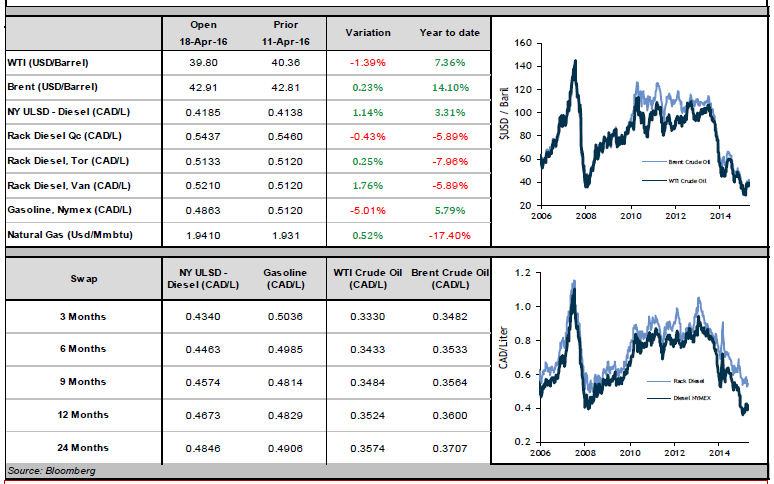

A volatile week in the oil market saw the WTI price increase by over 6% by Wednesday, then fall on Thursday and Friday to close the week up 1%. This movement was copied to near-perfection by Brent crude (also up 1% on the week). Both benchmarks continue to trade around $40/bbl.

Speculation regarding Sunday’s meeting in Doha has been dominating headlines for weeks. As this reunion will probably be one of the most significant events in the energy market in 2016, we want to dedicate this newsletter to understanding its implications. Despite many rumors suggesting a deal would be reached, the 16 oil-producing countries concluded that there would be no production freeze. Oil prices plunged at market open, but have since found some strength and are basically flat on the day. With traders seemingly unsure of yesterday’s meeting’s consequences, we would like to analyze the market from a fundamental perspective. Most countries are already producing near capacity and cannot possibly increase output significantly. Only Libya, Iran and Saudi Arabia have real room to grow. Libya’s production is limited by civil war, and Iran is struggling to compensate for years of under-investment. The Saudis’ actions have made it clear that they act in their best interest—which has not changed in the past 5 days. Regardless of the freeze, the fundamental outlook is essentially the same. And, although prices will be volatile because traders often invest based on sentiment, at the end of the day, fundamentals will control the market. We therefore end with two fundamental facts. First, last week, American production fell below 9M bpd for the first time since 2014. Second, the International Energy Agency stated on Thursday that shrinking U.S. supply and rising demand could erase the global oversupply by the end of the year. Traders might act on instinct and emotion to try to make a profit; we, however, encourage clients to consider long-term dynamics before finalizing their opinion on the price of oil.

Refined product prices in Canada were more or less flat, with diesel increasing 2% and gasoline losing 1%. A small appreciation of the loonie helped reduce costs slightly at home. Diesel is currently trading at 0.42 CAD/L, and gasoline at 0.50 CAD/L.