Investing.com’s stocks of the week

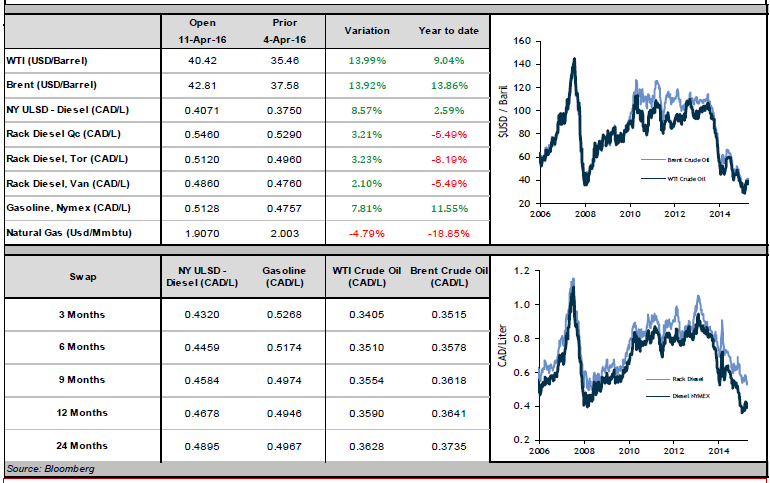

Both Brent and WTI crude oil found their strength again last week, with both benchmarks increasing by 4 USD/bbl. WTI closed the week just under $40/bbl., and Brent ended at $42/bbl. Brent’s final price on Friday set a new yearly maximum, while WTI is $2 under its peak set at the end of March.

Bullish American data was the largest cause of oil’s reversal back to rising prices. On Wednesday, the Energy Information Administration released its weekly report, which claimed that American oil inventories decreased for the first time in 8 weeks and that crude production fell to 9.01 million barrels per day. Analysts expect U.S. oil production to fall below 9 million barrels per day this week, which would be the lowest level since late-2014. Additionally, Baker Hughes stated that the number active oil rigs fell again (15th decrease in 16 weeks). All this information points to the fact that American producers simply cannot survive in the low-price environment. High global supply is suffocating North American oil, and these high-cost producers have little to no choice but to reduce their output.

The rivalry between Saudi Arabia and Iran continues, with the latter country announcing a major price discount on its oil. For the first time in 7 years, Iran will sell its benchmark Forozan Blend at a lower price than Saudi Arabia’s Arab Medium crude. Iran is looking to undercut Saudi Arabia’s attempts to regain market share by offering its products at a discount. Essentially, just as Saudi Arabia seems to be muscling North American production out of the market, Iran is attempting to do the same to their fellow OPEC member. While this is a bearish force for the moment, escalating tensions between two of the Middle East’s most powerful nations could have important political consequences, which means geopolitical risk could increase prices.

Gasoline and diesel on the NYMEX rose with oil last week, increasing 0.08 USD/gal. and 0.11 USD/gal, respectively. Oil’s strength and strong employment data at home caused the loonie to also rise last week by half an American cent (but gained almost 2 cents on Friday alone). The net effect was a 0.04 CAD/L increase in diesel and a 0.03 CAD/L rise in gasoline. Gasoline is now back over 0.50 CAD/L, and diesel is trading at 0.41 CAD/L. Both products are below the peaks set in March.